How do I look at KFIMA?

GenghisHoe

Publish date: Mon, 23 Jun 2014, 10:32 PM

Introduction

KFIMA was incorporated by the Malaysian Government on 24 February 1972 under the name of Fima Sdn. Bhd. (FIMA is the acronym for “Food Industries of Malaysia”). Until year 1991, KFIMA underwent a Management Buyout (MBO) in line with the privatisation policy of the Malaysian Government. KFIMA was listed on the Main Board of KLSE in 1996 and having suffered significant losses from year 1998 to 2002. After the financial year ended 31 March 2002, the Company was able to turn around to sustain its businesses.

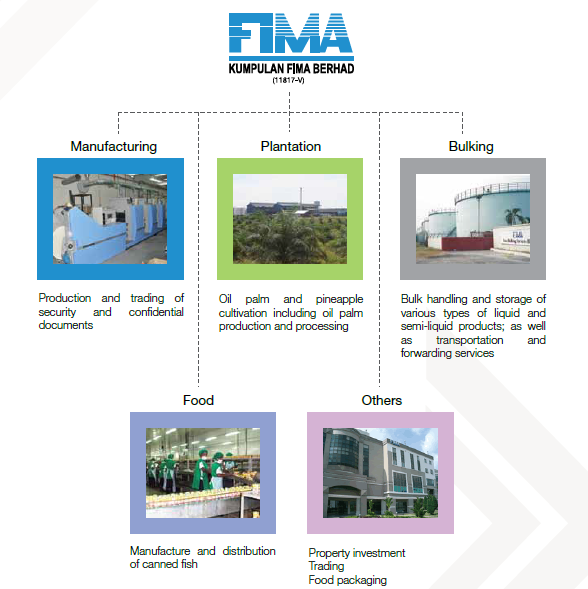

The Company is principally engaged in the following activities:

(i) Manufacturing - Production and trading of security and confidential documents

(ii) Bulking - Providing bulk handling and storage of various types of liquid and semi-liquid products; as well as transportation and forwarding services

(iii) Plantation - Oil palm and pineapple estate operations

(iv) Food - Fish processing, canning and distribution and packaging of food products

(v) Others - Investment holding, rental and management of commercial properties and trading

Additionally, it is worth noting that a subsidiary, Fima Metal Box Holdings Sdn. Bhd. (“FMBH”) is wholly owned by the Company and FMBH has a direct ownership interest of 60.9% in Fima Corporation Bhd. The control is exercised through an ‘indirect ownership interest’ (ie. through its direct ownership interest in FMBH) between KFIMA and Fima Corporation Bhd.

Fima Corporation Bhd. is engaged in property management and investment holding. The Company, through its subsidiaries, is engaged in the production of security and confidential documents, oil palm production and processing, and production and sale of bank notes. Its subsidiaries include Security Printers (M) Sdn. Bhd., Percetakan Keselamatan Nasional Sdn. Bhd., FCB Property Management Sdn. Bhd., FCB Plantation Holdings Sdn. Bhd. and PT Nunukan Jaya Lestari.

iReview

As at the financial year ended 31 March 2013, KFIMA’s turnover has grown by 3.4% to RM486.5 million from RM470.7 million in FYE2012. The revenue contributions are made up of the manufacturing division (41.5%), plantation (21.9%), food (20.5%), bulking (15.2%) and others (0.9%). Over the last five years, its gross margin and net margin stand at an average of 43.2% and 22.1% respectively. As for the management efficiencies, it can be inferred from the return on equity that maintains at an average of 15.5%. What does it really tell us? Additionally, it has a short term debt of RM18.5 million with paying out 0.6% of its operating income in interest payments (in accordance with the annual report 2013) and undoubtedly, it is a net cash of RM253.8 million because its cash rich subsidiaries (indirectly, Fima Corporation Bhd has a cash of RM48.6 million) are hoarding a RM262.6 million cash pile. Does it financially sound?

Looking back the last six years of the business development, KFIMA has focused on restructuring the Plantation and Food Divisions so as to strengthen its investment portfolio. As a result, the Plantation Division has registered a turnover of 19.9% compounded annually and the Food Division with a turnover of 6.9% compounded annually. However, the performance of Plantation Division would be faced with the weather effect and the fluctuating CPO price and the Food Division would be primarily affected by the foreign currency like Kina (Papua New Guinea’s) and US dollar (raw materials purchased in USD). To highlight, the Company has rapidly enlarged the plantation landholdings and its Food Division’s tuna business has been certified to export to European Union and has commenced export of its tuna loins and private label canned tuna to several European countries, so as to penetrate the new markets and to broaden the customer base. At the same time, the Company pursues strategic alliances with its raw material suppliers to strengthen its competitive advantage in the industry. As for the largest contributor – Manufacturing Division, it has been deemed a cash cow that is able to back the potential growth divisions to grow organically or inorganically.

To recall, the Company has been suffering substantial losses from year 1998 to 2002 (net loss of RM434.6 million in 1998, RM58.8 million in 1999, RM30.6 million in 2000, RM13.5 million in 2001 and RM74.9 million in 2002). Until year 2003, the Company undertakes the divestment of non-core assets to reallocate resources to the core activities so as to ‘cut losses’ – this shows that the management was able to turn around the recurring losses into the sustainable profits with the revised investment portfolio. Does it have a sound management team?

iValue

Based on the current price of RM2.19, how does the market react? Has the current price been factored in the Company’s fundamentals with its future sustainable growth prospect? What about quoting RM3.56 with an adjusted discount rate of approximately 10% and an estimated growth rate of 7%, doesn’t it sound reasonable?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|