How ‘Britain’s Warren Buffett’, Terry Smith, invests in the stock market - Choon Leo Wang

Tan KW

Publish date: Fri, 15 Jul 2022, 08:48 AM

Terry Smith, popularly known as ‘Britain’s Warren Buffett’, is a highly successful fund manager who has over three decades of experience in the industry. His investment fund Fundsmith began operating in 2010 and is now the largest investment fund in the UK.

As of end-June 2022, Fundsmith held over £22 billion in assets under management and has returned 15.8% p.a. to its unitholders since inception. (In comparison, the MSCI world index returned 11.2% p.a. over the same period.)

Unlike Buffet, Terry Smith is a lot more brash compared to his American peer. Smith is famous (or some might say infamous) for his book ‘Accounting for Growth’ which critiqued accounting practices at companies after a series of high-profile FTSE 100 public companies went bankrupt in 1990. His then-employer, UBS, asked Smith to withdraw the book. He refused and was later fired.

Smith believes that macro trends are difficult to predict accurately. He considers investing in high-quality companies with sustainable growth prospects to be far more lucrative than making bold forecasts. Through his extensive experience working in the investment industry, Smith has developed a rigorous research process for Fundsmith to find good companies with strong competitive advantages.

Here is a breakdown of his strategy.

Focus on companies with a competitive advantage in a good industry

Terry Smith advocates finding companies with a solid competitive edge that can offer customers a superior product or service; these businesses tend to have impressive financial results. Competitive advantages will allow these companies to withstand fierce competition and avoid erosion.

Fundsmith tends to steer clear from investing in highly competitive industries such as banks, insurance, real estate, industrial chemicals, construction, commodities, utilities, and airlines.

‘A vast majority of the market is of no interest to us whatsoever.’ — Terry Smith

Here are a few common characteristics of good, high-quality companies:

- High returns on operating capital

- Growth driven from reinvestment of their cash flows at high rates of return

- Makes money from a large number of repeatable, predictable transactions

- Able to protect returns against competition

- Resilient to change, particularly to technological innovation

- Operating in sectors with intangible advantages: brands, distribution, installed base, franchisers

Terry Smith’s six ratios

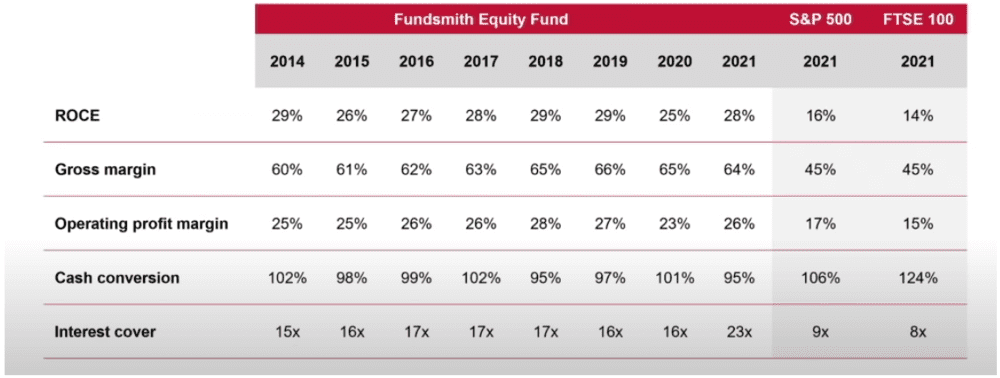

1. Gross margin measures the percentage of the company’s revenue after deducting the cost of goods sold (COGS). It measures how efficient the company is at managing their material and labour costs during the production process. Companies with a high gross margin imply that they keep a substantial portion of their revenue, which means they are better prepared to deal with adverse situations. Ideally, Smith advises searching for companies with a stable high gross margin over a long period to avoid ‘one-trick wonder’ stocks.

2. Operating margin measures the amount of operating profit a company keeps for every dollar of revenue. The higher the margin, the more profitable a company is for every dollar it makes in revenue. Operating margins can vary significantly across industries and can be influenced by various factors, including competition, product mix, and pricing. Since operating margin is an indication of why a business is profitable, it can often offer insight into the competitive edge of a company within an industry.

3. Return on capital employed (ROCE) is an excellent gauge of the management’s ability to earn profits by utilising its capital. Unlike common indicators such as return on equity (ROE), which only concentrates on profitability in relation to a company’s equity, ROCE examines the impact of capital provided through debt and equity. A higher ROCE than industry peers indicates that the company has been able to harvest a more significant percentage profit of its capital employed than expected.

4. Cash conversion ratio. All companies within Fundsmith’s investable universe should have a cash conversion ratio that is both high and stable. The cash conversion ratio (operating cash flow ÷ operating profit) is Terry Smith’s measure to track the relationship between operating cash flow and operating profit. He recommends only investing in companies with an operating cash flow with at least 95% of operating profit.

5. Debt-to-equity ratio measures a company’s level of financial leverage. It reflects the proportion of debt and equity used to finance a company’s assets. Companies with higher debt are considered higher risk for investors. Excessive debt may also limit a company’s flexibility when raising capital. Smith advises investors to avoid companies with a high debt-to-equity ratio.

6. Interest cover measures the company’s ability to cover existing debt interest payments. The interest cover ratio is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expenses. Terry Smith advises investors to avoid companies with an interest coverage ratio of below 10.

The fifth perspective

While the structure of Terry Smith’s investment approach appears straightforward, most investors often overlook these factors when investing in stocks, particularly when the stock is wrapped in a compelling narrative. As an investor, the foundation laid by Terry Smith’s approach should assist us in weeding out low-quality businesses. However, we should not depend just on ratios and should always conduct our own research before making an investment decision.

https://fifthperson.com/terry-smith-6-ratios/

More articles on Gurus

Created by Tan KW | Jun 26, 2024

Created by Tan KW | May 05, 2024

Created by Tan KW | Apr 17, 2024

Created by Tan KW | Jan 30, 2024