Jack Schwager, the author of Market Wizards series, when answering a question on Quora on whether value investing works, turned to the wisdom of Joel Greenblatt, one of the foremost experts on the subject.

Schwager quoted this from his interview with Greenblatt –

Value investing doesn’t always work. The market doesn’t always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn’t work. And that is a very good thing.

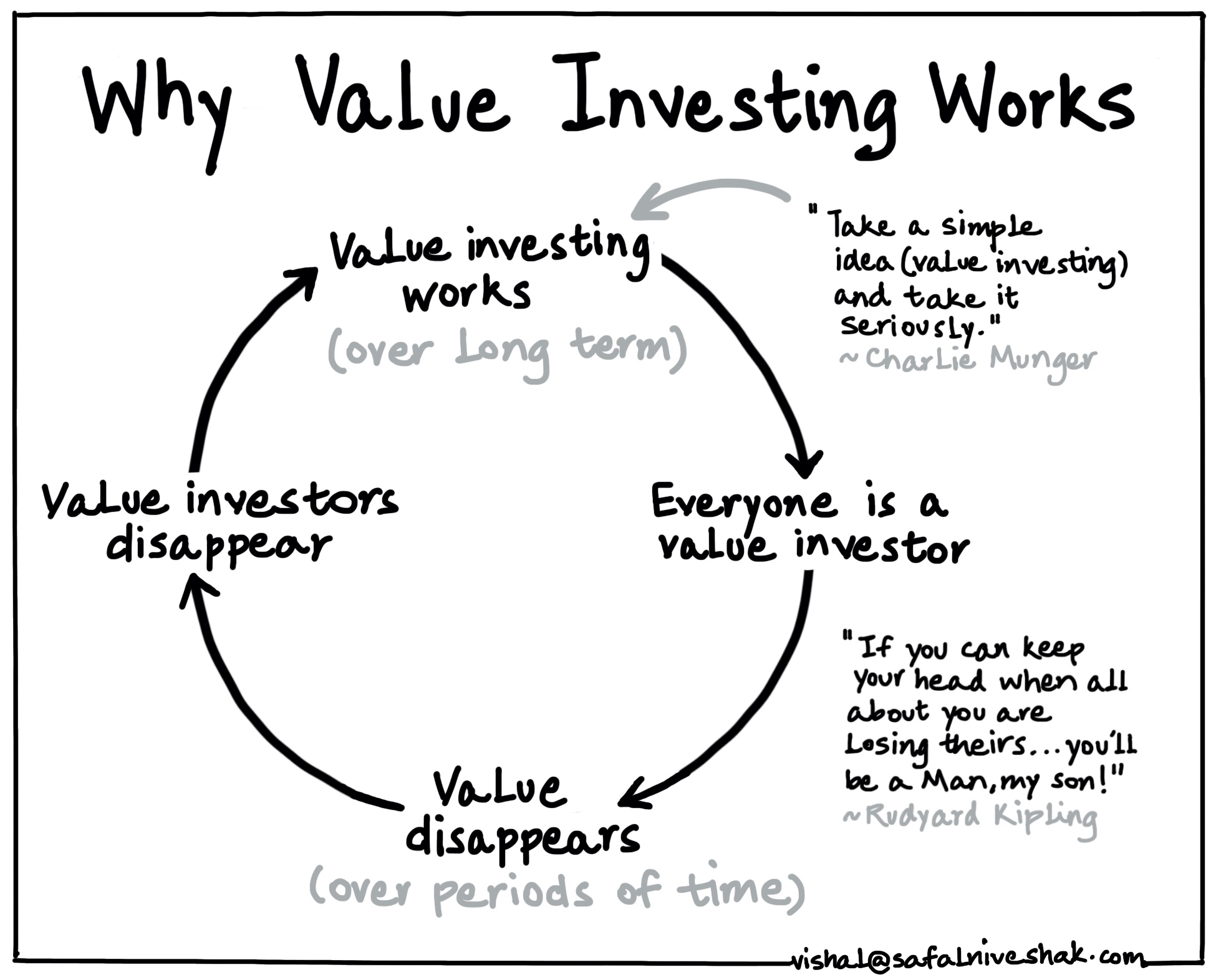

The fact that the value approach doesn’t work over periods of time is precisely the reason why it continues to work over the long term.

You see, the biggest problems in the long-term practice of value investing are that –

- It flies in the face of anything taught in business schools where most influencers/experts come from, and

- It requires a painful degree of patience because it is only over long periods of time that the market eventually gravitates toward value.

As Schwager quoted Greenblatt –

It is very difficult to follow a value approach unless you have sufficient confidence in it. In my books and in my classes, I spend a lot of time trying to get people to understand that in aggregate we are buying above-average companies at below-average prices. If that approach makes sense to you, then you will have the confidence to stick with the strategy over the long-term, even when it’s not working. You will give it a chance to work. But the only way you will stick with something that is not working is by understanding what you are doing.

This is a very important statement Greenblatt makes, that the only way you will stick with something that is not working (temporarily) is by understanding what you are doing.

Sadly, most people participating in the stock market don’t really understand what they are doing. This is especially when making money gets quick and easy, and they are doing great at it. Like Aesop’s wolf in sheep’s clothing, they play a role contrary to their real character, which often leads them to disaster.

However, the lack of patience of such people to invest with a long-term horizon creates the opportunity for the few committed to long-term holding periods.

In the battle between impatience and patience, the latter wins.

All in all, Greenblatt’s simple idea is so insightful. Value investing works (over the long term) because it sometimes does not work (in the short term).

With over fifteen years of practicing value investing with sincerity and with decent success, and seeing a lot of my fellow investors drop out due to their disbelief in its continuity and now ruing their decisions, I can vouch for this powerful idea.

What about you?

https://www.safalniveshak.com/why-value-investing-works/