(SuperMan 99) Gadang Holdings - A New Rising Star 建筑股新宠儿

SuperMan 99

Publish date: Fri, 20 Nov 2015, 02:04 AM

I have been following Gadang since September 2015 & decided to accumulate this stock.

The reasons I invested in this company were as follows:

1. Capital City Project (estimated net profit = 220m & company market value = 310m)

2. Outstanding construction order book = 875m @ 30/10/2015 (profit margin = 10% & enough to busy next 2 years)

3. Unbilled property sales = 189m @ 31/5/2015 (excluding capital city project)

4. Good history in successfully getting jobs in MRT & from Petronas (most important, delivered with good profits)

5. Prudent & Sound Management (old school business man)

6. Cash in hand (31/5/2015 @ RM232m & increase every year since 2012)

7. Debts to equity = 50.7% (borrowing = 193m)

Most importantly, the rolling PE ratio is still below 6! (Price RM1.90 @ 4/12/2015)

(All profits in accounts were actual operating profits, no gain on forex or fair value in investment properties, OR disposal of something like others)

Subsequently, the Company had accepted the Pengerang Package 2 Project with contract value of RM375M from Petronas on 21 October 2015. This was good suprise & this news had really pushed the price up since then.

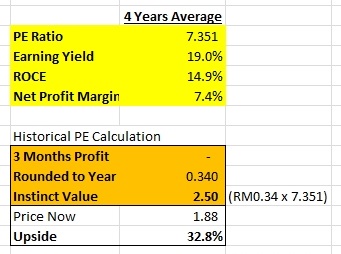

Based on my own calculation, my target price for Gadang is RM2.50 (refer to Table 1 below), representing potential upside of 32.8%.

My calculation & assumptions may be wrong & I have to confess that I am not professional analyst, you are freely to disagree my projection.

My presentation here are merely for sharing & reference purposes only.

Table 1: 4 years average & Price Target

Note: Please refer to Table 5 for how to obtain average 4 years' historical PE ratio.

Table 2: Profit Estimation for FYE 2016 (based on Q1 result)

Table 3: Movement in Construction Order Book

Note: CFO Ms Kok had announced in 2015 AGM that Construction Division still have a total of up to RM875m orderbooks till-date (19/11/2015). (Please read here for more details: AGM 2015 updates 嘉登控股 股东大会 2015 by Zefftan)

I can't really get the amount as announced in AGM & please help to point out which part I may have gone wrong in the calculation. Thank you in advance.

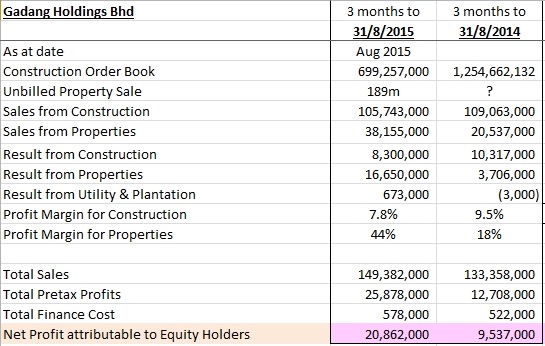

Table 4: Comparison on Q1 2016 & 2015

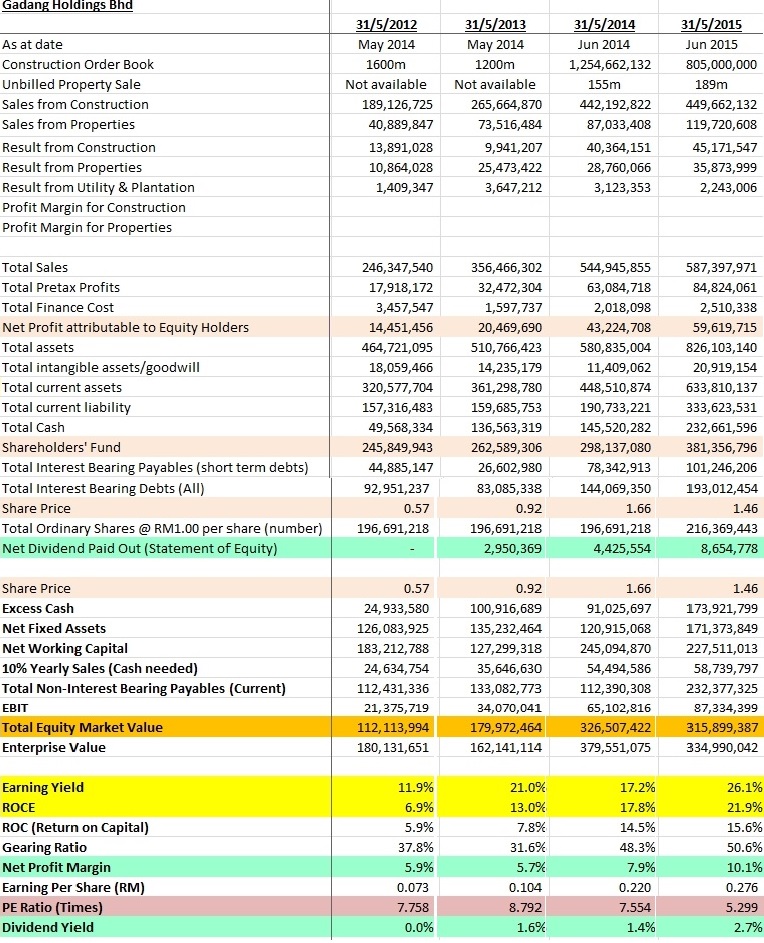

Table 5: Financial information based past 4 years' audited accounts

Recommendation:

The above are only figures based on historical & current financial reports, you are welcome to read articles from Icon for better picture of this stocks:

(Icon8888) Gadang (Part 1) - JV Project Will Create Value Greater Than Existing Market Cap

(Icon8888) Gadang (Part 2) - Encouraging News on the Joint Venture Project

(Icon8888) Gadang (Part 3) - Dawn of a New Era

(Icon8888) Gadang (Part 4) - Market Beginning to Realise its Potential

(Icon8888) Gadang (Part 5) - Key Take Aways From EGM

(Icon8888) Gadang (Part 6) - Capital 21 Is Approximately 60% Sold

Declaration & Disclaimers:

I have interest & own shares in this company.

All the above are merely presented & written for sharing, educational & reference purposes and does not constitute as recommendation to purchase/buy or sell. You should make your investing decision based on your own judgement & at your own risk.

I will not be responsible nor liable for your action.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Work Hard for Easy Life - SuperMan 99

Created by SuperMan 99 | May 16, 2016

Created by SuperMan 99 | Oct 29, 2015

Discussions

Stupidivan, You are new ID & you are what your name called. Seem like you register this ID to shout "idiot" & "stupid" at every places you go.

Now I know how Icon feel, there are always monkeys spitting here & there.

2015-11-21 01:37

Ok, now you have a point here. I agree with your point that property is slowing down, that's why all small cap (less than 1b) property companies are priced at around PE 5, except some big guns.

While we expect more challenging business environment in coming years for property company, the near future supports are from Capital City. See below:

"The Capital City in Johor could contribute about RM20m in the coming FY2016 as currently they're just launching the Capital Mall only due to the poor property market sentiment in Johor."

(Above was extracted from http://klse.i3investor.com/blogs/zefftan/86490.jsp)

Meanwhile, the company is optimistic to get Petronas Rapid & MRT projects, reason of optimistic from Management was also illustrated in the AGM.

It is whether you buy the ideas or not, I do not try to convince anyone but you are freely to agree or disagree.

Let's see how it goes.

.

.

Ps. Why I agree your point because I am avoiding pure property companies like Hua Yang, Ken, Tambun, Malton & KSL (though KSL has one mall), though I like them very much.

2015-11-21 11:05

Thanks, chernhung, the above are half of my homework and I did that for every companies that seem attractive.

Sometimes it will tell totally different stories when dig deep into the figures. Some looked good but bad inside, OR good outside & inside but bad management, OR everything good but wrong industry... :(

All in all, I need to convince myself why should I invest in this company & hope you will be convinced to buy & push further up the price... :)

2015-11-27 19:38

DreamSubjugator

You want an over-pessimistic report. Of course.

2015-11-21 01:33