Climbing The "HIL"L (8443)

dotdotdot

Publish date: Sun, 17 Mar 2019, 07:03 PM

Why we should put this counter into our radar on the coming week:

1) TA

A few indicators showing this counter in rebound and bullish trend:

- MACD upper golden cross on 16 days ago and now maintain at the upper level

- RSI 75% and Vol is showing healthy buying interest

- After 1 week of consolidation the price still strongly supported above 54c

- Parabolic indicates buying signal start from 26-Feb

2) FA

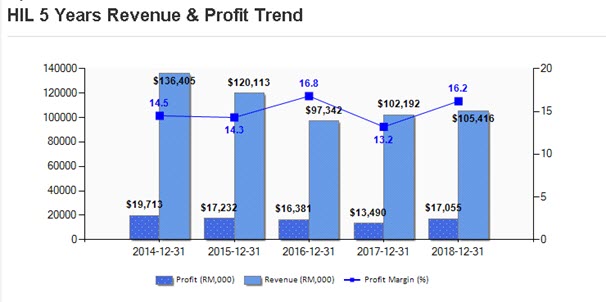

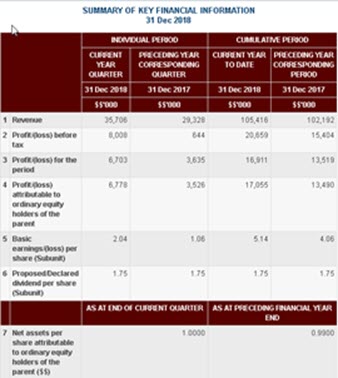

From the above 3 photos enough to tell how strong the FA position of this company. NTA = RM1, PE ~10, Div 3.15%, earning yield >10% and most importantly you can see it is making profit on 5 consecutive years and profit yoy increase 92%

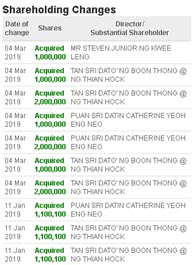

3) Directors Direct Interest

Directors keep buying the company shares in big quantity in the open market. This is telling us they are very much confident with the company business and future.

4) TP 70c set by Mplus Research on 27-Feb-2019

In view of the above data and facts, i believe HIL will easily hit TP1 (60c) and TP2 (70c) in short term.

cutie

shhhhhhhhh!!!!!!!!

2019-03-17 20:58