Traders Brief - Downside Risk Still Persist

HLInvest

Publish date: Wed, 29 May 2019, 09:53 AM

MARKET REVIEW

Despite President Trump commenting that Washington was not ready to make a deal with Beijing on Monday, Asia’s stock markets ended broadly higher following the conclusion of his 4-day visit to Japan to craft a trade deal. The Nikkei 225 gained 0.37%, while Shanghai Composite Index and Hang Seng Index added 0.61% and 0.38%, respectively.

Similarly, the FBM KLCI managed to trend above the 1,600 psychological to 1,614.57 pts (+0.83%) amid healthier trading activities as market overall volume crossed above the 2.0bn mark at 2.4bn worth RM4.52bn. Market breadth turned positive with 427 advancers vs. 395 decliners. Also, selected construction stocks such as Econpile and Advancecon traded actively higher.

Wall Street ended much lower as investors digested the statement from Trump that the US was “not ready” to make a deal with China. In addition, the Trump stated that the tariffs on Chinese imports may go up “substantially” and has contributed towards further trade tensions and concerns over further slowdown in future economic activity. The Dow and S&P500 down 0.93% and 0.84%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI closed higher and broke out of the sideways consolidation phase at this juncture. The MACD indicator has formed a positive cross, while both the RSI and Stochastic oscillators are turning upwards. Based on the mildly positive technical readings, the KLCI could retest the resistance around 1,618-1,630, while support will be anchored around 1,600, followed by 1,580.

With the negative performances on overnight Wall Street, selling pressure may emerge on the local bourse, contributing to another round of trade outflows amongst foreigners, which may limit the potential upside on the FBM KLCI (resistance is located around 1,618-1,630). Also, we believe technology shares may face with another round of profit taking activities after the recent technical rebound.

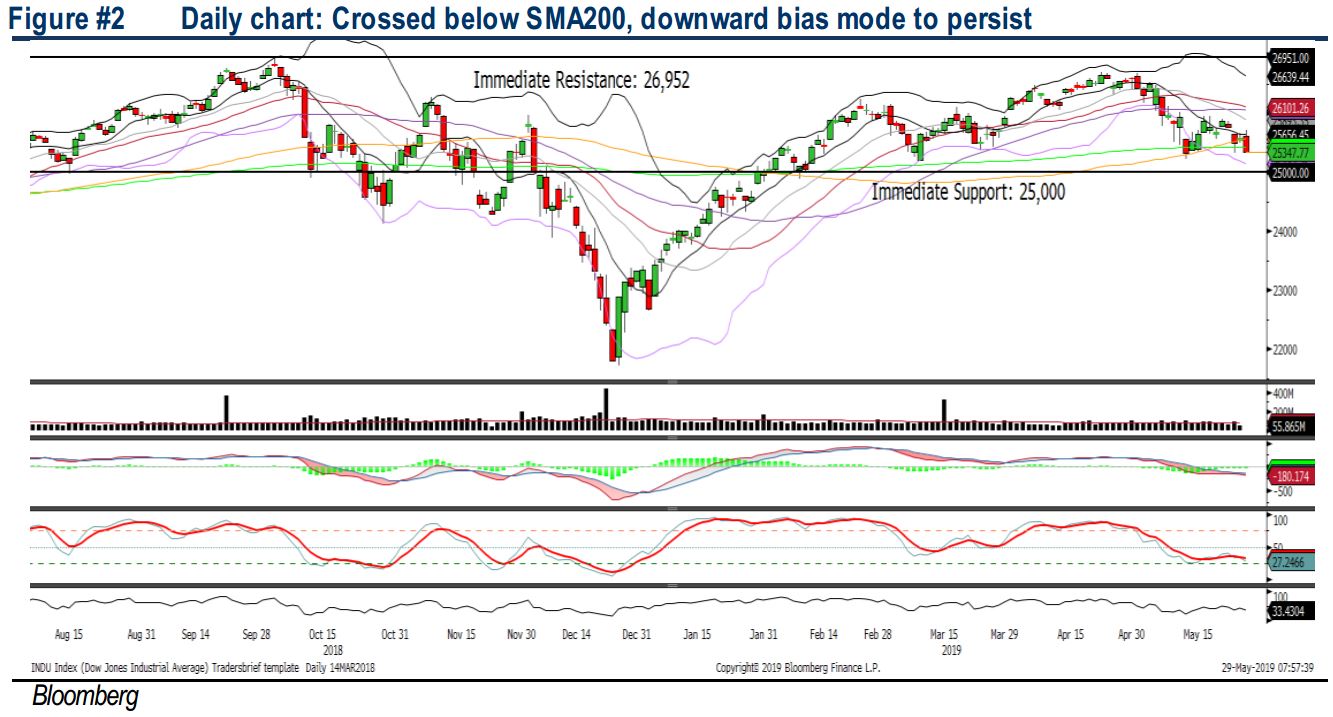

TECHNICAL OUTLOOK: DOW JONES

The Dow has declined below the SMA200 for another session and the MACD indicator (trending lower below zero) remains weak at this juncture. Also, the momentum oscillators (RSI and Stochastic) are suggesting that the key index is having downward bias tone for the moment. Hence, with the still-negative technical, the Dow could revisit the support around 25,000. Meanwhile, resistance is pegged around 25,500-26,000.

As the trade tensions escalated with Trump’s comments on trade front, we believe the trading tone could stay negative over the near term, thus capping the upward momentum on Wall Street. Also, traders will be watching closely any trade developments before the G20 event in end-June as investors are hoping for some clarity on trade progress and anticipating a trade deal to be struck soon. The Dow’s resistance will be set around 25,500-26,000.

Source: Hong Leong Investment Bank Research - 29 May 2019