Traders Brief - Trade-war Concerns to Persist

HLInvest

Publish date: Mon, 03 Jun 2019, 10:19 AM

MARKET REVIEW

Shares in Asia trended mixed as market participants worried that the trade tensions between the US and China may extend longer-than-expected (at this juncture, the projected timeline is likely to be within June). Also, the US manufacturing PMI registered the lowest level in May since Sept-2009 at 50.6 has contributed towards an uncertain trading sentiment across Asia; the Nikkei 225 fell 0.16%, but Hang Seng Index rose 0.32%, while Shanghai Composite Index (+0.02%) ended flat.

Meanwhile, sentiment on the local front was negative with the KLCI declining for the third straight trading day at 1,598.32 pts (-0.22%). Market breadth was slightly bearish with decliners leading advancers by a ratio of 4-to-3, accompanied by 1.89bn shares traded worth RM1.55bn for the session. Nevertheless, we noticed selected technology stocks such as Inari and MPI rebounded amid oversold conditions. Despite the escalating trade-war tension as well as the Huawei ban, Wall Street rebounded last Friday, paring down partial weekly losses on major indexes.

Despite the recovery in trading tone last Friday, some of the economic data were suggesting that the US durable goods orders declined 2.1% last month amid the slowdown in exports and an increase in inventories, while US manufacturing activity fell to a 9-year low could have capped the upside potential on Wall Street; the Dow and S&P500 added 0.37% and 0.14%, respectively.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended lower last Friday and for the week. The MACD Line remained below zero, but the MACD Histogram is mildly recovering. However, both the RSI and Stochastic oscillators are still hovering below 50; suggesting that the momentum is still negative. The resistance is located around 1,618-1,630, while support will be set around 1,570-1,580.

With the relief rebound on Wall Street, coupled with lesser negative trade headlines over the weekend, sentiment on the local front could recover and bargain hunting activities could emerge on the broader market. Also, traders may trade within the technology and O&G sectors as it was beaten down severely last week. Meanwhile, the KLCI’s resistance is located around 1,618-1,630.

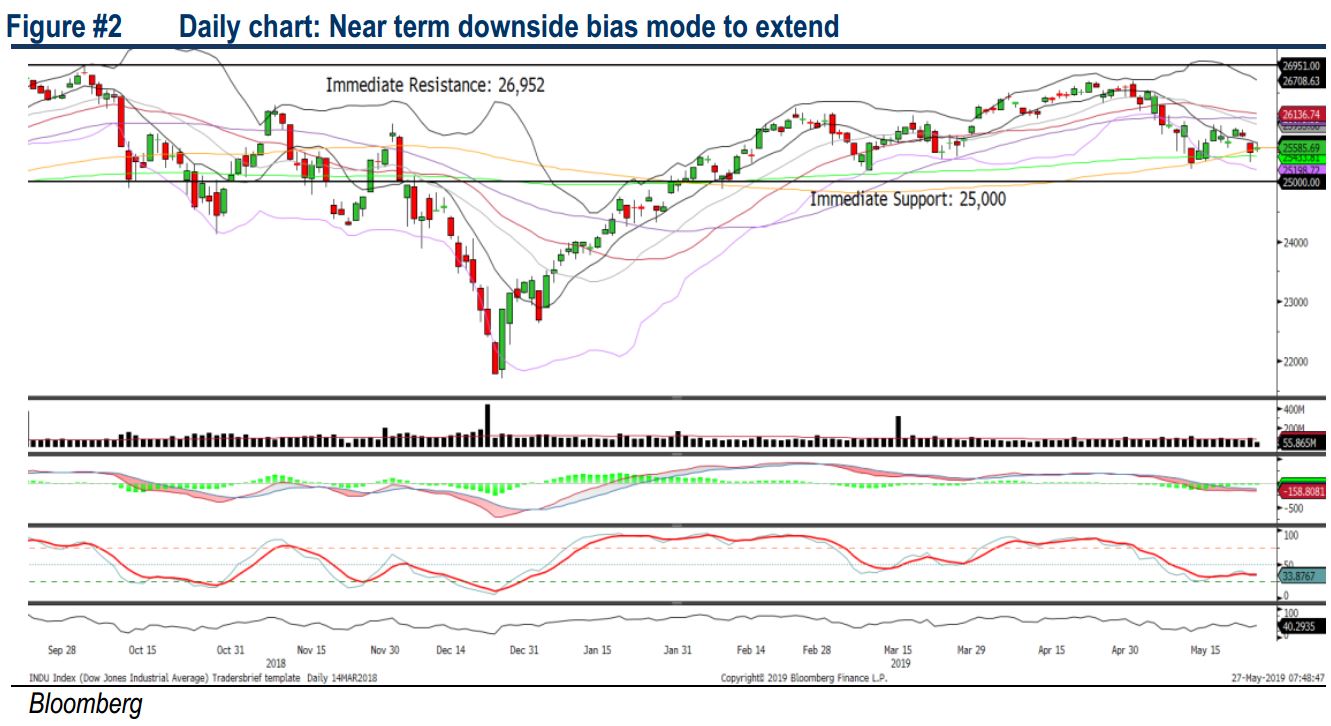

TECHNICAL OUTLOOK: DOW JONES

The Dow trended mildly higher on Friday and staged above SMA200 for the week. The MACD Line however is still hovering below zero, while both the RSI and Stochastic oscillators are trending below 50; indicating that the negative momentum is intact. Hence, with still-negative technical readings, we believe the Dow’s upside will be capped over the near term around 26,000, while support will be pegged around 25,433 (SMA200), followed by 25,000.

Although Wall Street recovered mildly last Friday, we opine that the upside could be limited with the release of several softer-than-expected economic data (US durable goods orders and manufacturing activity). In addition, investors are waiting for further clarity on the trade progress between US-China, while the Huawei ban episode has delayed trade discussions at this moment, which may cause further uncertain trading sentiment over the near term.

TECHNICAL TRACKER: GENTING MALAYSIA

Technical rebound may emerge as negatives priced in. To recap, GENM’s share price tumbled 11.7% or RM0.41 with a total RM2.4bn market cap wipe-off over the past three months, amid concerns of long term earnings jeopardy following a series of negative news flow i.e. (i) the new casino taxes, (ii) legal proceedings against Disney and Fox (GENM is seeking USD1bn lawsuit against Fox and could also face a counter claim of USD46m from Disney) and (iii) RM1.8bn impairment related to the Mashpee’s notes. However, we believe these risks have been largely priced in, given the commendable 1Q19 results, where consensus have turned more optimistic (with 10 BUYs/5 HOLDs/5 SELLs) and undemanding valuations at 12x FY20 P/E (29% below 10Y average 17x) as well as 0.98x P/B (25% below 10Y average of 1.3x). Technically, GENM is poised for a downtrend line breakout (near RM3.18) to spur prices towards RM3.25-3.55 levels in the mid to long term.

Source: Hong Leong Investment Bank Research - 3 Jun 2019