Traders Brief - KLCI Overbought, Upside Resistance Around 1,666

HLInvest

Publish date: Tue, 04 Jun 2019, 09:59 AM

MARKET REVIEW

Despite the better-than-expected Caixin/ Markit China general PMI for May which stood at 50.2 (vs. consensus of 50), market sentiment was dragged down by the prolonged trade tension between the US and China. The Hang Seng Index and Shanghai Composite Index declined 0.03% and 0.30%, respectively while Nikkei 225 fell 0.92%.

Meanwhile, market sentiment on the local front bucked the regional trend, reversing from the negative territory into positive zone on the back of buying support in the last trading hour; the FBM KLCI rose 0.28% to 1,655.31 pts. Market breadth, however was negative with 577 decliners vs. 266 advancers, accompanied by thinner volumes of 1.60bn (worth RM1.55bn). Crude oil related stocks were beaten down following a plunge in Brent oil price (-4.98%).

Wall Street ended mostly lower led by technology giants such as Alphabet, Amazon, Facebook and Apple as US government is planning to target big companies in the industry with antitrust and business practice probes. The Nasdaq plunged 1.61%, while S&P500 declined 0.28%. Meanwhile, the US ISM manufacturing data dropped to 52.1 (as compared to consensus of 53) in May, the lowest trading since Oct-2016.

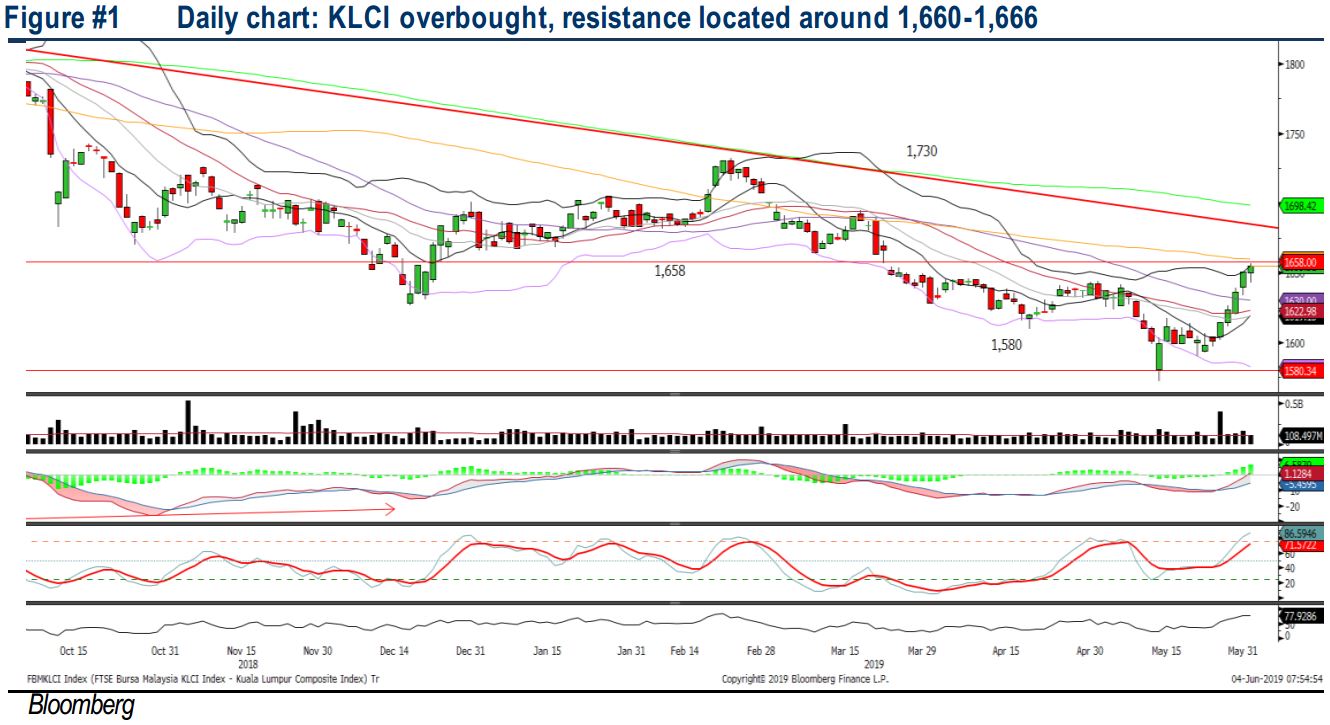

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has recovered substantially from the 1,572 level amid decent foreign inflows and the MACD Line has surged above zero. Meanwhile, both the RSI and Stochastic have just entered into the overbought region; the KLCI could be due for a healthy retracement. The resistance will be located around 1,666, while support is anchored around 1,640.

Tracking negative overnight performances on Nasdaq, coupled with the unsettled trade tensions, we believe that the negative sentiment may spill over towards technology stocks on the local front. Hence, under this cautious environment, investors could be taking a defensive approach to look for net cash or high dividend yielding stocks in order to cushion the downside risk in the market. In addition, export-related sector such as gloves may still be in focus on the back of weakening bias ringgit.

TECHNICAL OUTLOOK: DOW JONES

The Dow has formed a Doji candle yesterday after hitting an intraday low around 24,680 level. The MACD Line is trending lower, but both the RSI and Stochastic are oversold. Hence, we believe that the Dow could be due for a technical rebound. Resistance will be pegged around 25,425, while support is set around 24,500.

In the US, with the on-going trade disputes between the US and China, market participants are dealing with another potential downside risk as several tech giants will be facing increased regulatory scrutiny as US Justice Department is preparing an antitrust investigation into selected tech giants. Hence, this may be a hurdle for further expansions in the future. Also, traders will be watching closely on developments between now and the G20 summit that will be held end-June for more clarity on the trade front. The Dow’s trading range will be located between 24,500-25,425.

The revival of gold amid heightened uncertainties. The gold futures rallied 3.6% in the last four trading sessions to USD1322.7 (highest level in nine weeks) as market participants looked for safe-haven asset amid worries that the US-Chinese persistent stand-off and Washington’s threat of tariffs on Mexico would hurt the global economy. Following the downtrend channel breakout (daily) and long term bullish triangle breakout (monthly), gold futures are likely to trend higher in the mid to long term towards USD1350-1400 levels. For direct proxy to the surging gold prices, traders can track the SPDR Gold Shares (Figure #3 - NYSE:GLD) or Bahvest Resources (Figure #4 - BAHVEST: 0098).

Source: Hong Leong Investment Bank Research - 4 Jun 2019