Traders Brief - Market to Trend Slightly Higher

HLInvest

Publish date: Thu, 20 Jun 2019, 09:15 AM

MARKET REVIEW

Following the positive tweet from President Trump stating he “had a very good telephone conversation” with President Xi that a trade discussion will be happening in the upcoming G20 summit next week, market sentiment turned bullish and Asia’s stock markets gained momentum; the Shanghai Composite Index rose 0.92%, while Hang Seng Index and Nikkei 225 jumped 2.56% and 1.72%, respectively.

Similarly, KLCI trended higher, tracking the gains from overnight Wall Street and regional markets; the key index gained 0.83% to 1,666.54 pts. Market breadth was positive with advancers leading decliners by a ratio of 4-to-3. Market traded volume stood at 2.42bn worth RM2.34bn. Meanwhile, construction stocks such as IWCity and Ekovest, which are related to the Bandar Malaysia theme traded actively higher.

Stocks in the US traded slightly higher following the conclusion of the FOMC meeting where the central bank kept the interest rate unchanged for the time being and may also open up for looser monetary policy in the future. The Dow and S&P500 rose 0.15% and 0.30%, respectively while Nasdaq gained 0.42%.

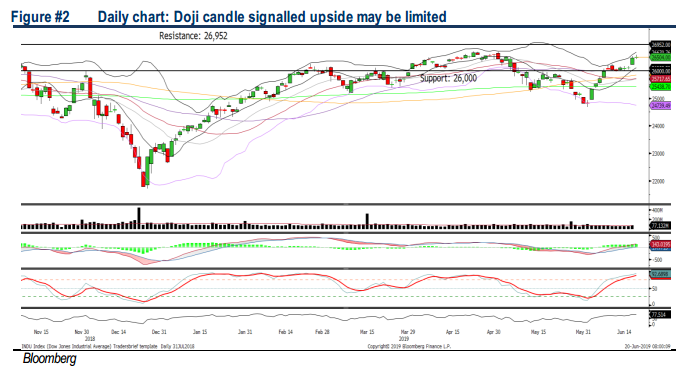

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has surged strongly above the 1,658 level yesterday, confirming the short term uptrend is intact. The MACD indicator has expanded on a positive note, but both the RSI and Stochastic oscillators are hovering within the overbought region. The KLCI may retest the 1,680 level, followed by the 1,700 psychological level. On the flip side, KLCI’s support will be pegged around 1,658 followed by 1,630.

The FOMC meeting has concluded with the Fed maintaining the interest rate for now and we expect traders to follow up on news regarding the G20 summit as well as developments on the trade front between the US and China. Tracking the positive overnight Wall Street, we expect minor buying interest on KLCI. However, upside might be limited as Stochastic is suggesting that the upside could be capped along 1,680.

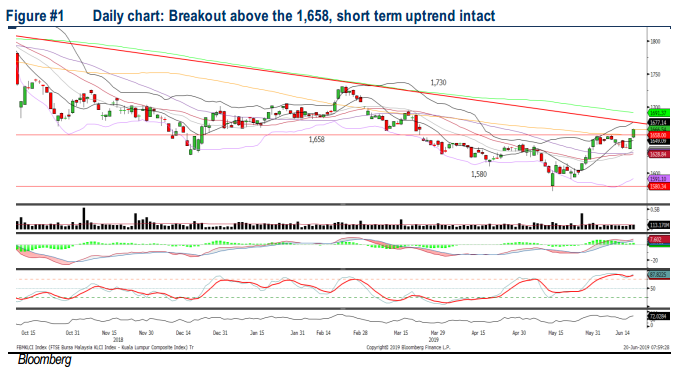

TECHNICAL OUTLOOK: DOW JONES

Despite the Dow trending higher yesterday, it has formed a Doji candle, approaching the resistance along 26,700 zone. The MACD indicator remained positive (MACD Line and Histogram hovering above zero), but Stochastic oscillator is overbought. Hence, with the mixed technical readings, we opine that the upside may be limited around 26,700-26,952 zone. Support will be envisaged around 26,000.

The Fed has kept its interest rate unchanged and the expectations of lower rates have lifted the market sentiment over the past few weeks. The lower rates expectation is likely to boost the markets further at least over the near term. However, market participants may shift their attention to the upcoming trade developments between President Trump and President Xi in the upcoming G20 summit, should any negative surprises surface on the trade front, it may dampen the global stock market’s sentiment. The Dow’s resistance is set along 26,700-26,952.

Source: Hong Leong Investment Bank Research - 20 Jun 2019