Traders Brief - Cautious Ahead of the G20 Meeting

HLInvest

Publish date: Wed, 26 Jun 2019, 09:47 AM

MARKET REVIEW

Led by losses in China (-0.87%) and Hong Kong (-1.15%) bourses, Asian markets declined as geopolitical tensions simmered in the build up to the high-stakes meeting between Presidents Trump and Xi during the G20 summit on 28-29 June. Meanwhile, investors sought for safer assets as Iran says a diplomatic solution with the US had closed after the Trump administration imposed sanctions against its supreme leader and other top officials, raising tensions days after the downing of an American drone brought the Middle East to the brink of war.

Tracking negative regional markets, KLCI fell as much as 3.7 pts to 1672.4 but it managed to finish 0.5-pt higher on the 11th hour at 1676.6, supported by index-linked heavyweights such as TENAGA, IOICORP, CIMB and MAHB. Trading volume decreased to 1.78bn shares worth RM1.75bn as compared to Monday’s 1.81bn shares worth RM1.68bn. Market breadth was negative with 364 gainers as compared to 413 losers.

The Dow tumbled 179 pts to 26548 amid growing US-Iran geopolitical tension and after comments from top Fed officials cooled investor optimism for a potential rate cut next month. Powell said the central bank is assessing whether current economic uncertainties call for lower rates and added the Fed remains independent of “short term political interests. Meanwhile, the US-China trade war anxieties found no relief following White House official’s remarks that Trump is “comfortable with any outcome” resulting from a planned President Trump-Xi meeting during the G20 summit this week.

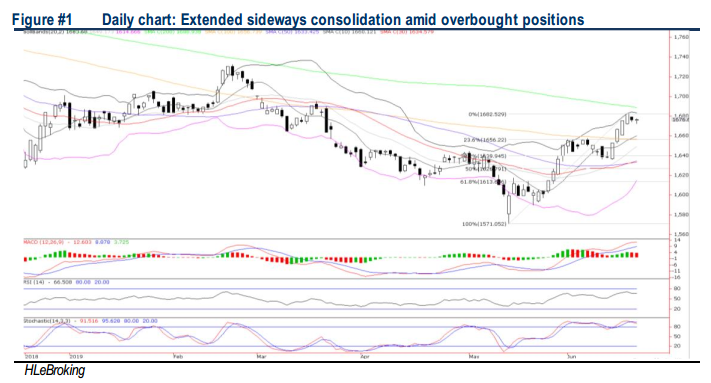

TECHNICAL OUTLOOK: KLCI

Following a 7% relief rally from 1572 (14 May) to 1682 (21 June), KLCI continued its profit taking mode as the index settled +0.5-pt at 1676.6 after oscillating between 1677.8 and low of 1672.4. Ahead of the G20 summit and US-Iran geopolitical uncertainties, KLCI is expected to engage in sideways consolidation amid weakening technical indicators. Resistance is pegged around 1682, 1690 (200D SMA) and 1700 psychological barrier while supports are near 1660 (10D SMA), 1650 and 1640 (38.2% FR) levels.

Following the overnight slide on Wall St amid US-Iran geopolitical tensions and US-China trade talks uncertainty during the G20 summit coupled with fading optimism of more rate cuts, KLCI is expected to remain choppy in the near term. Nevertheless, hopes for potential end June window dressing interest should underpin sentiment. Immediate upside hurdles are 1682- 1700, while supports are situated at 1640-1660.

TECHNICAL OUTLOOK: DOW JONES

The Dow plunged 179 pts overnight to 25648 on profit taking, following a 9% relief rally from a low of 24680 (3 June) to a high of 26907 (21 June). On the back of the formation of a shooting star and bearish indicators, the benchmark index is expected to consolidate further in the near term, with formidable resistances at 26900-27000 while supports fall on 26000-26400 territory.

In the US, sentiment may turn more cautious after overnight Dow’s fall amid US-Iran geopolitical tensions, US-China trade talks uncertainty during the G20 summit coupled with fading optimism of more rate cuts. Overall, we expect the Dow to trend in range bound mode within 26400-26950 levels in the near term.

Source: Hong Leong Investment Bank Research - 26 Jun 2019