Traders Brief - Follow Through Buying Support May Sustain

HLInvest

Publish date: Tue, 02 Jul 2019, 10:21 AM

MARKET REVIEW

Despite data from a private survey (Caixin/Markit factory PMI) showing that Chinese factory activity in June was weaker than expected, most of the key regional stock markets advanced strongly on Monday following the G20 summit in Japan, where both President Trump and President Xi agreed to take a pause on imposing additional tariffs against each other’s products and will continue the effort to resume trade talks. The Shanghai Composite Index and Nikkei 225 rallied 2.22% and 2.13%, respectively.

Similarly, tracking the gains regionally, the FBM KLCI gained 0.69% to 1,683.62 pts and broader market was led by technology stocks following the US-China trade truce. Market breadth was positive with 679 advancers vs. 214 decliners, accompanied by higher trading volume of 3.32bn, valued at RM2.18bn as compared to last Friday. Besides technology sector, traders were focusing on construction, telco and energy stocks for the session.

Wall Street gained momentum as meeting between the President Trump and President Xi went well as both leaders came to a common ground on trade front and is willing to extend the trade negotiations, as well as the US will ease restrictions on American companies from selling products to Huawei, US commented that China would “buy farm products”.

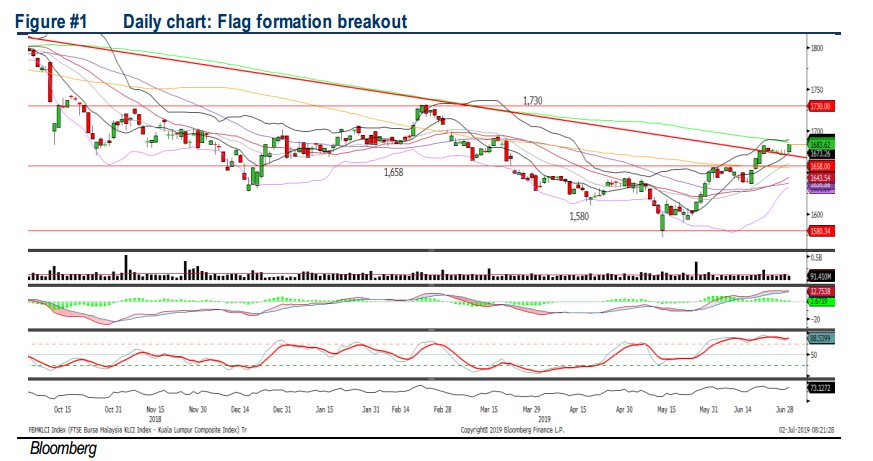

TECHNICAL OUTLOOK: KLCI

Given the FBM KLCI successfully formed a flag formation breakout, coupled with the long term trendline breakout in the weekly chart, we believe the recent rebound has evolved into an uptrend pattern, which may retest the 1,700 level. The MACD indicator has turned positive, while both the RSI and Stochastic oscillators are hovering positively above 50. Support will be anchored around 1,666, followed by 1,658.

Tracking the positive tone from the overnight Wall Street amid the positive trade developments, we think the buying interest could spillover towards technology sector at least over the near term. Meanwhile, traders would focus on O&G stocks as oil prices stayed firmly above USD65 amid extension of production cuts for the next nine months by OPEC and other producers.

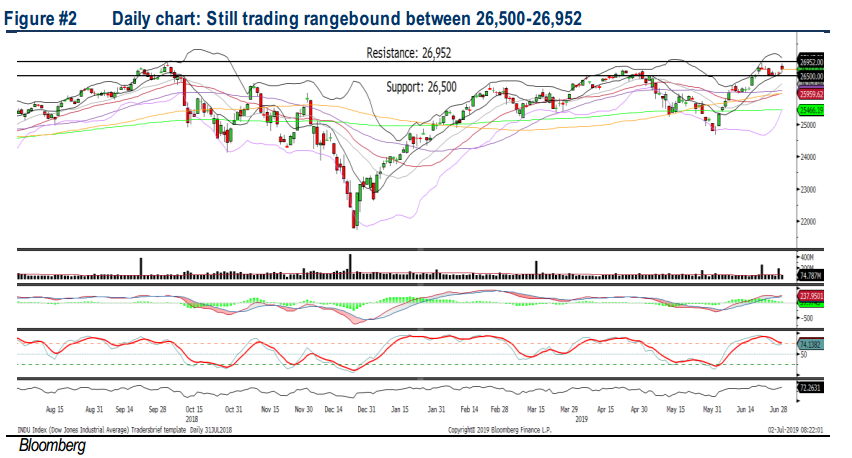

TECHNICAL OUTLOOK: DOW JONES

The Dow traded higher for the session but unable to retest the 26,952 level following the positive G20 summit. The MACD indicator remains positive, while both the RSI and Stochastic oscillators are trending higher but slightly below the overbought region. The resistance is pegged around 26,952, while the support will be located around 26,500, followed by 26,000.

On Wall Street, chipmakers are likely to trend positively following the trade truce and President Trump commented that US companies will be able to resume selling equipment to Huawei may provide some relief on the trade front, at least for the near term. However, the current trade progress are in a “no further tariffs escalation, but still no clear direction towards a comprehensive deal” status, hence upside on the Wall Street are likely to be capped.

TECHNICAL TRACKER: PESTECH

Impeccable track record at undemanding valuations. PESTECH is likely to ride on the fast growing regional demand for electricity and rail related infrastructure. In Malaysia, the continuation of ECRL, LRT 3, and the pending RTS projects presents positive prospects for further involvement in rail electrification in addition to its current on-going projects. Regionally, the Thailand 3-airports high speed rail link, and Philippine National Railways Clark 1 projects are the major infrastructure undertakings that PESTECH may explore for further growth potential in rail electrification. The stock is trading at undemanding valuations at 8.5x FY20 P/E (27% below 10Y average 11.7x) as well as 1.71x P/B (10% below 10Y average of 1.9x), supported by current order book of RM1.8bn. Technically, the rounding bottom formation bodes well for PESTECH to retest RM1.29-1.45 in the mid to long term.

Source: Hong Leong Investment Bank Research - 2 Jul 2019