Traders Brief - KLCI Overbought and Upside May be Limited

HLInvest

Publish date: Thu, 04 Jul 2019, 09:18 AM

MARKET REVIEW

Following the G20 summit, where the US and China put a hold to further escalation of trade tensions, a series of statements emerged from the US, threatening to impose further tariffs on goods from European Union and steel products from Vietnam. The Nikkei 225 and Shanghai Composite Index fell 0.53% and 0.94%, respectively, while Hang Seng Index trended marginally lower by 0.07%.

Similarly, the FBM KLCI trended lower towards an intraday low of 1,683.24 pts before ending flat at 1,690.05 pts (-0.06%). Market breadth was negative with 456 decliners vs. 395 gainers, accompanied by 3.01bn shares traded for the day, valued at RM1.82bn. Meanwhile, IT-related company such as Datasonic and SCICOM traded actively higher.

Wall Street ended in a positive note where most of the major indexes marked fresh highs led by the speculation that a potential rate cut from the Fed later this month after the release of the weaker-than-expected jobs data (private payrolls in the US increased 102k in June vs. economist consensus of 135k). The Dow and S&P500 gained 0.67% and 0.77%, respectively, while Nasdaq added 0.75%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has taken a pause after a two-day rebound. However, the MACD Line is hovering above zero. Nevertheless, both the RSI and Stochastic oscillators are overbought. Hence, with the mixed technical readings, the KLCI’s upside could be capped over the near term. Resistance will be set around 1,700-1,730. Support will be envisaged around 1,666- 1,680.

Tracking new highs on Wall Street, coupled with the foreign trade flow turning positive over the past 5 trading days, it could lift market sentiment across Asia’s key stock markets, eventually leading the FBM KLCI higher. Also, we noticed the shift of trading momentum back towards construction as the sub-index has been trending higher recently. Nevertheless, we expect the upward momentum on the broader market may be limited after the recent rebound and the KLCI’s upside will be envisaged around 1,730.

TECHNICAL OUTLOOK: DOW JONES

The Dow continued to breakout yesterday, surpassing the previous high of 26,952. The MACD Indicator is positive at this juncture, but both the RSI and Stochastic oscillators are overbought; it could suggest that the Dow’s upside potential might be limited. Resistance is envisaged around 27,000-27,500, while the support is anchored around 26,500.

Currently, market participants are pricing in potential interest rate cut by the Fed later this month and it is likely to boost market higher on Wall Street over the near term. However, should any slowdown in the economic data moving forward, profit taking activities may emerge and it may limit the upside potential. Meanwhile, policies and statements from President Trump in regards of the trade issues with its trading partners could be another factor that may increase near term volatility in the markets. The Dow’s resistance is pegged around 27,500.

TECHNICAL TRACKER: CLOSED POSITION

We Had Squared Off Our Position on GKENT (+9.1% Gains) on 3 July.

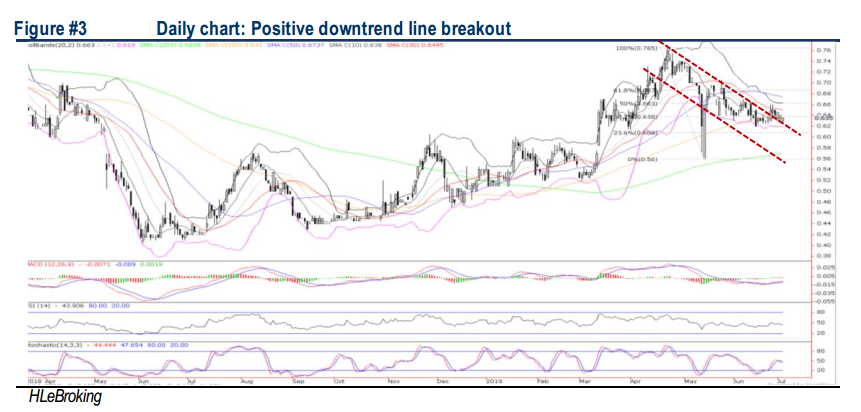

TECHNICAL TRACKER: TRC

A good proxy to Sarawak mega infrastructure projects. As construction contract awards are expected to gain tractions in the mid to long term to kick-start the economy, TRC is a laggard play to mega projects revival in Peninsular Malaysia and also well-positioned for infrastructure boom in Sarawak (ahead of the state elections in Sept 2021), given its unique UPK licence and a strong 30 years of business presence. Valuations are undemanding at 5.7x (ex-cash 3.4x) FY20 PE (41% discount to its peers) and 0.71x P/B (44% lower than its peers), supported by strong outstanding order book of RM2.6bn (could last for the 3-4 years), solid balance sheet with RM0.25 net cash/share (39% of share price) and attractive 4.7-5.5% yields for FY20-21. Technically, the stock is poised for a flag breakout before moving higher to RM0.685-0.765 zones.

Source: Hong Leong Investment Bank Research - 4 Jul 2019