Traders Brief - Still Hovering Within a Retracement Phase

HLInvest

Publish date: Tue, 16 Jul 2019, 09:10 AM

MARKET REVIEW

Despite China’s 2Q19 data on Monday which suggested that its economy slowed to the weakest rate of 6.2% since 1992, Asia’s stock markets ended on a positive note as the GDP data was deemed in-line with consensus estimates. The Shanghai Composite Index and Hang Seng Index added 0.40% and 0.29%, respectively, but the upside was limited with Hong Kong city still stuck in turmoil surrounding a controversial extradition bill. Meanwhile, Japan was closed for public holiday.

After trading mostly in the negative territory, the FBM KLCI closed higher on the back of last minute buying support and the key index inched higher by 0.17% to 1,672.37 pts. Market breadth was however negative with 469 decliners as compared to 375 gainers. Market traded volumes stood at 3.01bn, valued at RM1.65bn. On the broader market, we noticed technology stocks traded higher for the session.

Wall Street marked another record high, but upside was capped as investors were digesting China’s GDP, which recorded the lowest growth in 27 years as well as traders were cautious ahead of the corporate earnings season. The Dow and Nasdaq rose 0.10% and 0.17%, respectively, while S&P500 (0.02%) ended flat.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues to trend within the retracement phase (flag formation). The MACD indicator is still trending lower after the negative crossover signal two weeks back. Meanwhile, both the RSI and Stochastic momentum oscillators are still hovering below 50. Hence, with the weaker technical readings, the KLCI’s upside will be limited over the near term. Support is envisaged around 1,650-1,658. Resistance will be set along 1,700.

With China’s GDP suggesting that the country is growing at a softer pace amid the ongoing pressure that China could be facing in the midst of the trade negotiations with the US, we think the global slowdown may eventually result in a potential reduction in risky equities exposure. Nevertheless, selected stocks in Malaysia that were bashed down and oversold within the technology and O&G sectors may be seen as a good opportunity to trade for the rebound.

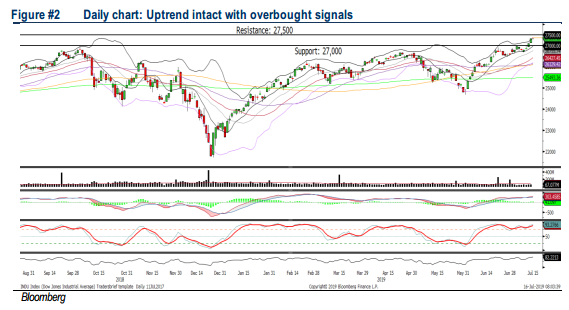

TECHNICAL OUTLOOK: DOW JONES

The Dow trended positively for the fourth trading day, the MACD indicator has expanded positively over last week, but both of the momentum oscillators are hovering in the overbought region; it could be suggesting that the uptrend could be limited over the near term. Resis tance will be pegged around 27,500, while support will be set along 27,500.

On Wall Street, we expect the upside could be limited given the overbought signals on the momentum oscillators. Meanwhile, investors will be watching closely on the upcoming corporate earnings season, coupled with the interest rate decision in the upcoming FOMC meeting. In addition, the unresolved trade war between the US and China will be another factor that may deter traders from aggressively buying into equities at this juncture. The Dow’s resistance will be located around 27,500.

TECHNICAL OUTLOOK: CLOSED POSITION

We Had Squared Off Our Technical Tracker Picks GDB (7.8% Return) Yesterday.

Source: Hong Leong Investment Bank Research - 16 Jul 2019