Traders Brief - Retracement Phase May Extend

HLInvest

Publish date: Thu, 18 Jul 2019, 09:11 AM

MARKET REVIEW

With renewed concerns over trade tensions between US and China following the public statements from President Trump, Asia’s stock market ended lower for the session; the Nikkei 225 fell 0.31%, while Shanghai Composite Index and Hang Seng Index slipped 0.20% and 0.09%, respectively. On a side note, Singapore's exports declined steeper than expected, non oil domestic exports contracted 17.3% YoY vs. consensus estimates of 9.9%.

Stocks on the local front traded mostly in the negative territory as the FBM KLCI ended lower by 0.68% to 1,657.53 pts led by Petronas Chemicals. Market breadth was negative with losers leading gainers by a ratio of 3-to-1. Market traded volumes stood at 3.83bn, worth RM1.97bn. Meanwhile, selected O&G stocks such as Reach Energy and Alam Maritim traded actively higher for the session.

Wall Street traded lower for the session as trade worries emerged following President Trump’s comments, which suggested more uncertainties in the ongoing trade discussions. Also, most of the transportation and logistics companies stated concerns caused by the protracted trade war, which affected their results and outlook moving forward; the Dow Jones Transportation index dropped 3.6%. Meanwhile, the Dow30 and S&P500 fell 0.42% and 0.65%, respectively, while Nasdaq declined 0.46%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has rejected the SMA200 and extended its retracement phase over the past two weeks. The MACD Line and MACD Histogram are declining, while both the RSI and Stochastic oscillators are trending lower below 50. With the negative technical readings , we opine that the KLCI’s upside will be limited around 1,680-1,700. Support will be set along 1,630.

With the overnight decline on Wall Street, we think the negative sentiment may spill over towards stocks on the local front, extending the current retracement phase below the SMA200. Moreover, the unresolved trade tensions, coupled with the slump in crude oil prices may put pressure amongst broader market on the local front. The FBM KLCI may trade within the range of 1,630-1,680.

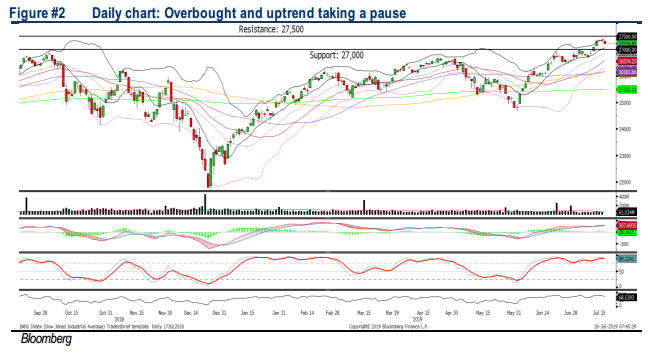

TECHNICAL OUTLOOK: DOW JONES

The Dow has been trending higher over the past few weeks towards the recent all-time-high zone on the back of the expectations of easier monetary policies. However, the upside is likely to be capped at this juncture after forming several small bodies candle and the MACD indicator is declining. Meanwhile, both the RSI and Stochastic oscillators are turning lower after threading along the overbought region recently; signs of momentum weakening. The resistance is pegged around 27,500, while support will be set around 27,000, followed by 26,500.

Despite a pause on additional US tariffs on Chinese goods during the G20 summit, the previous imposed tariffs have affected corporate earnings and outlook guidance by corporates. Hence, the ongoing earnings season may limit the upward move on Wall Street. In the meantime, investors are taking a cautious approach ahead of the FOMC meeting that will be held 30-31 July. The Dow’s resistance is located around 27,500.

Source: Hong Leong Investment Bank Research - 18 Jul 2019