USDMYR - Weakening Bias Towards RM4.20-4.25 Levels

HLInvest

Publish date: Tue, 06 Aug 2019, 09:23 AM

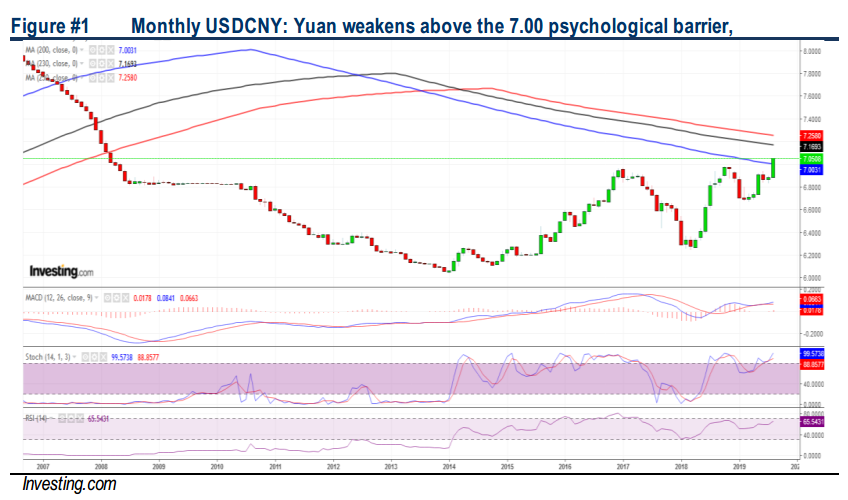

USDCNY slid 1.6% to 7.0504, below the 7.00 per USD for the 1st time since 2008 financial crisis amid escalating US-China trade tensions, which eventually sparked a selloff in Asian currency markets. The selloff came after Beijing vowed to retaliate against the recent tariffs threat and China’s Commerce Ministry said Chinese companies have stopped buying US agricultural products and will not rule out imposing import tariffs on US farm products that were bought after 3 Aug. Investors stampeded into safe harbours including yen, bonds and gold as investors are unlikely to see any meaningful resolution to the trade dispute anytime soon. Hence, HLIB institutional research had indicated ringgit to persist in the depreciation mode for the remainder of the year on the back of (i) heightened risk aversion with US-China trade tensions potentially evolving into a full blown trade war, (ii) a sustainable yuan depreciation and (iii) revision in the OPR expectations from unchanged to 25bps cut. Given the weak ringgit undertone, we reckon that export plays could return. HLIB insti top picks are Top Glove (BUY-RM5.31 TP/1.7% DY) and Lii Hen (BUY-RM4.22 TP/5.6% DY).

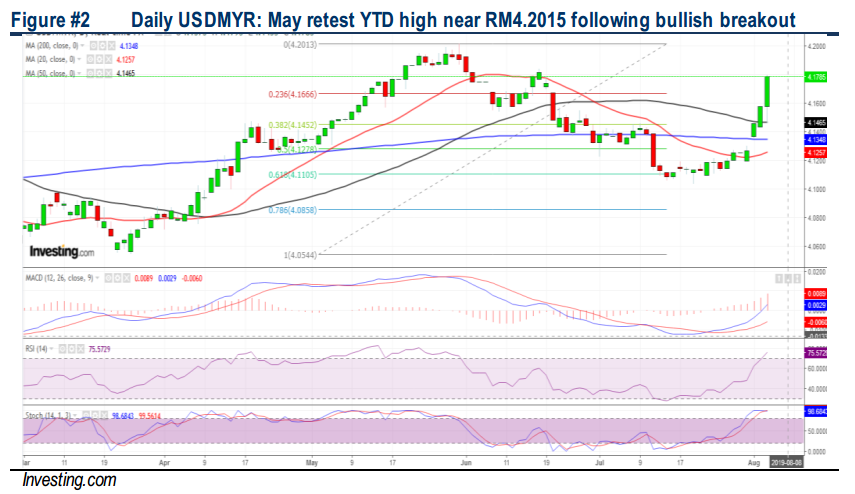

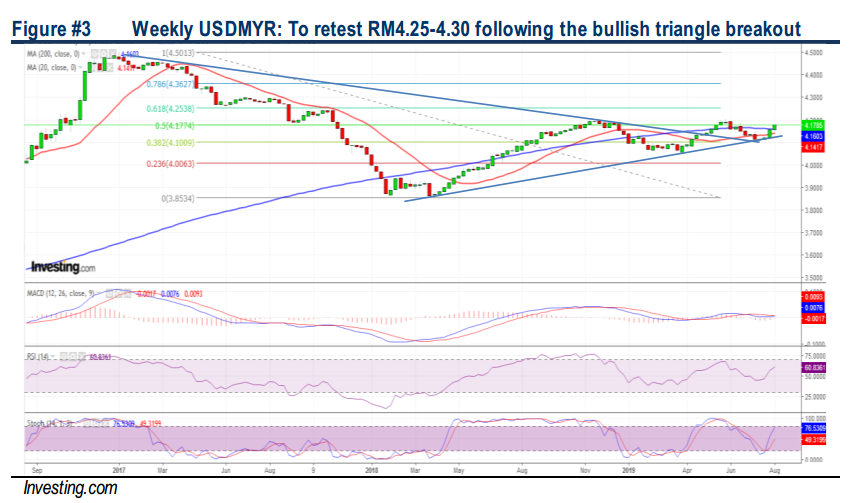

Weakening bias towards RM4.20-4.25 zones. After USDMYR strengthened 2.3% from YTD high of RM4.2015 (31 May) to a low of RM4.1035 (19 July), ringgit (vs USD) depreciated by 1.8% again to close at RM4.1715 yesterday following a series of multiple key 20D/50D/200D SMA resistance breakouts. We think the successful SMAs breakouts together with the bullish weekly symmetric triangle formation bode well for further RM weakening bias towards RM4.2015 and RM4.254 (61.8% FR) zones before retesting 1-year high at RM4.30 (16 Aug). On a flip side, a decisive violation below RM4.145 (50D SMA) and RM4.135 (200D SMA) levels would augur well for the currency to recover near RM4.1035 territory.

Source: Hong Leong Investment Bank Research - 6 Aug 2019

speakup

welcome to malaysia baru, where our ringgit is toilet-paper

who to blame now PH? blame BN? Trump? ISIS? Zakir? u are govt now, take the blame!

2019-08-06 11:52