Traders Brief - Technical Rebound to Persist

HLInvest

Publish date: Fri, 09 Aug 2019, 08:50 AM

MARKET REVIEW

Asia’s stock markets ended on a positive note amid a jump in China’s export data (July export data grew 3.3% YoY) despite the unsettled trade war between the US and China. Meanwhile, PBOC’s daily fix for yuan midpoint stood at 7.0039 per dollar on a Thursday, which was the weakest since 2008. The Shanghai Composite Index and Hang Seng Index rose 0.93% and 0.48%, respectively, while Nikkei 225 gained 0.37%.

Meanwhile, stocks on the local front were seeing some positive actions amid bargain hunting activities; the FBM KLCI advanced 0.71% to 1,616.02 pts. Market breadth was bullish with 508 advancers vs. 296 decliners. Market traded volumes stood at 2.12bn worth RM1.52bn. We noticed selected immigration-related stocks such as SCICOM, DSONIC and IRIS were traded actively throughout the session.

As traders digested better-than-expected export data from China, Wall Street was pushed strongly into the positive region led by bargain hunting activities within the energy and technology sectors. Also, 10-year treasury yield rebounded after hitting a low of 1.59% recently. The Dow and S&P500 increased 1.43% and 1.88%, respectively, while Nasdaq rallied 2.24%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI managed to rebound higher amid sustained bargain hunting interest and the MACD Histogram recovered mildly. Meanwhile, both the RSI and Stochastic oscillators are recovering after threading along the oversold region over the past few weeks. Hence, we believe a technical rebound may sustain over the near term, revisiting the 1,620-1,640 level. Support is set around 1,600, followed by 1,580.

Tracking the overnight Wall Street performance and the recovering technicals, as well as less negative news headlines for now, we opine that the buying support could sustain over the near term. Also, we observed immigration-related and O&G stocks may anticipate some mild recovery as trading volumes picked up recently and recovery in crude oil prices. Meanwhile, the KLCI’s resistance is set around 1,640-1,650.

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded sharply above the SMA200 around 25,500 level amid strong bargain hunting activities and the MACD Histogram has recovered over the past two sessions. Meanwhile, both the RSI and Stochastic oscillators have recovered above the oversold region. Hence, we opine the Dow could revisit the resistance along 26,500, with the support set around 26,000, followed by 25,500 (SMA200).

Globally, investors are watching closely on the currency fix in China, 10-year treasury yield and economic data under this protracted trade war environment between the US and China. In the meantime, the relief rally on crude oil prices after Saudi Arabia contacted other producers to discuss options to potentially stop the price from falling further and this could lend some support towards energy stocks over the near term.

TECHNICAL OUTLOOK: DOW JONES

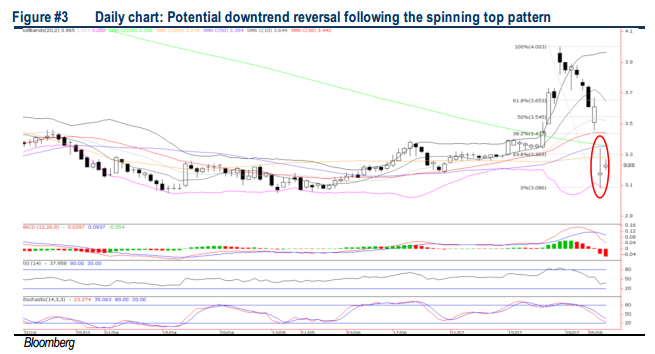

Limited downside risk amid undemanding valuations. After hitting YTD high of RM4.00 (26 July) following the GENM-Walt Disney/21st Century Fox lawsuit resolution, the stock plunged to a low of RM3.08 after a surprise related-party transaction. GENM’s downside may be limited on the back of undemanding valuation at 1.02x P/B (32% below 10Y average of 1.5x) and 15.5x FY20 P/E (8.3% below 10Y average of 16.9x). Technically, GENM is poised for potential downtrend reversal following the spinning top pattern, with upside targets at RM3.35-3.65 in the mid to long term, supported by the dispute resolution with Fox and clearer direction of the outdoor theme park.

Source: Hong Leong Investment Bank Research - 9 Aug 2019