Traders Brief - Positive Wall Street Sentiment to Spill Over

HLInvest

Publish date: Thu, 22 Aug 2019, 08:49 AM

MARKET REVIEW

Asia’s stock markets traded mixed tracking the negative performance from Wall Street overnight. Also, concerns over Brexit issues, Italian political crisis, protracted trade war as well as the recession fears contributed to the lacklustre trading tone across Asia. The Nikkei 225 slid 0.28%, but Hang Seng Index gained 0.15%, while Shanghai Composite index ended flat.

Meanwhile, stocks on the local front were mostly in the negative zone and key index traded lower by 0.51% to 1,594.59 pts. Market breadth was negative with losers leading gainers by a ratio of 4-to-3, accompanied by 2bn shares traded for the session, worth RM1.62bn. Nevertheless, automotive stocks such as MBMR and PECCA traded actively higher for the session.

Wall Street ended on a positive note following a set of better-than-expected results from retailers such as Target and Lowe and led more buying support into the broader market after traders were worried of a possible US economic slowdown last week. Meanwhile, the Fed’s meeting minutes suggested that the recent rate adjustment in July was a recalibration of current policy and not a signal of a major round of rate cut. The Dow and S&P500 gained 0.93% and 0.82%, respectively, while Nasdaq advanced 0.90%.

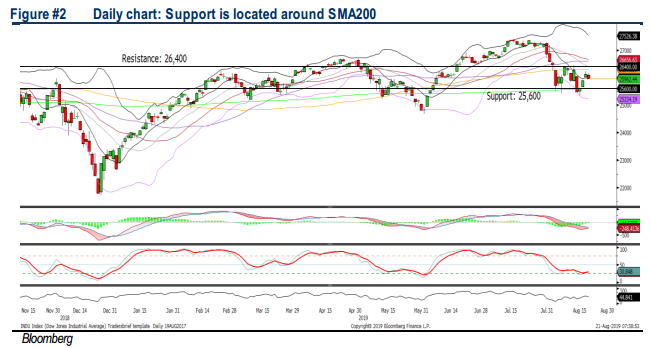

TECHNICAL OUTLOOK: KLCI

After reclaiming above the 1,600 psychological level, the KLCI fell briefly yesterday and the MACD indicator remains flattish below the zero level. Although both of the RSI and Stochastic oscillators have recovered above the oversold region, they are still hovering below 50. Hence, with the flattish indicators the KLCI may trend within a narrow range between 1,590-1,610 for the session.

Tracking the positive performance on Wall Street overnight, we expect buying support to emerge on the local front at least for today. We opine traders could look into several sectors such as technology (on a lookout for 2QCY19 results) and plantation (on the back of strong surge in CPO prices) for short term trading opportunities. The FBM KLCI is likely to retest the 1,600 level today.

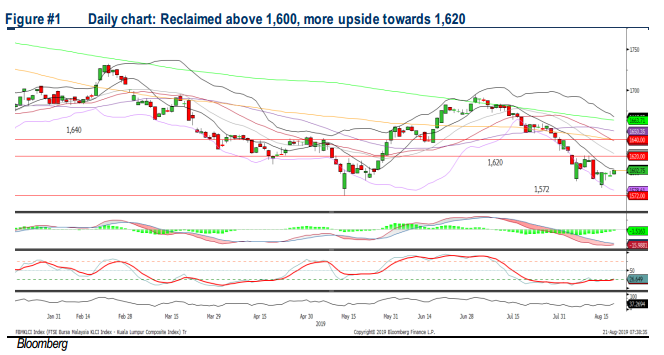

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded further and the MACD indicator has issued a buy signal (MACD Line crossing above Signal Line). Also, both the momentum oscillators are recovering, hence we anticipate that the Dow could retest the resistance around 26,400, while support will be pegged around 25,600.

Despite the Fed’s meeting minutes reaffirms the stance of a “mid-cycle adjustment”, investors will be watching the speech that will be delivered by Jerome Powell this Friday at the Jackson Hole, Wyoming symposium, which he may provide some clues on the future policy outlook. Besides, market participants are awaiting further developments on trade war between US and China in the upcoming discussion that will be resuming by September, should it provide some optimism in crafting some trade deals, we may anticipate further upward momentum on Wall Street.

Source: Hong Leong Investment Bank Research - 22 Aug 2019