Traders Brief - Heightened Worries Over Trade Spat

HLInvest

Publish date: Mon, 26 Aug 2019, 09:49 AM

MARKET REVIEW

Asia’s stock markets trended higher despite tensions between Japan and South Korea escalated after the latter commented to cancel an intelligence-sharing pact with Tokyo. Besides, investors were waiting for more clues on the interest rate outlook prior to an important speech by Jerome Powell in Jackson Hole, Wyoming. The Nikkei 225 rose 0.40%, while Shanghai Composite Index and Hang Seng Index added 0.50% and 0.49%, respectively.

Meanwhile, tracking the regional gains, KLCI closed higher by 0.43% to 1,609.33 pts, but market breadth was negative (400 losers vs. 381 gainers). Market traded volume stood at 2.01bn, worth RM1.74bn. Bandar Malaysia-theme and construction-related stocks such as Ekovest and IWCITY topped the active list.

Wall Street traded in the negative territory as China retaliated with imposing tariffs on by 5- 10% on USD75bn worth of US products, including automotive, which will be implemented in two batches (1st of Sept and 15th December). Following the retaliation, President Trump ordered US companies to look for alternative in their operations in China and the White House will raise existing duties on USD250bn and USD300bn worth of Chinese goods to 30% (from 25% on 1st Oct) and 15% (from 10% on 1st Sept).

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has surpassed the 1,600 psychological level and the MACD indicator has issued a “Buy” signal. Meanwhile, both the RSI and Stochastic oscillators are recovering towards the 50 zone after threading along the oversold region last week. The FBM KLCI may continue its rebound towards 1,620, with the support located around 1,572-1,580.

Despite the positive tilt in the KLCI’s technical outlook, market sentiment could be dampened today as tensions between the US and China intensified over the weekend following a series of reciprocal actions by both parties. KLCI could trade lower with investors fleeing for safe haven assets such as gold and USD. In addition, traders will trade cautiously throughout the final week of the August reporting season.

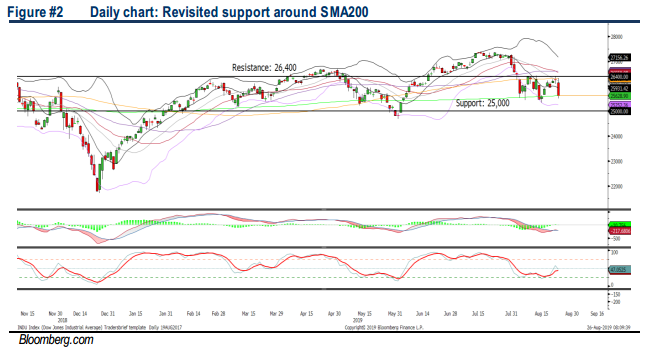

TECHNICAL OUTLOOK: DOW JONES

The Dow declined after retesting the 26,400 level and it has revisited the SMA200 last Friday. The MACD indicator is still hovering below zero and both the RSI and Stochastic oscillators have turned lower for the session. Hence, with the negative technical readings, we believe the downside risk may still persist and the Dow is likely to violate below the SMA200. Next support will be set around 25,000, while resistance will be envisaged around 26,400.

With drastic actions from President Trump imposing further tariffs on Chinese products which will be implemented in Sep and Dec, respectively, the tensions on the protracted trade war have intensified and we believe the downside risk may persist until a trade deal is reached (which is unlikely to be seen over the near term). Hence, the market tone is likely to stay negative this week and the Dow’s upside will be limited.

Source: Hong Leong Investment Bank Research - 26 Aug 2019