Traders Brief - Market Sentiment Turning Negative

HLInvest

Publish date: Wed, 28 Aug 2019, 09:08 AM

MARKET REVIEW

Asia’s stock markets ended mostly higher after President Trump’s comments during the G7 summit in France, stating that China would restart the trade talk (albeit China insisted that it is unaware of calls to Trump). The Nikkei 225 and Shanghai Composite Index rose 0.96% and 1.35%, respectively, while Hang Seng Index closed flat. Meanwhile, USDCNY traded on a weaker tone yesterday around 7.16 against the USD (weakest in more than 11 years).

Bucking the regional and Wall Street performance, KLCI fell 0.61% to 1,590.84 pts led by selected banking heavyweights. On the broader market, there were 471 decliners as compared to 293 gainers, while market traded volume stood at 2.11bn (valued at RM2.62bn). Selected technology stocks such as Vitrox, MPI and Dufu were traded actively higher for the session amid weaker ringgit tone.

Wall Street reversed earlier gains as the spread between the 10Y and 2Y Treasury yields turned negative, suggesting an inverted yield curve phenomenon. Market participants could be taking it as a sign of a potential slowdown in economic activities moving forward, which led to further profit taking activities. The Dow and S&P500 declined 0.47% and 0.32%, respectively, while Nasdaq slipped 0.34%.

TECHNICAL OUTLOOK: KLCI

After fluctuated near the 1,600 level for the past two weeks, the KLCI has closed below 1,600 and the MACD Histogram has turned weaker. Meanwhile, both the RSI and Stochastic oscillators are still hovering below 50. With the weakening technical indicators, the KLCI’s downward bias may extend over the near term, with the resistance envisaged around 1,620 and support is anchored around 1,572.

Given the negative performance on the Wall Street overnight, we expect selling pressure could spill over towards stocks on the local front and the FBM KLCI may hovers below 1,600 over the near term (supported by the negative technical readings. Traders could look into safe haven asset proxy (gold) such as GOLDETF, BAHVEST, POHKONG and TOMEI for trading opportunities under this cautious environment.

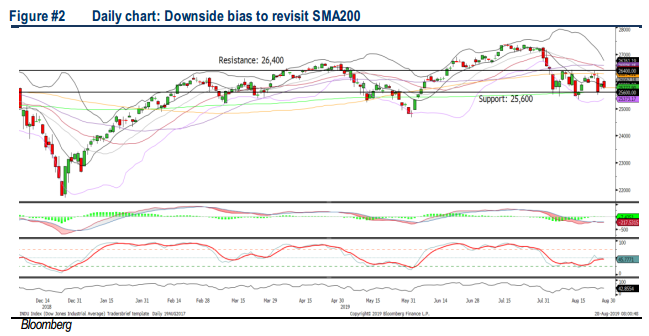

TECHNICAL OUTLOOK: DOW JONES

The Dow has trended lower yesterday and may revisit the SMA200 level over the near term, given the MACD indicator is still hovering in the negative region, while both the RSI and Stochastic have turned lower over the past few sessions. The Dow’s resistance will be envisaged around 26,400, while support is pegged around SMA200 (~25,600).

In the US, with the protracted trade war between the US and China (which has intensified recently last week as additional tariffs will be imposed on Chinese goods later this year), as well as the inverted yield curve phenomenon, we opine that the near term negative market sentiment may persist and the Dow could revisit SMA200 near the 25,600. Should it violates below 25,600, next support will be at 25,000.

TECHNICAL TRACKER: CLOSED POSITIONS

We had squared off our positions in ABMB (8% loss) and AWC (5.6% loss) amid sluggish results.

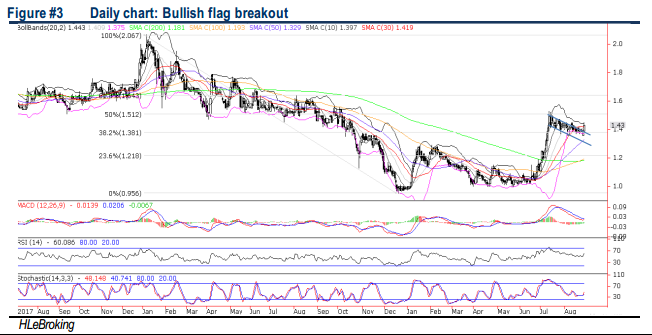

TECHNICAL TRACKER: PESTECH

Growing stronger. Despite rallying 44% YTD, PESTECH is expected to scale higher, backed by its sizeable order-book of RM1.63bn and robust earnings growth (34% EPS CAGR for FY18-20), riding on the fast growing regional (ASEAN, especially Cambodia and Myanmar) demand for electricity and rail related infrastructure, coupled with the call for greater implementation of renewable energy. In Malaysia, the revival of mega transportation infrastructure projects and the Large Scale Solar 3 projects presents positive prospects. The stock is trading at undemanding valuations at 10.5x FY20 P/E (16% below 5Y mean) as well as 1.96x P/B (15% below 5Y average), respectively. Technically, the bullish flag breakout bodes well for further price appreciation towards RM1.51-1.80 in the mid- to long-term.

Source: Hong Leong Investment Bank Research - 28 Aug 2019