Traders Brief - Slight Optimism, But Upside Limited

HLInvest

Publish date: Thu, 29 Aug 2019, 09:54 AM

MARKET REVIEW

Key regional benchmark indices ended on a mixed note following the inversion of yield curve (10Y vs. 2Y); traders were taking a cautious approach monitoring the developments on the trade front (ahead of a potential trade discussion in Washington by Sept). The Shanghai Composite Index and Hang Seng Index fell 0.29% and 0.19%, respectively, while Nikkei 225 added 0.11%.

Tracking the negative performance on Wall Street, as well as the inverted yield curve condition, stocks on the local extended its negative trading tone and the FBM KLCI slid marginally by 0.06% to 1,589.82 pts. Market breadth was still negative with losers leading gainers by a ratio of 5-to-3. Nevertheless, following the approval of National Fiberisation and Connectivity Plan by the government, stocks related to this theme such as OPCOM, OCK and BINACOM gained momentum during second trading session for the day.

Despite US yield curve inverting further, which led to an extension of selling pressure on Wall Street soon after the opening bell, it managed to reverse and end higher on major indexes at the end of the session. Energy stocks were taking the lead on the back of higher crude oil prices supported by lower US crude inventories (EIA commented a drop of 10m barrels in inventories last week), while consumer stock such as Tiffany gained traction posting better than-expected quarterly results. The Dow and S&P500 were traded higher by 1.00% and 0.65%, respectively, while Nasdaq rose 0.38%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has fallen for the second consecutive day and the MACD Line is hovering below zero, while the MACD Histogram continues to weaken for the second day. On the momentum oscillators, both the RSI and Stochastic are hovering below 50. Hence with the slightly weaker technical readings, we opine that the FBM KLCI’s upside could be limited around the resistance at 1,620, while support is set around 1,572-1,580.

Tracking the Wall Street overnight performance, we may anticipate some buying interest to spill over on the local bourse, especially within the O&G sector on the back of a surge in crude oil prices following the EIA report. However, we believe the protracted trade war between the US and China may limit the upside potential on the KLCI. Next resistance will be at 1,620.

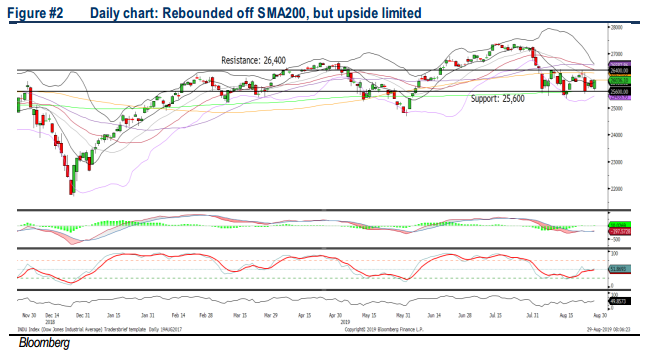

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded off near the SMA200 level, but the MACD Line is hovering below zero. Meanwhile, both the RSI and Stochastic oscillators are threading slightly below the 50. With the slightly negative technical readings, we opine that the upside of the Dow could be limited around 26,400 level, while the support is set around 25,600.

In the US, sentiment has turned slightly positive amid the rebound in crude oil. However, the upward momentum may face some resistance as additional tariffs will be imposed on selected Chinese goods this Sunday and the inversion of yield curve headlines will cap the upside momentum on Wall Street. The Dow’s resistance is envisaged around 26,400.

Source: Hong Leong Investment Bank Research - 29 Aug 2019