Traders Brief - Trade Optimism Could Lift Index Higher

HLInvest

Publish date: Fri, 30 Aug 2019, 09:19 AM

MARKET REVIEW

Asia’s key benchmark indices ended on a mixed note as investors were focusing on the inverted yield curve, the ongoing protest in Hong Kong and the weakening Chinese yuan (which traded briefly around the 7.17 level against the Greenback, the weakest in 11.5 years). Nikkei 225 and Shanghai Composite Index slid 0.09% and 0.10%, respectively, but Hang Seng Index added 0.34%.

Meanwhile, KLCI stabilised and turned higher, snapping the 2-day losing streak to end at 1,595.18 pts (+0.34%). Market breadth however was still negative with 338 advancers vs. 451 decliners, accompanied by 2.00bn shares traded for the session, valued at RM1.67bn. Nevertheless, we noticed selected O&G stocks (Dayang, Armada and KNM) were traded actively higher on back of slight recovery in Brent oil prices.

Following the gains on energy stocks, Wall Street traded higher as China’s Ministry of Commerce commented that China is willing to negotiate and collaborate with a “calm attitude” to solve the current trade situation, preventing from any escalation of trade war moving forward. The Dow and S&P500 jumped 1.25% and 1.27%, respectively, while Nasdaq gained 1.48%.

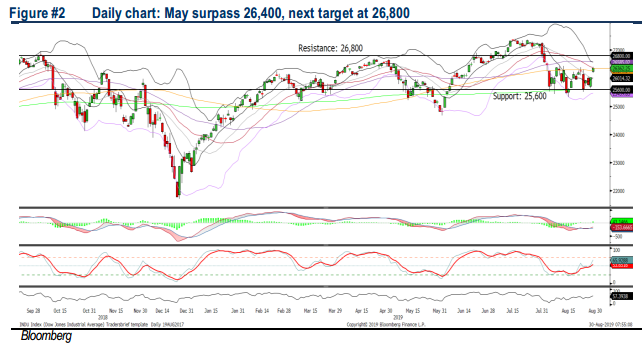

TECHNICAL OUTLOOK: KLCI

The KLCI rebounded after two days of losing streak and the MACD Histogram has recovered mildly in tandem with the MACD Line. However, both the RSI and Stochastic oscillators are still hovering below 50. With the mixed technical readings, the upward rebound could be limited around 1,620. Support is pegged around 1,572-1,580.

Given the KLCI turning slightly positive yesterday, coupled with Wall Street’s overnight bullish tone following statements from Chinese officials, we may anticipate further buying interest within stocks on the local bourse, lifting the KLCI towards the 1,600 psychological level. Traders may lookout for technology stocks for trading opportunities amid some uptick in trade optimism.

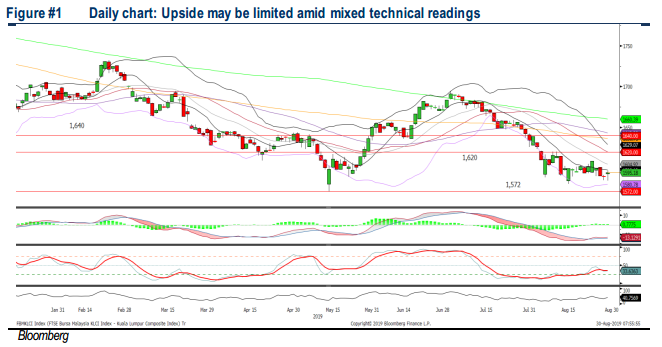

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to rebound higher and revisited the 26,400 level, while the MACD Line has been improving over the past few sessions (despite still below zero). For the momentum oscillators, both the RSI and Stochastic trended higher for the session; indicating that the momentum is picking up and the Dow may surpass the 26,400 resistance, targeting 26,800. Meanwhile, support is set around 26,000.

On Wall Street, we expect the current upward rebound to sustain led by technology sector given the trade negotiations between the US and China could resume in the near term following statements from China. However, any negative news headlines related to the a potential economic slowdown activities moving forward given the yield spread (between 10Y and 2Y) is still hovering in the negative region may limit the upside potential on Wall Street.

TECHNICAL TRACKER: TM

Trading opportunities emerge after selldown. After surging 41% YTD and factoring in expectations for less robust 2H19 results (1H19 core earnings RM523m; 2H RM364m), TM share prices plunged 8.3% or RM0.34 yesterday to RM3.74. We see values in the stock as our DCF-derived TP of RM5.00 still offers a strong 33.6% upside. Current valuation at 15.3x FY20 P/E is undemanding (48% lower than peers), supported by a 18.5% EPS FY19-21 CAGR. Technically, traders may accumulate near RM3.65-3.70 levels in anticipation for an oversold technical rebound towards RM3.88-4.18 levels.

Source: Hong Leong Investment Bank Research - 30 Aug 2019