Traders Brief - Slight Positive Bias Mode on FBM KLCI

HLInvest

Publish date: Tue, 10 Sep 2019, 11:27 AM

MARKET REVIEW

Asia’s stock markets ended mixed as investors digested weaker-than-expected China exports data, which fell 1% YoY in August and traders are anticipating that Beijing may introduce more stimulus measures to boost its economy. The Shanghai Composite Index and Nikkei 225 rose 0.84% and 0.56%, respectively, but Hang Seng Index fell marginally by 0.04% as protracted protest in Hong Kong continues to dampen the market sentiment.

Meanwhile, trading interest on Friday was slightly lower ahead of the long weekend break as Bursa Exchange was closed for a public holiday on Monday. On Friday, the FBM KLCI rose 0.30% to 1,604.47 pts, while trading volume was lower at 1.67bn (worth RM1.44bn) as compared to 1.85bn (valued at RM1.58bn) on Thursday. Nevertheless, we observed that selected O&G stocks such as UZMA, DAYANG and PENERGY traded actively higher.

Wall Street closed mixed despite a positive news flow on the trade front where China offered last week to increase purchases of US agricultural products if the US eases up exports restrictions on Huawei as well as delaying the Oct 1st tariff escalation on USD250bn worth of Chinese goods. The Dow up 0.14%, while Nasdaq declined 0.19% and S&P500 traded flat for the session.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI rebounded mildly over the past three trading days and the MACD indicator has improved over the past sessions. Meanwhile, both the RSI and Stochastic oscillators have crossed above 50. Hence, with the recovering technicals, we expect the FBM KLCI to recover over the near term. Resistance is envisaged around 1,620. Support will be anchored around 1,572-1,580.

With slight optimism on the trade progress at this juncture, we believe investors may take the opportunity to scoop up some heavyweights on the local front given the KLCI has stabilised around 1,580-1,600 over the past month. Also, traders may lookout for shares which could be related to the upcoming Budget Malaysia 2020. On the KLCI, it is currently having positive bias mode, near term target at 1,620.

TECHNICAL OUTLOOK: DOW JONES

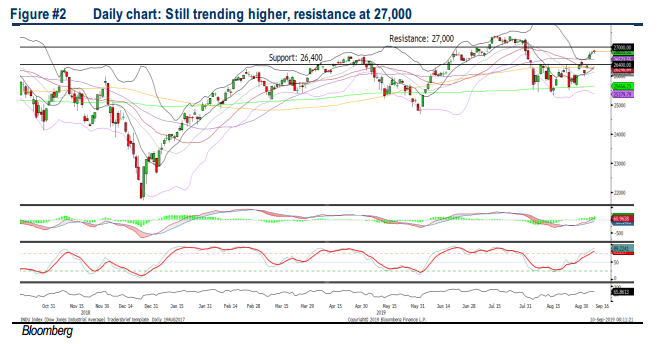

The Dow extended the recent rebound after surpassing the 26,400 level last week. The MACD indicator is positive (MACD Line is above zero). The rebound could retest the 27,000 psychological level. Meanwhile, both the RSI and Stochastic are trending positively over the past few sessions. Support is pegged at 26,400.

In the US, we anticipate that traders will continue to monitor on the progress regarding the US and China trade talks which will be held in Washington in October. At this juncture, the positive hopes on striking a trade deal between the US and China may still alleviate the market sentiment on Wall Street and the Dow could trade higher in the near term, targeting 27,000.

TECHNICAL TRACKER: CLOSED POSITION

We had squared off our positions on HSl (1% return) and PESTECH (7% loss) last Friday amid weakening technicals.

TECHNICAL TRACKER: TUNEPRO

Anticipate a stronger 2H19. TUNEPRO is a leader in digital insurance and a dominant player in the local travel insurance segment, riding on its sister company, Air Asia’s low cost carriers’ aggressive network expansion into new markets and strong passenger growth. It could serve as an alternative investment vehicle for investors who wish to participate in AirAsia’s strong growth story without exposures to jet fuel price and USD borrowings risks. After tumbling 20% from YTD high to RM0.615 after a poor 2Q19 results, valuations are cheap at 6.6x FY20 P/E and 0.87x P/B, which are 53% and 67% lower than its peers, supported by expectations of a better 2H19, superior FY20 dividend yield of 5.7% (71% higher than its peers) and stable 11.3% earnings CAGR for FY19-21. Technically, the stock is heading towards RM0.645-0.71 levels after staging a downtrend line breakout last Friday.

Source: Hong Leong Investment Bank Research - 10 Sept 2019