Traders Brief - Revisiting Upper Band of the Consolidation Phase

HLInvest

Publish date: Thu, 12 Sep 2019, 09:37 AM

MARKET REVIEW

Asia’s stock markets ended mixed with investors trading cautiously ahead of the ECB’s decision on interest rates on Thursday. Meanwhile, shares of Apple’s suppliers were mostly higher following the unveiling of Apple’s latest products and services on Tuesday. The Nikkei 225 and Hang Seng Index rose 0.96% and 1.78%, respectively, but Shanghai Composite Index declined 0.41%.

Throughout the session, the FBM KLCI traded mostly in the positive territory as foreign funds were seen returning into our local bourse, net buying flow stood at RM197m and RM100m for Tuesday and Wednesday, respectively; the FBM KLCI rose 0.40% to 1,602.30 pts. Market breadth was positive with 422 gainers as compared to 359 losers, accompanied by 2.33bn, worth RM1.78bn. Selected gloves (SUPERMAX) and O&G (DELEUM and DAYANG) stocks were traded actively higher for the session.

Wall Street ended higher led by Apple following the launching of new products and services by Apple on Tuesday as well as improved sentiment following the positive progress on the trade front, where both the US and Chinese officials will be meeting up in Washington next month. The Dow and S&P500 gained 0.85% and 0.72%, respectively, while Nasdaq advanced 1.06%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI recovered mildly and managed to surpass the 1,600 level, but is still hovering between the 1,580-1,620 levels. The MACD Indicator improved mildly yesterday, with the MACD Histogram showing an uptick. Meanwhile, both the RSI and Stochastic oscillators have crossed above 50; suggesting that the positive momentum could be picking up. Hence, we believe the FBM KLCI could tilt higher over the near term, retesting the 1,620. Support will be at 1,580.

On the local front, we believe the buying interest may spill over towards stocks on the local front, especially technology stocks on the back of positive Apple’s performance overnight. Traders will be looking out for opportunities within the O&G and gloves stocks on the back of firmer crude oil prices and potential trade diversion from China to Malaysia amid the US trade tensions, respectively. The FBM KLCI may trend higher towards 1,620.

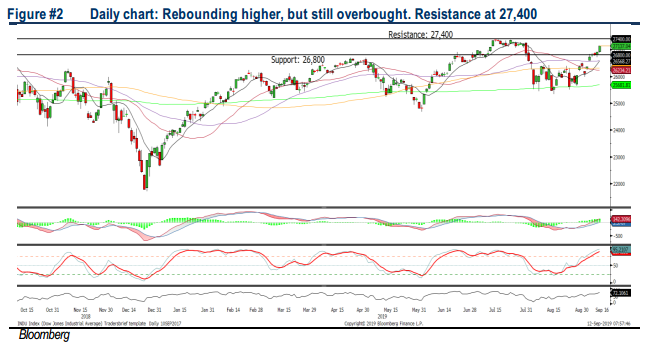

TECHNICAL OUTLOOK: DOW JONES

The Dow extended the rebound and surpassed the 27,000 psychological level. The MACD indicator continues to trend higher, but the Stochastic oscillator is overbought. Hence, the rebound trend on the Dow could be due for a mild pullback. Resistance is set around 27,400, while support is located around 26,800.

With the sentiment turning positive and the Dow surpassing 27,000 psychological level convincingly, we expect further buying interest to emerge on Wall Street. In addition to the positive sentiment, President Trump will be delaying the increase of tariffs (25% to 30%) on USD250bn of Chinese products to 15th Oct (initially on 1st Oct). Meanwhile, traders will be monitoring closely on the outcome in the ECB and FOMC meetings this week and next week respectively, where market participants are expecting rate cuts this month.

Source: Hong Leong Investment Bank Research - 12 Sept 2019