Traders Brief - Buying Interest Could Emerge on KLCI

HLInvest

Publish date: Fri, 13 Sep 2019, 09:27 AM

MARKET REVIEW

Asia’s key regional benchmark indices trended mixed despite President Trump’s tweet that the increase tariffs on USD250bn worth of Chinese goods that was supposed to set in on 1st of October will be delayed to 15th of October. Also, traders were slightly cautious prior to the ECB’s decision on monetary policies. The Nikkei 225 and Shanghai Composite index added 0.75% each, but Hang Seng Index slipped 0.25%.

Meanwhile, the FBM KLCI reversed earlier gains as profit taking activities emerged near the end of the session; the key index fell marginally by 0.08% to 1,601.00 pts. Market breadth was however positive with advancers leading decliners by a ratio 4-to-3, accompanied by 1.89bn (worth RM1.74bn) shares traded for the day. Selected technology stocks such as KESM, VITROX, MI, ELSOFT and SALUTE were traded actively higher for the day.

Following a gesture of goodwill by President Trump by delaying the planned increase of tariffs on Chinese goods to mid-October coupled with the ECB announcing a cut to its deposits rates by 10 basis points to negative 0.5% as well as a substantial bond-buying program of 20bn euros per month, Wall Street ended higher for the session. The Dow and S&P500 rose 0.17% and 0.29%, respectively, while Nasdaq added 0.30%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended sideways after a two-day rebound formation and still hovering around the 1,600 psychological level. The MACD Line and MACD Histogram have moved higher for the session. Meanwhile, both the RSI and Stochastic are trending sideways near the 50 level. Hence, with the mixed technical readings, we think the FBM KLCI could stay within the range of 1,580-1,620 over the near term.

Given the optimism on the trade front and the interest rate cut in the ECB’s meeting yesterday, buying interest may emerge on the local front and the KLCI may be lifted higher for the session; the key index is likely to revisit 1,620. Traders could also focus on technology stocks, should President Trump strike an interim deal with China.

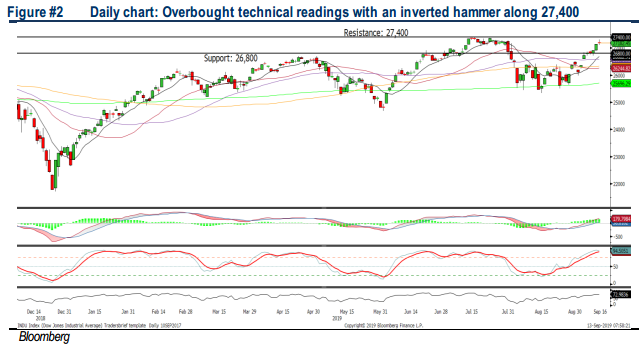

TECHNICAL OUTLOOK: DOW JONES

The Dow trended higher yesterday but it has formed an inverted hammer yesterday. The MACD indicator is trending positively above zero. Meanwhile, the Stochastic oscillator is overbought; suggesting that the upside could be limited. The resistance is set along 27,400, while support is anchored around 26,800.

With the mildly positive trade progress as well as the ECB’s rate cut and QE moving forward, we expect the market sentiment to remain positive over the near term. Also, we think sentiment will remain steady with the President Trump signalling that he would consider an interim trade deal with China (albeit it was denied by a White House official). Nevertheless, the Dow’s upside could be limited around 27,400.

Source: Hong Leong Investment Bank Research - 13 Sept 2019