Traders Brief - Still Positive Bias on KLCI

HLInvest

Publish date: Wed, 18 Sep 2019, 05:49 PM

MARKET REVIEW

On the back of increasing geopolitical tensions after a series of drones attack on the world’s largest oil processing facility in Saudi Arabia, key regional benchmark indices traded on a cautious tone amid the rising oil prices. The Shanghai Composite Index and Hang Seng Index lost 1.74% and 1.23%, respectively, but Nikkei 225 gained marginally by 0.06% as President Donald Trump indicated on Monday that the US had reached initial trade agreements with Japan on tariffs and digital trade that will not require congressional approval.

Stocks on the local front traded on a mixed note as the KLCI index was fluctuating between the positive and negative territories before ending marginally higher by 0.10% to 1,604.30 pts led by Petronas related heavyweights. Market breadth was however negative as decliners led losers by a ratio of 5-to-3, accompanied by 2.73bn shares traded, valued at RM2.18bn. Most of the O&G stocks traded actively higher on the drones attack incident.

Wall Street ended higher as oil fears subsided after Saudi Arabia commented that half of the production at the key processing facilities was restored in two days and the remaining will be restored by end September. Meanwhile, traders will turned their focus back onto the FOMC meeting, where consensus is expecting an interest rate cut this round. The Dow and S&P500 rose 0.13% and 0.26%, respectively, while Nasdaq advanced 0.40%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has maintained above the 1,600 level for the fourth trading day. The MACD indicator is trending higher but hovering below zero. Meanwhile, both the RSI and Stochastic oscillators are trending above 50. Hence, we believe the KLCI may trend higher over the near term. Resistance will be set around 1,620. Support is envisaged around 1,572-1,580.

For now, the crude oil rally has taken a pause and Saudi Arabia had partially resumed on their processing facilities. We think stocks on the local front may recover as trading tone stabilised. However, crude oil related stocks that had jumped yesterday may see profit taking activities today as the short term hype could be taking a pause. Nevertheless, since the Brent oil has experienced a strong breakout this week, we think trading interest on O&G stocks may sustain in the mid- to long-term.

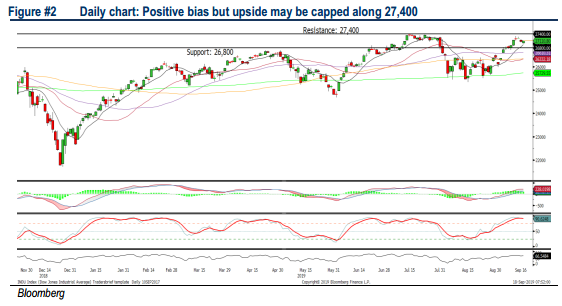

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded marginally after a one-day pullback. The MACD indicator is trending positively above zero and RSI is hovering above 50, but the Stochastic is overbought. With the mixed technical readings, we believe the Dow is still up trending, but the near term upside could be limited around the 27,400. Meanwhile, support will be located around 26,800.

Given Saudi Arabia managed to restore their oil processing facilities partially, we think the crude oil rally might subside for now. However, despite the quick fix at Abqaiq, the geopolitical tensions in the Middle East region could prolong, while traders would watch out for any oil disruption signals in the next few weeks as the production capacity may not be fully restored until November. FOMC meeting will be closely monitored over the next two days.

TECHNICAL TRACKER: CLOSED POSITIONS

We took profit on DAYANG (12.7% return) and CARIMIN (15.9% return) yesterday after share prices hit above R1 upside targets.

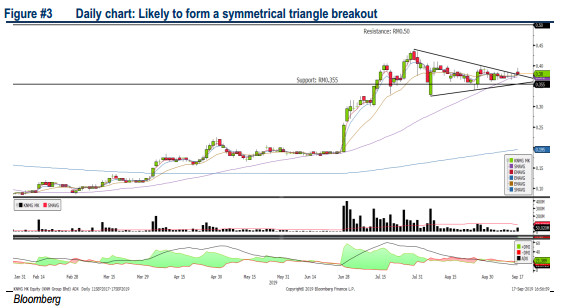

TECHNICAL TRACKER: KNM

Triangle breakout after a decent consolidation phase. KNM was awarded with a contract worth RM53.3m, adding to the feel good sentiment amid the crude oil rally (albeit the rally is taking a pause) following the drones attack over the weekend on Saudi Arabia’s production facilities. Meanwhile, Borsig listing on Singapore Exchange is still a market catalyst. Yesterday, KNM tried to breakout above the symmetrical triangle and the share price is holding above the upper band. Resistance is pegged at RM0.415-0.44, with a LT TP set at RM0.50. Support is anchored around RM0.36-0.37, while cut loss stood at RM0.355.

Source: Hong Leong Investment Bank Research - 18 Sept 2019