Traders Brief - Neutral to Downward Bias Tone to Persist

HLInvest

Publish date: Wed, 25 Sep 2019, 09:16 AM

MARKET REVIEW

Asia’s stockmarkets ended on a positive note, despite manufacturing activity (September IHS Markit Flash Germany Manufacturing PMI stood at 41.4 in September) in Germany fell to its lowest level since mid-2009. However, some trade development has lifted the sentiment regionally, whereby Chinese importers bought about 10 boatloads of US soybeans on Monday following the deputy-level trade talks in Washington last week. Shanghai Composite Index and Hang Seng Index rose 0.28% and 0.22%, respectively, while Nikkei 225 added 0.09%.

Meanwhile, the FBM KLCI bucked the regional trend to trade marginally lower by 0.04% to 1,592.33 pts. Market breadth was still negative with 425 decliners as compared to 349 gainers, accompanied by 1.98bn shares traded for the day, valued at RM1.57bn. We noticed selected technology stocks such as Vitrox, Pentamaster and Globetronic were traded actively higher amid weaker ringgit tone.

With the rising uncertainty in the US political scene as the US House Speaker Nancy Pelosi may announce a formal impeachment inquiry after discussing with her caucus regarding the controversial call between Trump and the Ukraine’s leader, Volodymyr Zelensky. Also, the weaker than expected consumer confidence of 125.1 (vs. 135.1 in August) in September has dragged the market sentiment. The Dow and S&P500 fell 0.53% and 0.84%, respectively, while Nasdaq declined 1.46%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended lower for the second consecutive day, but it has formed a hammer candle near the lower band of the consolidation phase. The MACD Line continues to hover below zero, while MACD Histogram is weakening over the past few trading days. Both the RSI and Stochastic oscillators are trending down as well. KLCI’s resistance is envisaged around 1,620, while support is pegged around 1,580.

We believe investors are trading on cautious tone ahead of the FTSE Russell’s World Government Bond Index (WGBI) review of Malaysia bond on 26 Sep and the tabling on Budget 2020 on 11 Oct. Meanwhile, we opine that export-driven and technology stocks will remain exciting at this juncture on the back of the weaker ringgit tone. Hence, the FBM KLCI is likely to trade along 1,580-1,620 over the near term.

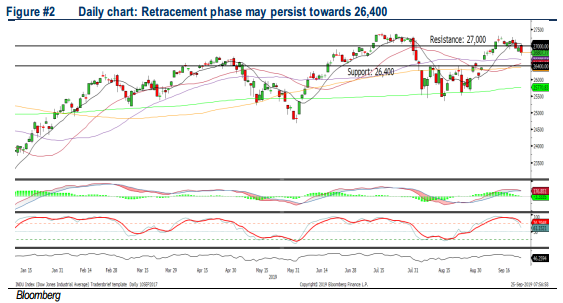

TECHNICAL OUTLOOK: DOW JONES

After reaching a short term peak along the 27,300 level on 12 Sep, the Dow has moved into a retracement phase and the MACD indicator has flagged a negative crossover signal. Both the RSI and Stochastic are trending lower; suggesting that the momentum is declining. The resistance is located around 27,000, while support will be anchored around 26,400.

While the market attention is focusing on the trade progress between the US and China, the political uncertainty in the US may contribute to some negative swings on Wall Street. Hence, we believe it may contribute towards sideways to downward bias trading tone on Wall Street, with a stiff resistance set along 27,400 on the Dow.

Source: Hong Leong Investment Bank Research - 25 Sept 2019