Traders Brief - Continue to Lock in Sideways Consolidation Mode

HLInvest

Publish date: Fri, 27 Sep 2019, 08:55 AM

MARKET REVIEW

Asia markets mostly ended midly higher as investors cheered signs of US-China trade progress after Trump said a deal could happen sooner than people think and that the Chinese were making big agricultural purchases from the US. However, Shanghai market slipped 0.9% ahead of the week-long National Day holidays (1-7 Oct) amid uncertainties over the US-China trade talks after Trumped rebuked China’s trade practices on Tuesday at the UN, saying he would not accept a “bad deal” in the negotiations.

In line with higher regional bourses, KLCI inched up 3.4 pts to 1593 after traded within a tight range between 1589.2-1593.1 levels, Nevertheless, sentiment remained lacklustre ahead of the FTSE Russell’s World Government Bond Index (WGBI) announcement, with trading volume decreased to 1.81bn shares worth RM1.61bn as compared to Wednesday’s 2.19bn shares worth RM1.62bn. We observed selected O&G (ARMADA, KNM) and technology (INARI, JFTECH, ELSOFT) stocks were traded actively higher for the session.

The release of a whistle-blower report tied to the Democrats’ impeachment move against Trump and Bloomberg news that the US is unlikely to extend a waiver allowing American firms to supply China’s Huawei Technologies kept uncertainty high. The Dow tumbled as much as 167 pts intraday before mitigating the losses to 79 pts at 26891 after China’s top diplomat said that China was willing to buy more US products and said trade talks would yield results if both sides “take more enthusiastic measures” to show goodwill and reduce “pessimistic language” in their trade dispute.

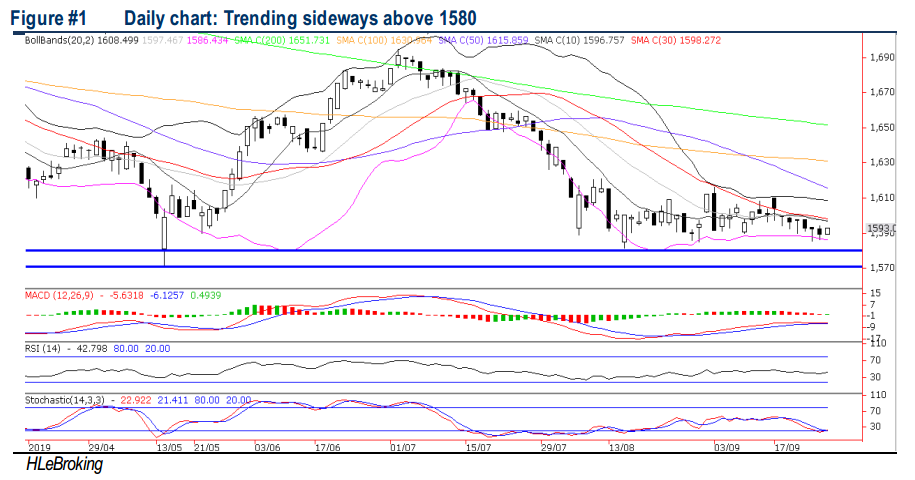

TECHNICAL OUTLOOK: KLCI

We reiterate that KLCI is expected to trend sideways as the MACD indicator is hovering below zero while both RSI and Stochastic oscillators are still in oversold positions. Immediate supports are situated around 1581 (15 Aug low) and 1572 (14 May low), while the resistance is pegged at 1600 psychological barrier and 1608 (upper BB).

Following FTSE Russell’s decision to retain Malaysian government bonds on the Watch List for potential downgrade in the WGBI (pending the next review in March 2020) and continued overnight Wall Street volatility, trading sentiment on Bursa Malaysia is likely to remain tepid as investors await the crucial US-China trade talks in October and the tabling of Budget 2020 on 11 Oct. KLCI is likely to engage in sideways trading around 1581-1595 zones.

TECHNICAL OUTLOOK: DOW JONES

After hitting 1M high of 27306 (12 Sep), the Dow has reversed and drifted lower to a low of 26804 yesterday before ending at 26891. Given the MACD dead cross formation and the weakening RSI/ Stochastic indicators, the index is expected to engage in an extended consolidation, with key supports situated near 26586 (50D SMA) and 26374 (30D SMA). Stiff resistances are pegged at 27000-27400 zones.

We maintain our view that the Dow will continue to trend in range bound mode (26500-27400 zones) as investors digest the divided views on the next course of actions by the Fed in the Oct 30-31 and Dec 10-11 FOMC meetings, as well as closely monitoring of the Trump’s impeachment development. In addition, traders will be shifting their attention towards the crucial US-China trade negotiation in early October as well as the upcoming US 3Q19 reporting season in mid Oct (consensus is predicting the S&P 500 earnings to decline 4.8% YoY from a flat performance in Q1 and Q2).

TECHNICAL TRACKER: PRESBHD

Trendline breakout with improved volumes. To recap, a RM3.5bn contract for the new immigration system to replace MyIMMS was initially awarded to PRESBHD in 2017, by previous administration, through a public private partnership (PPP) model covering a concession period of 15 years. However, this project was terminated last December. Hence, PRESBHD is seeking mediation against government for RM732.9m in compensation. Soon after the news was released, market viewed this mildly positive and the stock traded higher. We believe the technicals are improving and buying interest could spur the share price higher towards RM0.54-0.64, followed by RM0.80, while support is set around RM0.445-0.45. Cut loss is set around RM0.43.

Source: Hong Leong Investment Bank Research - 27 Sept 2019