Traders Brief - Anticipating a Mild Rebound, But Upside Limited

HLInvest

Publish date: Thu, 10 Oct 2019, 06:41 PM

MARKET REVIEW

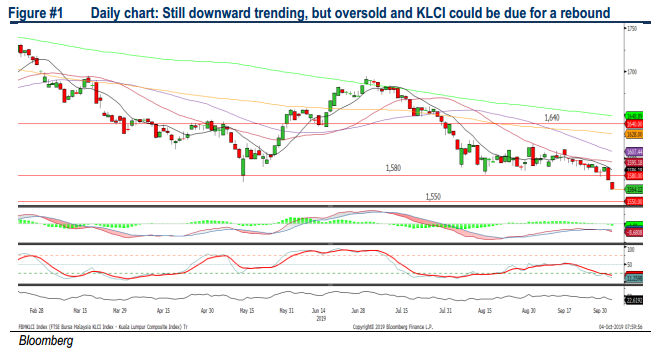

TECHNICAL OUTLOOK: KLCI

The FBM KLCI traded lower after the violation below the 1,581 level two trading days ago. The MACD indicator continues to trend lower over the past few sessions, but both the RSI and Stochastic oscillators are hovering in the oversold region. With the oversold momentum oscillators, we think the KLCI could be due for a slight technical rebound. However, the upside will be limited around 1,570-1,580. Support will be located around 1,550, followed by 1,530.

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded off the SMA200 level (~25,837), forming a hammer candle. The MACD line is slightly below zero, while both the RSI and Stochastic oscillators are turning higher from the oversold region. Hence with the improving momentum oscillators, we believe the technical rebound could retest the resistance around 26,400

We maintain our view that the Dow will remain choppy despite yesterday’s rebound as market sentiment will depend highly on the news flow that will be emerging in October as major events such as trade discussion between the US and China as well as the FOMC meeting at end-Oct may contribute to higher volatility. Unless a trade deal is being struck between the US and China in the upcoming meeting in Washington, downside bias tone may still persist on Wall Street. The Dow’s trading range is located around 25,837-26,400.

Source: Hong Leong Investment Bank Research - 10 Oct 2019