Retail Strategy - Budget 2020 Stimuli to Drive 4Q Interest

HLInvest

Publish date: Thu, 17 Oct 2019, 10:09 AM

With the returned of slight optimism following the mini-trade deal, coupled with the less austerity sounding Budget 2020 (a change of tone from Budget 2019), we think local equity market may gain attractiveness moving forward. Thus, we are picking sectors/ stocks such as (i) technology – ISTONE, KESM, (ii) renewable energy – CYPARK, PESTECH, (iii) construction OKA, KIMLUN, and (iv) tourism – TUNEPRO on the back of incentives/ initiatives/ policies announced in the recent Budget 2020.

3Q19 Market Review and 4Q19 Outlook

Still slowing economic activities globally… on the back of the protracted trade war, albeit with a slight relief on a “mini-deal” between the US and China recently. The PMI since Jun-18 has been broadly declining (Figure #1) across the major economies following the impact from higher tariffs, resulting in a cautious business environment.

…but Malaysia has some positive angles. Barring the external trade uncertainties, Malaysia was able to grow at 4.7% in 1H19. Also, MOF is projecting a growth of 4.8% (HLIB forecast: 4.4%) in 2020. We believe the less austerity sounding Budget 2020 (vs its 2019 predecessor which had a slew of taxes) could provide some optimism to local businesses, resulting in a recovery trend in our local markets moving forward.

Foreign flow still negative YTD. Despite the slightly positive Budget 2020, foreign trade flow is still negative at RM8.91bn YTD.

Retail Strategy For 4Q19

Budget 2020 as main trading catalysts for 4Q. On the back of improving optimism on trade war (amid the phase-1 deal between US and China), coupled with less austerity sounding Budget 2020 which market participants felt the change of tone vs. Budget 2019, we opine traders to lookout for sectors such as:-

(i) Technology (automation, E&E and customized packaged investment incentives as well as weak ringgit ranging ~RM4.18/USD)

(ii) Renewable energy (green investments tax allowance)

(iii) Telecommunication (ongoing National Fiberisation and Connectivity Plan (NFCP initiatives)

(iv) Construction (increased development expenditure by 2.4% YoY)

(v) Tourism (to boost tourist arrivals to 30 million)

Time to scoop up some equities. In 4Q, we opine the slightly positive sounding Budget 2020 as well as window dressing in December (average 10-year December return: 1.98%) would be able to lift the broader market sentiment (although some earnings disappointment may surface in November). In addition, the earlier mentioned catalysts would bode well for stocks selections in 4Q.

Technology: We believe the broad technology sector will be benefiting under the E&E and automation incentives, which could result in higher demand for automation equipment moving forward; under this section we like ISTONE and KESM.

Power-related: With the increasing demand for rural electrification in Malaysia, PESTECH would be the favoured pick amid its power transmission infrastructure expertise. Meanwhile, for renewable energy stimulus, we like CYPARK.

Construction: Given the increase in development expenditure and potentially improving construction sector, we see precast concrete manufacturers such as OKA and KIMLUN to benefit from the initial stage of construction jobs.

Tourism: Under the Budget 2020, RM1.1bn was allocated for VMY2020, which the government intends to achieve 30m tourist arrivals. In this space, we like TUNEPRO for the travel insurance play, which is a proxy towards tourism industry.

Retail Stock Picks for 4Q19

Technology: Benefiting from the Budget 2020 policies and incentives

In the recent Budget, tax incentives are provided to promote high-value added activities in the E&E industry to transition into 5G digital economy and Industry 4.0 as well as to encourage automation and increase productivity. Hence, we believe this may result in higher demand for automation services and equipment moving forward.

ISTONE – A Specialised Automation Machine Manufacturer

Expansion plans to kick in within next two years. ISTONE is expected to acquire machineries within the next 2 years, boosting its group’s annual production capacity by 20% to 864 machines. In addition, the reduced lead time is expected to increase the group’s annual production capacity by 11.1% from 864 machines to 960 machines as well as decrease labour cost by up to 10%.

Dyson future development as catalyst. Dyson is always combining technology and trend in its smart home products. With its strong relationship with Dyson, should there be any launches of new products moving forward, we view this as a positive factor for ISTONE’s growth in the long run.

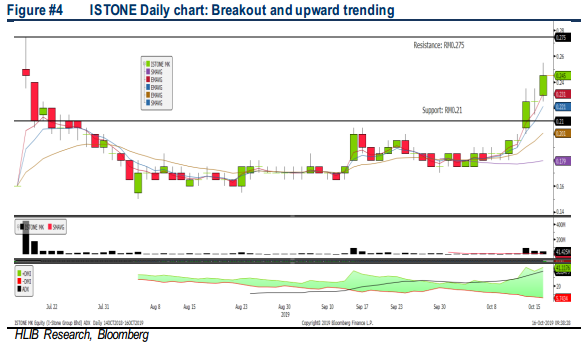

Uptrend rally is emerging. Since the recent breakout above the RM0.21 level, ISTONE has been rallying strongly and ADX indicator is suggesting that the momentum is intact, targeting RM0.265-0.275, with a LT target set around RM0.30. Support is anchored around RM0.22-0.225, with a cut loss set around RM0.21.

KESM – Tagging With the Semiconductor Industry

Still solid despite external events. KESM remains profitable, despite the challenging environment amid protracted trade war over past 18 months, and it could benefit from the automation and E&E incentives provided by the government moving forward. Market consensus is expecting a gradual recovery in industry demand for burn-in and testing services and inventory replenishment after a tight inventory control in the past year. KESM is looking attractive with its healthy net cash of RM3.47/share.

Forming a base and poised for a trendline breakout. KESM has been forming a base along RM6.70-7.30 over the past two months and noted a mild breakout above RM7.27 recently with improved volumes. The ADX indicator is positive and could be poised for a breakout. Target is located around RM8.00-8.30, followed by a LT target of RM8.69. Support will be set around RM7.20-7.27, with a cut loss set at RM7.00.

Construction: Improving Sentiment on Construction Jobs

The increased in development expenditure (+2.4% YoY) under Budget 2020 should bode well for construction sector and it could indicate that the outlook is improving moving forward. Hence, we believe the building materials/ precast concrete products may benefit at the initial stage.

OKA – One of the largest manufacturers of precast concrete products in Malaysia

Infrastructure and construction jobs beneficiary. With decent track record in the past on infrastructure projects, OKA should benefit from the improving outlook of construction jobs as well as the less austerity sounding Budget 2020. Besides, OKA’s 19.2 sen net cash per share and 5.6% dividend yield should be attractive to accumulate.

Downward trendline breakout. After share price turned sideways along the RM0.50- 0.60 levels, we noticed a breakout above the trendline. The weekly ADX Indicator is improving and hence we expect further upside on OKA towards RM0.69-0.72, followed by a LT TP of RM0.77. Support is set around RM0.63-0.64, with a cut loss set at RM0.62.

KIMLUN – Unjustified Construction Laggard

Robust order book of RM2bn (construction: RM1.7bn, manufacturing RM0.3bn) to sustain growth into next two years and future jobs bidding will focus on affordable housing development (part of the highlights in Budget 2020).

Prospect in Sarawak remains positive from the ongoing Pan Borneo Sarawak project. In addition, KIMLUN is one of the construction laggards given its bargain valuations at 6.6x FY19E P/E (36% below peers) and 0.63x P/B (29% below peers).

Potential downtrend line breakout. Following a 20.8% slump in share price from 52- week high of RM1.49 (30 Apr) to a low of RM1.18 (23 Sep), KIMLUN’s share prices has recovered 5.9% to end at RM1.25. Given its bottoming up technicals, it is poised for a downtrend line breakout near RM1.30 soon, before reaching RM1.37 (61.8% FR) and our LT objective at RM1.49. Supports are pegged at 1.21 (SMA 10D) and RM1.18 levels. Cut loss is RM1.15.

Power-related: Green Energy Incentives and Rural Electrification

We opine that solar-related industry will benefit under Budget 2020 as the government will be providing an extension of Green Investment Tax Allowance (GITA) and Green Income Tax Exemption (GITE) incentives till 2023 as well as a 70% income tax exemption of up to 10 years will be given to companies undertaking solar leasing activities. Meanwhile, RM500m on rural electrification throughout Malaysia may benefit cable and power transmission infrastructure players.

CYPARK – Energising a Sustainable Future

Bright RE outlook. The Minister of Energy, Science Technology, Environment and Climate Change (MESTECC) has a clear roadmap to achieve a 20% (currently 2%) renewable energy (RE) target by 2025. These measures bode well for CYPARK as it will increase its RE installed capacity from the current 31 MW to around 62 MW, upon commissioning of its WTE plant and solar farms.

Decent track record. Based on its solid R&D track record, we expect CYPARK to benefit from the government’s promises to increase RE. We are positive on CYPARK given its steady 8% FY19-21 EPS CAGR in anticipation of the commissioning of the 20MW WTE plant (by early 2020) and LSS1&2 plants. CYPARK plans to bid for a capacity of 100MW (expect to generate RM50-60m revenue p.a.) in the LSS3 scheme and it is well positioned to score the job, in view of its cost leadership in RE and high success rate in the past two LSS schemes.

Undemanding valuations. We like CYPARK for: (i) cheap valuation at 8.3x FY21E P/E (12% below its mean since listed), (ii) well positioned for LSS3 scheme; (iii) and defensive play amid external headwinds as >90% of its projects are based in Malaysia (order book: ~RM500-600m and tender book: ~RM1bn).

Recovering below SMA200. After tumbling 29.4% from YTD high of RM1.77 (7 Mar) to a low of RM1.25 (28 Aug), the stock has been gradually forming a floor amid the formation of spinning top (30 Aug week) and hammers (11 Oct week) patterns, supported by bottoming up indicators. The next targets are RM1.49 (SMA 30W) and RM1.55 (SMA 200D) before reaching our LT objective at RM1.60 (SMA100W). Meanwhile key supports are pegged at RM1.34 (SMA10W) and RM1.30. Cut loss at RM1.28.

PESTECH – Leading utility infrastructure player with strong regional presence

Sizeable orderbook of RM1.63bn and bright prospects. The stock is trading at undemanding valuations at 9.9x FY21 P/E (15% below 10Y mean a verage) and robust earnings growth (34% EPS CAGR for FY18-20), riding on the fast growing regional (ASEAN, especially Cambodia and Myanmar) demand for electricity and rail related infrastructure, coupled with the call for greater implementation of renewable energy. In Malaysia, the revival of mega transportation infrastructure projects and the Large Scale Solar 3 projects presents positive prospects.

Uptrend intact. After sliding 23.5% from YTD high of RM1.53 (11 Jul) to a low of RM1.17 (30 Sep), PESTECH’s share price has rebounded to a high of RM1.41 before easing to RM1.33 on profit taking (still above the key uptrend line near RM1.22 and multiple key SMAs). After a brief pullback, the stock is poised to test RM1.41-1.50 before reaching our LT objective at RM1.53. On the flip side, failure to h old at RM1.26 (SMA 30D) and RM1.22 may indicate weakness ahead. Cut loss at RM1.21.

Tourism: VMY2020 to Achieve 30 Million Tourist Arrivals

The government has allocated RM1.1bn to the Ministry of Tourism, Arts and Culture to rollout of the VMY2020. This may benefit aviation and travel insurance industry.

TUNEPRO – Beneficiary of VMY 2020 and attractive dividend yield

A beneficiary of VMY2020. TUNEPRO is a leader in digital insurance and a dominant player in the local travel insurance segment, riding on AirAsia’s aggressive network expansion into new markets and strong passenger growth, which we think it could serve as a beneficiary of VMY 2020 and an alternative investment vehicle for investors who wish to participate in AirAsia’s growth story without exposure to jet fuel price and USD borrowings risks.

Undemanding valuations with decent DY. After tumbling 25% from YTD high of RM0.765 to RM0.57, valuations are cheap at 6.2x FY20 P/E and 0.82x P/B, which are 56% and 69% lower than its peers, supported by expectations of a better 2H19, superior FY20 dividend yield of 6% (80% higher than its peers) and stable 11.3% earnings CAGR for FY19-21.

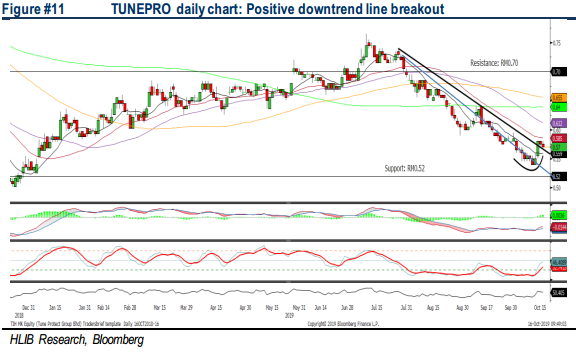

May rebound further amid Tweezers bottom pattern. After sliding 29% from RM0.765 to a low of RM0.54, TUNEPRO inched up 5.5% to end at RM0.57. In our view, the stock is at the tail end of the downtrend following the Tweezers bottom pattern and downtrend line breakout. Short term upside targets are RM0.60 and RM0.65 (SMA 200D) before reaching our LT objective at RM0.70. Key supports are RM0.54 and RM0.525 (Dec 2018 low). Cut loss at RM0.52.

Source: Hong Leong Investment Bank Research - 17 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|