Traders Brief - Positive bias mode on KLCI

HLInvest

Publish date: Wed, 23 Oct 2019, 09:04 AM

Asia’s stock markets ended on a positive note amid improved sentiment over the ongoing negotiations between the US and China. In addition, chief economic adviser Larry Kudlow, commented that there is a possibility for the planned tariff hikes on Chinese goods in December to be halted if the current trade talks go well. The Shanghai Composite Index and Hang Seng Index rose 0.50% and 0.23%, respectively, while Nikkei 225 closed for public holiday.

Meanwhile, the FBM KLCI ended marginally higher by 0.20% to 1,574.09 pts amid slight gains on selected banking and oil and gas heavyweights. Market breadth was negative with 452 decliners vs. 411 gainers. Market traded volumes stood at 3.29bn, worth RM2.10bn. Also, we noticed selected technology stocks such as KESM, JFTECH, INARI and JCY traded actively higher for the day.

Although the mood on the trade discussions between US and China were slightly positive following comments from both the US and Chinese officials as they have achieved some progress in the recent meetings, trading sentiment was dampened by weaker-than-expected earnings from several US corporates such as McDonalds and Travelers as well as UK lawmakers rejected a limited time frame to review a deal on Brexit. The Dow and S&P500 fell 0.15% and 0.36%, respectively, while Nasdaq declined 0.72%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended mildly higher yesterday, but still within a narrow range over the past 5 trading days. The MACD Indicator is improving below the zero level. Also, both the RSI and Stochastic oscillators are hovering above 50. Resistance will be set around 1,580, while support will be anchored along 1,560.

We expect improved sentiment from the Budget 2020 as well as the ongoing trade talks optimism would be able to sustain the positive trading tone amongst small caps and lower liners on the local front. However, the upside may be capped along the way in view of a slightly muted November reporting season. Hence, the FBM KLCI likely to stay within 1,560-1,580.

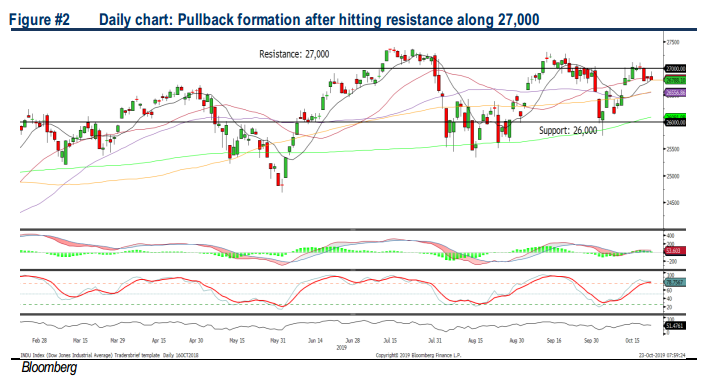

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trade below the 27,000 level, while the MACD Indicator is still above zero. Meanwhile, the RSI is hovering above 50, but the Stochastic is slightly overbought. Hence, we anticipate that the Dow could pullback further over the near term amid mixed signals from the indicators. Resistance is pegged around 27,000-27,400, while support will be located around 26,000-26,400.

Still, traders will focus on several events such as the US corporate earnings, Brexit (currently may extend the 31 October deadline) as well as ongoing US-China trade talks (waiting for green light in mid-November). Hence, we think the Dow could trend sideways within the range of 26,400-27,400.

Source: Hong Leong Investment Bank Research - 23 Oct 2019