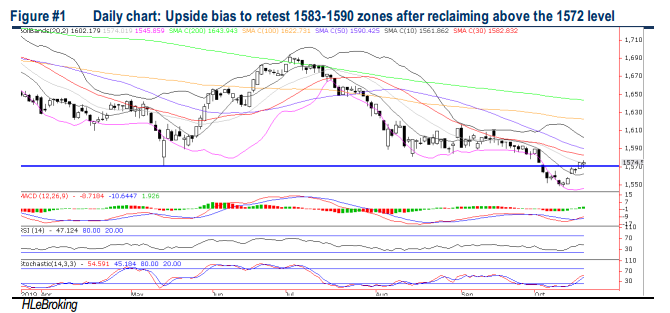

Traders Brief - Facing Stiff Resistances Near 1583-1590 Levels

HLInvest

Publish date: Thu, 24 Oct 2019, 04:24 PM

MARKET REVIEW

Asian markets ended mixed as investors awaited more details on a proposed US-China trade deal as the trade negotiators are working on nailing down a Phase 1 trade deal for their presidents to sign next month in Chile’s APEC summit (11-17 Nov). Sentiment was also cautious following IMF’s dire warning of weakening global growth and the ongoing Brexit negotiations between the UK and EU. Tracking mixed regional markets, KLCI eased 0.4-pt at to 1574.5 after hovering between an intra-day high of 1577.0 and a low of 1569.2. Trading volume decreased to 2.33bn shares worth RM1.88bn as compared to Wednesday’s 3.06bn shares worth RM2.23bn. Market breadth was subdued (losers 413 and gainers 393) amid profit taking after KLCI’s recent 1.7% advance from Oct low’s 1548. The Dow jumped as much as 110 pts to 27112 as sentiment was buoyed by a string of better than expected corporate earnings (e.g. Morgan Stanley and Netflix) and optimism from a Brexit draft agreement coupled with positive statement from Washington fueled hopes that a phased agreement after Steven Mnuchin said he was prepared to travel to Beijing for more meetings if necessary. However, the early gains reduced to 24 pts at 27026 following downbeat US economic reports from new housing permits and industrial production and disappoinitng results from IBM.

TECHNICAL OUTLOOK: KLCI

On the back of the “mini” US-China trade deal optimism and less austerity sounding Budget 2020, KLCI finally staged a 26-pt or 1.7% oversold rebound from 52W low of 1548 (10 Oct) to end at 1575 yesterday, a tad above the crucial neckline support-turned-resistance at 1572 (14 May low). Technically, the rebound remains intact towards 1583 (SMA 30D) and 1590 (SMA 50D) zones, supported by bottoming up indicators. Key supports are 1562 (SMA10D) and 1548 levels

Following the start of upbeat US corporate earnings and on hopes of a US-China and Brexit deals breakthrough coupled with a less austerity sounding Budget 2020, KLCI is likely to resume its upward trajectory to retest 1583-1590 zones in the near term, supported by bottoming up technical indicators. However, the index should encounter stiff barriers near 1600 zones in anticipation of another lacklustre Nov reporting season and KLCI’s relatively unattractive valuations. Key supports are pegged at 1562/1548 territory

TECHNICAL OUTLOOK: DOW JONES

The Dow’s uptrend from Oct low at 25743 (3 Oct) remains intact following the rebound above the SMA200D levels near 26037. Despite an overbought slow stochastic, the MACD golden cross coupled with the rising RSI still auger well for further advance to retest all-time high of 27398 (18 Jul) and 27600 (weekly upper BB) territory. Key supports are set around 26700/26500 levels.

Despite a relatively good start in the 3Q19 reporting season as the S&P 500 earnings (over 80% reported results so far beat earnings estimates) is expected to fall only at 2.9% YoY from -5% before the start of the earnings season, volatility could persist due to the return of trade deal uncertainty ahead of the phase-one signing when Trump is scheduled to meet President Xi at the APEC summit in Chile (11-17 Nov). Overall, any small steps forward could increase business confidence and spark capital investment, lifting corporate profits. We remain hopeful that further significant downside risk is limited (supported by the strong 200D SMA near 26037), cushioned by expectations of another round of Fed rate cut during the 30-31 Oct FOMC meeting to cushion a string of weak US economic indicators. For the Dow, the trading range is set around 26700-27400.

Source: Hong Leong Investment Bank Research - 24 Oct 2019