Traders Brief - Short Term Risk on Mode

HLInvest

Publish date: Thu, 31 Oct 2019, 09:14 AM

MARKET REVIEW

Key regional benchmark indices ended on a negative tone as investors traded cautiously prior to FOMC meeting, coupled with the anticipation of the phase-one trade deal to be signed over the near term. The Hang Seng Index and Shanghai Composite Index declined 0.50% and 0.44%, respectively while Nikkei 225 fell 0.57%.

Bucking the regional trend, KLCI ended on a higher note at 1,580.00 pts (+0.14%) amid positive cumulative 5-day foreign trade inflow. Market breadth however was negative with 469 losers as compared to 328 gainers. Market traded volumes stood at 2.27bn shares traded worth RM1.71bn. Nevertheless, selected construction stocks such as Mudajaya and Jaks Resources were traded actively higher for the session.

Wall Street closed higher following the third rate cut by the Fed in the FOMC meeting and Jerome Powell commented that central bank would need to see a “really significant” rise in inflation before the Fed would look into interest rate hikes in the futures. Also, US GDP grew at a pace of 1.9% in 3Q (vs. consensus of 1.6%) and US private payrolls added 125k in October (vs. consensus of 100k) have lifted the mood in equities; the Dow and S&P500 gained 0.43% and 0.33%, while Nasdaq added 0.33%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues its short term uptrend move following the flag formation breakout two days ago. The MACD line is approaching zero, while the MACD Histogram is recovering. Momentum oscillators such a RSI and Stochastic are still trending higher. Resistance is set along 1,600, while support is pegged around 1,550.

Tracking the positive sentiment from Wall Street overnight, we opine that the FBM KLCI could trend higher as buying interest may spill over towards stocks on the local front. Although market participants may deploy a risk-on mode in equities, trading sentiment will also depend on the upcoming November reporting season; should there be any negative surprises from the corporate earnings, it may cap the upside potential on KLCI (trading range: 1,550-1,600).

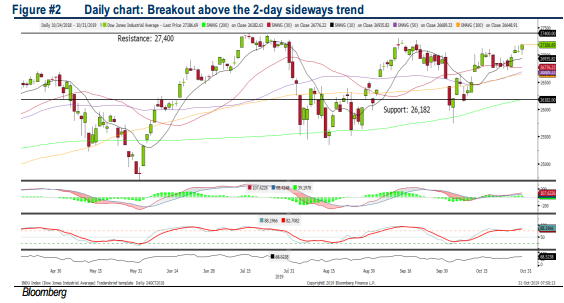

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trend higher after a short pause over the previous two trading days. The MACD Indicator is trending positively above zero, while the RSI is hovering above 50. However, the Stochastic oscillator is overbought. Hence, with the slight overbought status on the Dow, the upside move could be hitting resistance along 27,400. Meanwhile support will be set around 26,182.

With the conclusion of the FOMC meeting with the third rate cut for 2019, coupled with the growing US economy, we may anticipate market participants to remain focus in equities for now and the Dow could trend higher over the near term. However, the cancellation of the APEC summit (where a President Trump and President were scheduled to meet) could raise some uncertainties over a possible “phase-one” deal that the two countries are close to finalising. The Dow’s trading range will be located around 26,151-27,400.

Source: Hong Leong Investment Bank Research - 31 Oct 2019