Traders Brief - KLCI Facing Stiff Resistances Around 1616

HLInvest

Publish date: Fri, 01 Nov 2019, 09:02 AM

MARKET REVIEW

Asian markets ended mixed after the Fed cut rates by 25 bps for the 3rd time in 2019 and indicated the possibility of a pause in easing monetary policy. Sentiment was also affected by the sluggish China Oct PMI at an 8-month low to 49.3 (Bloomberg est: 49.8). Meanwhile, the Trump administration still expects to sign an initial trade agreement with China next month despite the cancellation of the APEC summit in Chile, while Chinese officials voiced optimism that Beijing and Washington can find a way to clinch the Phase One trade deal next month.

Contrary to the mixed regional markets, KLCI surged 18 pts to 1598, mainly led by banking stocks such as PBBANK, CIMB, MAYBANK and HLBANK after an upbeat review by BNM that local banking institutions are able to withstand severe macroeconomic and financial shocks as they are armed with excess capital buffers. Trading volume jumped to 2.95bn shares valued at RM2.7bn against Wednesday’s 2.27bn shares worth RM1.71bn. Market breadth was positive with 539 gainers as compared to 307 losers.

Despite better-than-expected earnings from Facebook and Apple and the Fed’s 3rd rate cuts of 2019, the Dow tumbled as much as 268 pts as investors turned their focus to US-China trade negotiations. Bloomberg News reported earlier that Chinese officials have been c asting doubt over the possibility of a long-term trade deal with the US amid concerns over Trump’s “impulsive nature” and the risk of him backing out of any kind of deal. However, losses were cut to 140 pts after Trump twittered to assuage fears that the US-China are working on selecting a new site for signing of Phase One of Trade Agreement after an unexpected cancellation of APEC summit in Chile in Nov.

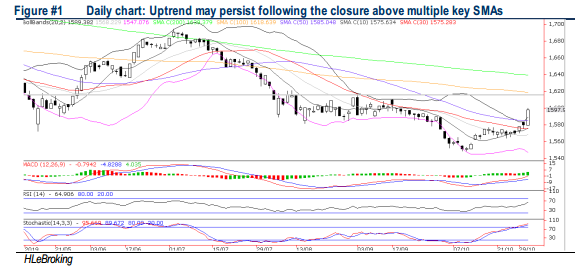

TECHNICAL OUTLOOK: KLCI

KLCI closed at 7-week high yesterday with a 18-pt gain at 1598. The bullish close saw the index pushed past the key 50D SMA resistance and may continue to work its way higher in the coming days amid rising MACD and RSI, offsetting overbought stochastic indicators. Resistances are set at 1600 to 1616 (3 Sep high) whilst supports fall on 1585 (50D SMA) and 1575 (30d SMA).

Tracking the negative sentiment from Wall Street overnight, KLCI’s upward momentum could encounter resistance near 1600-1616 zones, as market participants may stay cautious ahead of the upcoming Nov reporting season. Meanwhile, banking stocks could face some pullback after recent rally in the absence of strong sector-wide growth catalysts in the near to medium term. HLIB preferred picks are Maybank (TP: RM9.50), RHB (TP: RM6.45), Alliance (TP: RM3.40) and BIMB (TP: RM5.00).

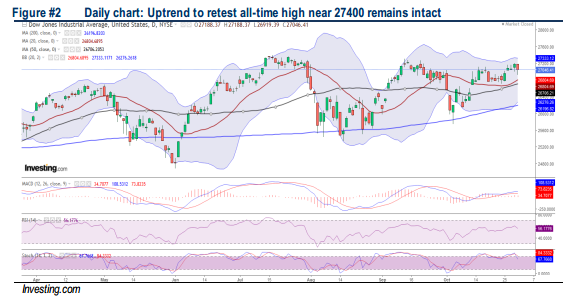

TECHNICAL OUTLOOK: DOW JONES

Pending the US-China signing of Phase One deal and ongoing reporting season, the Dow could face some volatility after the surge from Oct low at 25743 (3 Oct). However, the uptrend should remain intact unless there is a decisive break down below 50D SMA support at 26706 in the coming days. Immediate resistances are 27300-27500 while supports fall on 26700/26500 levels.

In the short term, we remain hopeful that the index could retest all-time high at 27398 and a sharp correction is limited (with sound support near 50D/200D SMA at 26706/26196 levels), cushioned by the optimism of an impending signing of the US-China Phased 1 trade deal. Moreover, the US 3Q19 reporting season has made a good start as the S&P 500 earnings (over 75% reported results so far beat earnings estimates) is expected to fall only at 2.6% YoY from -4.9% before the start of the earnings season

Source: Hong Leong Investment Bank Research - 1 Nov 2019