Tradersbrief - Sideways Consolidation Phase to Extend on KLCI

HLInvest

Publish date: Fri, 01 Nov 2019, 04:48 PM

MARKET REVIEW

Asia’s stock markets trended mixed as investors digested softer South Korea economic data, which grew at a softer pace of 0.4% in 3Q19, according to the preliminary central bank estimates. Also, traders were trading on a cautious tone ahead of the ECB meeting on Thursday. Nikkei 225 and Hang Seng Index advanced 0.55% and 0.87%, respectively, while Shanghai Composite Index traded flat.

Meanwhile, KLCI fluctuated between the negative and positive territories before closing 0.15% higher at 1,571.11 pts. Market breadth was still negative with decliners led advancers by a ratio of 4-to-3. Market traded volume stood at 2.11bn, worth RM1.69bn. Nevertheless, IT related software companies such as DSONIC and SCICOM were traded actively higher.

Wall Street ended on a positive note led by technology stocks such as Microsoft and PayPal on the back of stronger-than-expected results, lifting the trading tone on S&P500 (+0.19%) and Nasdaq (+0.81%). Meanwhile, the Dow slipped marginally by 0.11% as 3M posted weaker earnings this quarter.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continues to stay within a narrow trading range between 1,564-1,574 over the past 5 trading days. The MACD Histogram has weakened over the past two trading days. Meanwhile, both the RSI and Stochastic oscillators are trending higher above 50. With the mixed technical readings, we expect the sideways consolidation phase to extend over the near term.

On the local front, we expect some buying interest to emerge on technology related stocks such as KRONO following the decent growth in web/ cloud services in Microsoft and Amazon. Meanwhile, the FBM KLCI may still consolidate sideways on the back of mixed technical readings at this juncture; trading range expected to be around 1,564-1,574.

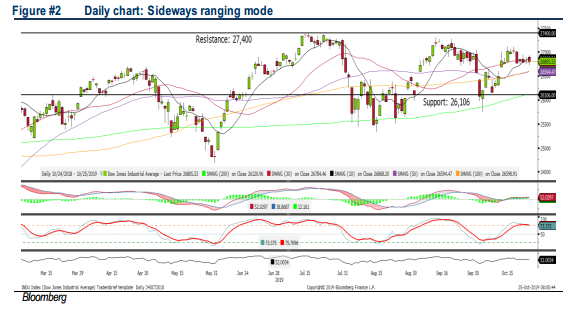

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its consolidation mode for another session within the range of 26,714- 26,946. The MACD indicator is hovering above 50, while both the RSI and Stochastic oscillators are on a declining trend (albeit standing above 50). With the mixed technical readings, we opine the Dow may consolidate and retrace over the near term. Resistance is pegged around 27,400, while support will be set along 26,106-26,400.

Traders will still be focusing on the current reporting season and trade on a cautious tone ahead of the FOMC meeting that will be held next week. At this juncture, market participants are anticipating a rate cut in the meeting and have an easing outlook for interest rate throughout 2019. Hence, we expect the Dow to remain sideways over the near term ranging between 26,400-27,400.

Source: Hong Leong Investment Bank Research - 1 Nov 2019