Traders Brief - KLCI likely to take a breather

HLInvest

Publish date: Tue, 05 Nov 2019, 09:04 AM

Despite S&P500 registering a new record high overnight, Asia’s stock markets ended mixed as market participants were looking for more concrete developments on the trade front between the US and China. Nikkei 225 rose 0.47%, but Shanghai Composite Index and Hang Seng Index declined 0.87% and 0.39%, respectively - the latter declined amid comments from Chief Executive Carrie Lam as she expects Hong Kong to book negative growth for 2019 on the back of ongoing protests in the city. Bucking the regional peers, KLCI managed to recover 0.50% to 1,577.70 pts led by banking heavyweights. Market breadth was mildly positive with 408 advancers as compared to 393 decliners, accompanied by 2.30bn shares traded, worth RM1.91bn. Besides, we observed most of the furniture and poultry stocks were traded actively higher for the session. Wall Street ended marginally lower after S&P hit record high on Monday as traders traded cautiously ahead of the key Federal Reserve meeting that will be held 30-31 Oct. At this juncture, market participants are anticipating the Fed to reduce the interest rate by 25 basis points. The Dow and S&P500 slid marginally by 0.05% and 0.06%, respectively, while Nasdaq dropped 0.59%.

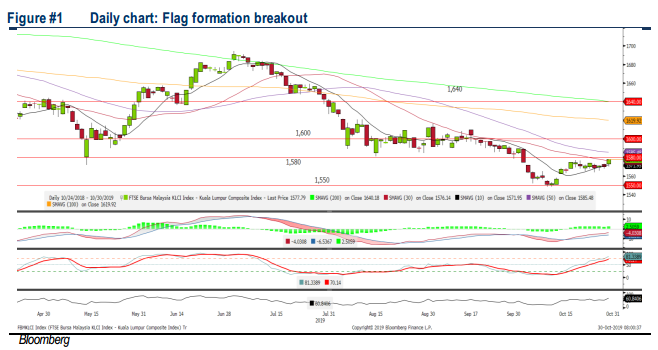

TECHNICAL OUTLOOK: KLCI

After the recent consolidation, the FBM KLCI managed to trend higher above the 1,575 immediate resistance. The MACD Histogram has improved, while both the RSI and Stochastic oscillators are improving (albeit Stochastic oscillator is in the overbought region). The next resistance for the KLCI will be pegged along 1,600, while support is set around 1,550, followed by 1,530.

Following the mild breather on Wall Street, we believe this could also attract profit taking activities over the near term. In addition, investors and traders may deploy a side-lines approach over the near term, trading cautiously in the upcoming November reporting season month. Nevertheless, we opine that poultry and furniture related counters may trade actively as we noticed price and volume surge yesterday. Meanwhile, the KLCI’s trading range is located around 1,550-1,600.

TECHNICAL OUTLOOK: DOW JONES

The Dow has surged above the 27,000 psychological level and had taken a pause yesterday, floating above the support. The MACD indicator is trending positively above zero, while RSI is hovering above 50. However, the Stochastic oscillator is slightly overbought. Hence, with the mixed technical readings, we expect the Dow to consolidate around 27,000 over the near term. Resistance is envisaged around 27,400, while support is set along 26,151.

Despite investors are trading cautiously ahead of the Fed’s meeting, the attention will be on the interest rate outlook and monetary policies by the end of the FOMC meeting. In the meantime, the improved sentiment following the recent progress on the US and China over the weekend, stating both sides have agreed to address the core issues in the mini phase-one deal would lend some support towards stock markets, at least for the near term. The Dow’s trading range should be located around 26,151-27,400.

Source: Hong Leong Investment Bank Research - 5 Nov 2019