Traders Brief - Approaching Overbought Region

HLInvest

Publish date: Wed, 06 Nov 2019, 04:40 PM

MARKET REVIEW

Despite a private survey of China’s services data indicating activity slowing to an 8-month low in Oct (Caixin/ Markit services PMI stood at 51.1 – its lowest reading since Feb), most of Asia’s stock markets advanced strongly yesterday. The Nikkei 225 touched its record highs, advancing 1.76% to 23,251.9 pts, while Hang Seng Index and Shanghai Composite Index added 0.49% and 0.54%, respectively over the recent positive developments on the US-China trade front.

The FBM KLCI added marginally higher by 0.20% to 1,606.74 pts led by banking heavyweights as BNM decided to maintain the OPR rate at 3.00%. Market breadth however was negative with 425 decliners as compared to 403 gainers. Market traded volumes stood at 2.62bn, worth RM2.25bn. Meanwhile, we observed that selected technology stocks such as Pentamaster, Kronologi Asia and MI Equipment traded actively higher.

Wall Street ended slightly higher lifted by better-than-expected ISM non-manufacturing index for October, which stood at 54.7 (vs. consensus of 53.5). However, the fresh developments on the trade front, where China is pushing President Trump to remove selected tariffs as part of the “Phase-One” deal has kept the upside limited on Wall Street. The Dow and Nasdaq rose 0.11% and 0.02%, respectively, but S&P500 slipped 0.12%.

TECHNICAL OUTLOOK: KLCI

The FBMKLCI extended its technical rebound after the key index surpassed the 1,600 psychological level two days ago. The MACD Indicator expanded positively above zero, while both the RSI and Stochastic momentum oscillators are trending higher and approaching overbought region. The next resistance will be set around 1,610, followed by 1,620, while support is set around 1,600, followed by 1,580.

We believe the bullish tone in the regional stock markets may sustain over the near term given the positive progress in the US-China trade talks (albeit market participants are still waiting for the signing of “Phase-One” deal following the push factor from China). Although general market trend is supported by the lift in banking shares, should there be any disappointments in the upcoming reporting season, profit taking activities could emerge. KLCI’s trading range will be located around 1,600-1,620.

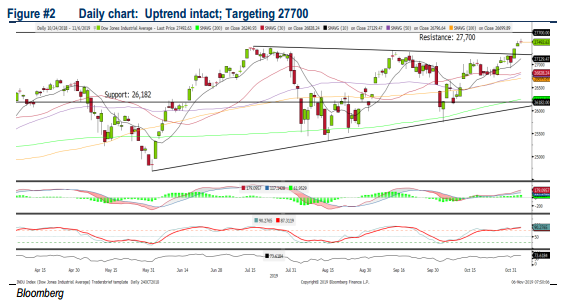

TECHNICAL OUTLOOK: DOW JONES

The Dow has extended its recent rally hitting the all-time-high region, but has formed a Doji candle yesterday; indicating that the buying interest could be fading. The MACD indicator is still hovering above zero, but both the Stochastic oscillator is hovering in the overbought region. Hence, with the mixed technical readings on the indicators, we believe the near term upside could be limited and resistance will be set around 27,700, while support is located at 27,000.

Despite the positive progress in the US and China trade front over the past few weeks, the comments from China to request for a partial tariffs removal on selected Chinese goods could be another resistance towards a potential mini deal to be signed over the near term. Hence, market participants could be slightly cautious over the near term, capped the upside potential on Wall Street. The Dow’s support is at 27,000.

TECHNICAL TRACKER: MHB

A turnaround play backed by solid balance sheet and parental support. We remain sanguine over MHB’s prospects and current price rally has legs in anticipation of improving 4Q19 results and a meaningful turnaround in FY20-21. Despite surging 58.7% YTD, valuation is unjustifiably trading at 0.58x P/B (66% below peers’ average of 1.73x), supported by solid net cash/share of RM0.32 (37% of share price) and multi-year high RM2.7bn order book (providing earnings visibility for the next 3 years) after securing the Kasawari project coupled with solid tender-book of RM13.7bn (signifying greater contract award opportunities). In addition, MHB is likely to enjoy strong parental support (via MISC’s 66% stake) and beneficiary of PETRONAS’ future developments. Technically, the stock is poised for appreciation towards RM0.97-1.02 levels after staging a bullish V-shaped recovery.

Source: Hong Leong Investment Bank Research - 6 Nov 2019