Traders Brief - Cautious Sentiment Amid Ongoing Reporting Month

HLInvest

Publish date: Mon, 18 Nov 2019, 09:01 AM

MARKET REVIEW

Asian stocks ended higher last Friday, lifted by White House comments that suggested the possibility of an imminent trade deal between Washington and Beijing. Nonetheless, SHCOMP fell 0.64% after weak data from China reinforced concerns about the global economy and increasing caution about false signs of progress in the Sino-US trade talks.

Tracking higher regional markets, KLCI closed up 1.2 pts after traded within a tight range of 4.6 pts between an intra-day high of 1596.9 and a low of 1592.2, as investors weighed Malaysia's economic figures and corporate earnings against the impact of the US-China trade war on global growth. Trading volume increased to 2.69bn shares worth RM1.69bn as compared to Thursday’s 2.20bn shares worth RM1.68bn. Market breadth was negative with 382 gainers as compared to 423 losers.

Wall Street jumped to record highs, partly on optimism that a US-China trade agreement will occur soon and on fairly strong retail sales data from October. The Dow rallied 222 pts to 28004 and ended 1.54% higher WoW. Overall, sentiment was boosted by White House economic adviser Larry Kudlow’s comments late Thursday that negotiations between the two countries were nearing the final stages.

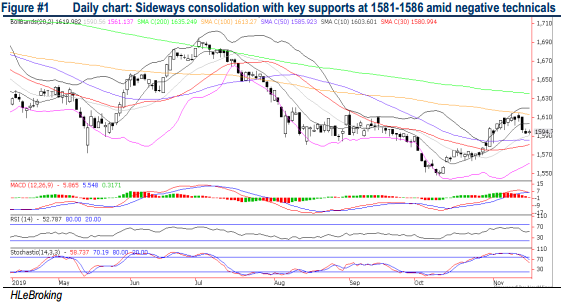

TECHNICAL OUTLOOK: KLCI

After rallying from a 4Y low of 1548 (10 Oct) to 1614 (12 Nov), KLCI retreated 19.5 pts to end at 1594.7 last Friday on profit taking. We see an extended consolidation ahead amid an impending MACD dead cross formation whilst RSI and stochastic indicators are hooking down. Key supports are situated at 1586 (50D SMA) and 1581 (30D SMA) while resistances are located around 1603 (10D SMA) and 1614.

Despite bullish Wall Street, local sentiment is likely to stay cautious amid the ongoing Nov reporting season. Nevertheless, with the positive comments from US economic adviser, it may support the overall sentiment. Hence, the KLCI may trend sideways for the near term. Support is set around 1,581-1,586 levels, while stiff resistances seems located around 1,603-1,614.

TECHNICAL OUTLOOK: DOW JONES

Following the recent triangle pattern breakout, the MACD Indicator has expanded positively above zero whilst both the RSI and Stochastic (albeit in the overbought region) has hooked upwards. Hence, the Dow is likely to advance further towards the next formidable resistance located around 28500 (upper channel), barring any decisive violation below 10D SMA near 27675. Breaking 10D SMA support will trigger further fall towards 27300/27000 zones.

Investors were pushing Wall Street towards the all-time-high region over the past few weeks in the anticipation of a phase one mini deal to go through, supported by recent positive economic data and upbeat US 3Q19 reporting season as the S&P 500 earnings is expected to fall only around 1.8% YoY from -4.9% before the start of the earnings season. Nevertheless, without any solid details at this juncture until the signing of the agreement coupled with overbought levels, the Dow is likely to remain event-driven with formidable resistance near 28500. Key supports are located 27600/27300.

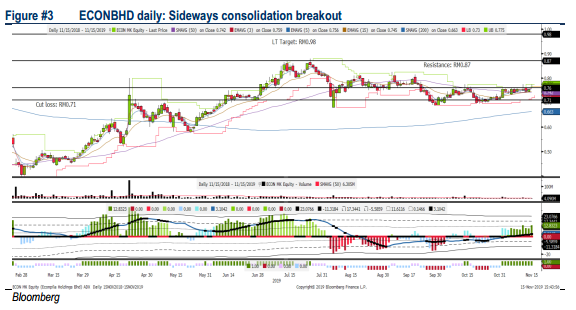

TECHNICAL TRACKER: ECONBHD

Sideways consolidation breakout. Following several contracts being awarded to ECONBHD since October, it has brought YTD orderbook to c.RM900m, which may sustain the earnings for next two years. Moving forward, we believe mega projects such as KVDT, ECRL, KL-SG HSR and MRT3 could be seen as next catalyst to drive earnings for ECONBHD. Based on our proprietary indicator, ECONBHD could be moving in a sustainable rally from this level onwards. Resistance will be set around RM0.85-0.87, with a LT target set around RM0.98. Support is pegged around RM0.73-0.74, with a cut loss located around RM0.71

Source: Hong Leong Investment Bank Research - 18 Nov 2019