Tradersbrief - KLCI’s Upside Likely to be Capped

HLInvest

Publish date: Wed, 20 Nov 2019, 05:48 PM

MARKET REVIEW

Despite the recent concerns over the US and China trade negotiations, coupled with some news article citing a government source, that Beijing is pessimistic about the trade deal, Asia’s stock markets ended mostly higher; the Hang Seng Index and Shanghai Composite Index advanced 1.55% and 0.85%, respectively, but Nikkei 225 fell 0.53%.

The FBM KLCI managed to end in the positive territory on a last minute buying support, recouping earlier losses; the FBM KLCI inched higher by 0.06% to 1,605.31 pts. Market breadth was neutral with 408 gainers vs. 411 losers. Market traded volumes stood at 2.68bn shares traded for the session, worth RM1.63bn. Meanwhile, we observed selected technology (Mi Equipment and KESM) and O&G (Dayang and Perdana) stocks traded higher.

US stock markets ended mixed with the ongoing conflicting signals on the trade developments, where market participants are waiting for a phase one mini deal to be signed over the near term. Also, weaker results and guidance from retail stocks such as Home Depot and Kohl have dragged related consumer stocks in yesterday’s session; contributing to both the decline in Dow and S&P500 by 0.36% and 0.06%. Meanwhile, Nasdaq rose 0.24%.

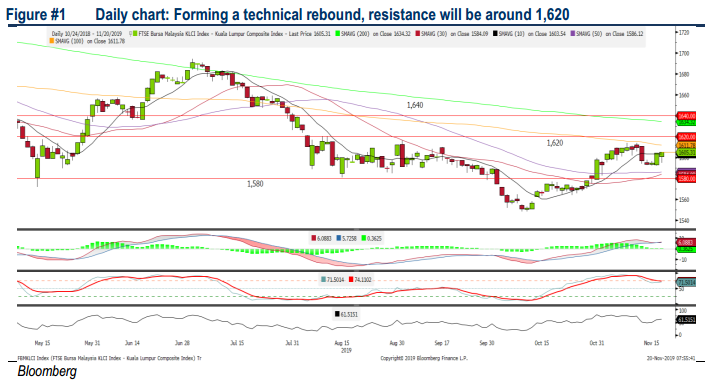

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has rebounded for the third consecutive day surpassing the 1,600 level. Both the MACD Line and MACD Histogram have turned flattish (albeit in the positive region). Meanwhile, RSI and Stochastic oscillators are hovering above 50. With the mixed technical readings, we believe the KLCI could trend within a range between 1,580-1,620 over the near term.

On our local front, we expect sentiment to remain cautious amid the ongoing November reporting season as well as the concerns over whether the phase one mini deal will be signed off ahead of the scheduled trade war tariff on the 15th of December. Should further tariffs being imposed on Chinese goods, we expect another round of pullback on the key index on our local front. Hence, the KLCI’s upside may be limited around 1,610-1,620. Nevertheless, traditional window dressing activities in December is likely to lend some support to the KLCI.

TECHNICAL OUTLOOK: DOW JONES

The Dow has flirted around the 28,000 psychological level over the past few trading days. The MACD Indicator is still trending positively above zero. Meanwhile, both the RSI and Stochastic oscillators are in the overbought region. Hence, we opine that the Dow could be having limited upside over the near term. Resistance is pegged around 28,200, while support is set around 27,100.

In the US, we think the upside could be capped over the near term following President Trump’s reiteration of the scheduled 15% tariffs (may increase further) on around USD156bn worth of Chinese imports will be imposed if the phase one mini deal is not reached. In addition, the current overbought situation on the Dow suggested that the stiff resistance is envisaged around 28,000-28,300 levels and the key index may take a breather after the recent rally.

TECHNICAL TRACKER: NAIM

Proxy to Sarawak infrastructure and O&G exposure. At RM1.03, NAIM is only trading at 0.41x P/B (33% below 10Y average and peers’ average of 0.6x) and 0.43x to its revised RNAV of RM2.32 (after applying a huge 30% investment holding discount). We believe such steep discounts could provide sufficient margin of safety and cushion further price fall, thanks to the stable earnings from its O&G division, strong construction order book of RM1.5bn and expectations of more pump-priming activities before Sept 2021 Sarawak state election. Technically, the stock is ripe for further advance towards RM1.10-1.26 zones after staging a positive downtrend line breakout.

Source: Hong Leong Investment Bank Research - 20 Nov 2019