Traders Brief - Extended Consolidation

HLInvest

Publish date: Thu, 21 Nov 2019, 10:09 AM

MARKET REVIEW

Asian markets slipped lower on fears that strained US-China relations could derail trade negotiations after Trump threatened any tariff rollbacks would require deeper concessions from China. Sentiment was also dampened after the US Senate passed a bill aimed at protecting human rights of pro-democracy protesters in HK, drawing a flak from Beijing and driving a wedge into ongoing US-China negotiations.

Tracking cautious regional markets and on-going Nov reporting season, KLCI eased 4.2 pts to 1601.1 after hovering at 1604.4 and 1598.3. Trading volume increased to 2.9bn shares worth RM1.98bn as compared to Tuesday’s 2.68bn shares worth RM1.63bn but market breadth was positive with 426 gainers as compared to 411 losers.

The Dow slid as much as 259 pts in early trades amid reports of a potential delay in a partial US-China trade pact as disagreement exists on specific tariffs. However, cautious optimism that President Trump will still strike a partial trade deal that will help to resolve longstanding tensions between the world’s biggest economies narrowed the losses to 113pts to end at 27821.

TECHNICAL OUTLOOK: KLCI

KLCI eased 4.2 pts at 1601.1 on a mild pullback after rallying from a 4Y low of 1548 (10 Oct) to 1614 (12 Nov). Unless KLCI can stage a strong breakout above 1614 pts, we are likely to see the index to extend its consolidation on potential MACD dead cross formation whilst RSI and stochastic indicators are trending sideways. Key supports are situated at 1586 (50D SMA) and 1570 (lower BB) while resistances are located around 1614 and 1620 (upper BB).

On our local front, we expect sentiment to remain cautious amid the ongoing November reporting season as well as the uncertainty over whether the phase one mini deal will be signed off ahead of the scheduled trade war tariff on the 15 Dec. Should further tariffs being imposed on Chinese goods, we expect another rout on global financial markets. Stiff resistances are around 1610-1620 zones whilst supports fall on 1570-1586 as traditional window dressing activities in December is likely to lend some support to the KLCI.

TECHNICAL OUTLOOK: DOW JONES

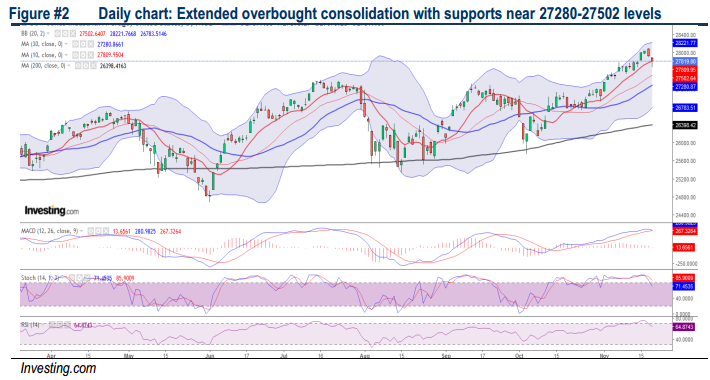

The Dow has flirted around the 28,000 psychological levels over the past few trading days. In wake of potential MACD dead cross formation and retreating RSI and Stochastic oscillators, Dow’s near term upside could be capped at 28200-28500. Key supports are situated at 27280- 27500.

On the back of overbought levels and until the signing of the US-China phase 1 trade agreement, the Dow is likely to remain event-driven with formidable resistance near 28200- 28500 as disagreement exists between the US and China on specific tariffs. Nevertheless, any pullback is likely to be cushioned near 27300-27500 amid recent positive economic data and upbeat US 3Q19 reporting season.

TECHNICAL TRACKER: T7GLOBAL

Another laggard in the O&G segment. T7G has been bagging several contracts and could be seen as a laggard in the O&G sector. Currently, its orderbook stood at more than RM900m, with the tenderbook holding up at RM3bn. We believe traders’ would lookout for O&G maintenance players after a decent rally seen in CARIMIN, DAYANG and PENERGY over the past few weeks. Next phase of growth for T7G could be seen in aerospace segment, where the fully automated metal treatment facility will commence by end-2019. Based on our indicator, T7G could be poised for a breakout amid steady increase in momentum. Share price has surpassed RM0.505, next resistance is envisaged at RM0.55-0.575, with a LT TP set at RM0.63. Support is located at RM0.485-0.495, with cut loss set around RM0.48.

Source: Hong Leong Investment Bank Research - 21 Nov 2019