Traders Brief - Still in the consolidation phase

HLInvest

Publish date: Mon, 25 Nov 2019, 09:23 AM

MARKET REVIEW

Asia’s stock markets ended mixed on Friday with the ongoing complicated situation in the US and China trade developments. As of this juncture, market participants are still waiting for the phase one mini deal to go through, hence the market trended mixed. The Shanghai Composite Index declined 0.63%, while Nikkei 225 and Hang Seng Index gained 0.32% and 0.48%, respectively.

Meanwhile, FBM KLCI managed to recoup earlier session’s losses and closed higher by 0.29% to 1,596.84 pts led by buying support in Petronas-related and selected plantations heavyweights. Market breadth was however negative with 423 decliners as compared to 398 gainers. Market trade volume stood at 2.56bn shares traded for the session, worth RM2.00bn. Most of the plantation stocks trended higher given the steady uptrend in crude palm oil prices - above the RM2,700 level.

Despite the ongoing concerns over US-China trade progress, Wall Street ended on a higher note last Friday following the statement from President Trump commenting that both sides (US and China) are “very close” to reaching a trade agreement. The Dow and S&P500 rose 0.39% and 0.22%, while Nasdaq added 0.16%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has been trading in the retracement phase, but could be supporting along the SMA50 for now. The MACD Line has turned flattish above zero, but both the RSI and Stochastic oscillators are slightly below 50. With the technical indicators pointing towards slightly negative readings, we opine that the KLCI could trend sideways, consolidate further within the region of 1,580-1,620 levels.

With the positive tone on Wall Street and statements from President Trump, we believe buying interest may emerge on the local front. In addition, the crude palm oil prices may sustain the trading interest amongst plantation heavyweights, contributing towards further rebound in FBM KLCI. Trading range of the KLCI will be located around 1,580-1,620.

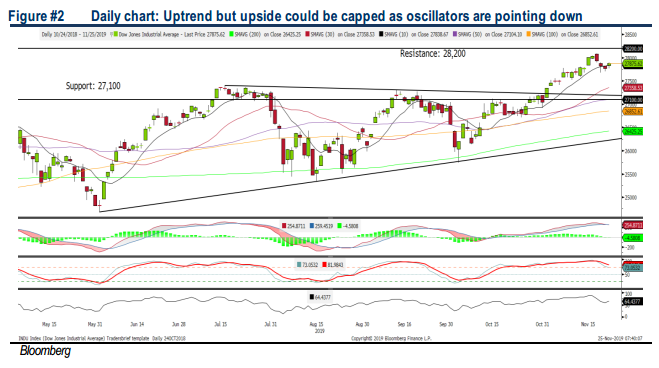

TECHNICAL OUTLOOK: DOW JONES

The Dow is flirting along the 28,000 psychological level over the past week. The MACD indicator has formed a negative signal, where the MACD Line is below the Signal Line. Meanwhile, both the RSI and Stochastic oscillators are declining over the past few sessions. Based on the technical readings, upside could be limited at this juncture with resistances set around 28,000-28,200. Support is located around 27,400.

In the US, market participants certainly are waiting for the results of a phase one mini trade deal, if trade negotiators cannot come to an agreement before 15th December, a new set of tariffs may kick in on mid-Dec. This may put pressure on the Dow, limiting the upside potential on the Dow (which is having stiff resistance along 28,000-28,200 for the time being.

Source: Hong Leong Investment Bank Research - 25 Nov 2019