Traders Brief - Mild rebound expected, but upside limited

HLInvest

Publish date: Thu, 05 Dec 2019, 08:46 AM

Asia’s stock markets closed lower amid uncertain developments on the trade front and investors were trading on the cautious note in the anticipation for a trade deal to be inked in the near term. The Nikkei 225 and Hang Seng Index declined 1.05% and 1.25%, respectively, while Shanghai Composite Index fell 0.23%. In tandem with the regional stock markets, the FBM KLCI extended its declining move for another session; the FBM KLCI dropped marginally by 0.09% to 1,560.93 pts. Market breadth was negative with 492 losers as compared to 339 gainers, accompanied by 2.14bn shares (worth RM1.70bn) traded for the day. Nevertheless, Sarawak-related stocks such as Zecon and Sarawak Cable traded actively higher for the day.

Wall Street rebounded, snapping the three-day losing streak as some news reported that the US and China are moving closer to a trade deal and could be looking to roll back some tariffs in the phase one deal. The Dow and S&P500 rose 0.53% and 0.63%, respectively, while Nasdaq up 0.54%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has declined for another session, forming another hammer candle and supported around 1,550 level. Although the MACD indicator is trending below zero, both the RSI and Stochastic oscillators are in the oversold region. Hence we opine that the KLCI could be due for a technical rebound with the resistance located around 1,580-1,600. Meanwhile, support will be set along 1,530-1,550.

Taking cues from overnight Wall Street performance, following some news citing that both the US and China could be nearer to form a trade deal, coupled with the statistics that window dressing activities are likely to bump up index heavyweights in December as well as the oversold status on KLCI, we believe buying sentiment may return, lifting the KLCI eventually. The KLCI’s support is at 1,550, while resistance is located around 1,580.

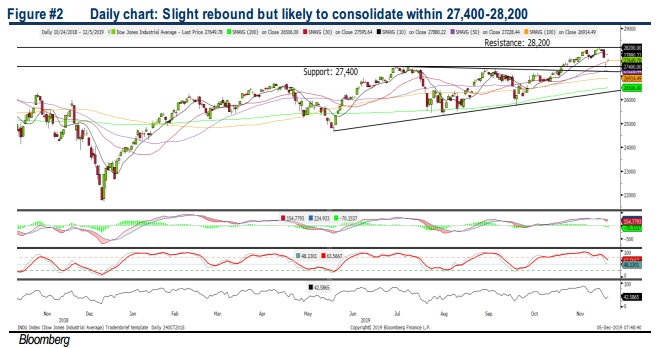

TECHNICAL OUTLOOK: DOW JONES

The Dow rebounded along the support of 27,400 and the MACD Indicator is still hovering above zero (albeit it formed a “sell” signal on Monday). Meanwhile, both the RSI and Stochastic oscillators are below 50. Hence, with the mixed technical readings, we expect the upward trading momentum to be limited and resistance will be set along 28,200, while support is located around 27,400.

The recent trade progress is more positive for the time being, hence market participants will be pricing in a potential deal to be struck and potential tariffs roll back in the phase one deal. Given the positive trading tone, we expect follow through buying interest to sustain at least over the near term. However, should any of the delay in trade deal and kicking in of the scheduled tariffs of 15% on about USD160bn worth of Chinese goods, we expect the Dow’s upside to be capped around 28,200-28,500.

Source: Hong Leong Investment Bank Research - 5 Dec 2019