Traders Brief - Window Dressing Activities to Lift KLCI

HLInvest

Publish date: Tue, 17 Dec 2019, 11:28 AM

MARKET REVIEW

Although the US and China finally agreeing to the phase one trade deal on Friday after a prolong 18-month trade war, regional stock markets ended on a mixed note amid profit taking activities in Nikkei 225 (-0.29%) and Hang Seng Index (-0.65%). Meanwhile, Shanghai Composite Index added 0.56% as China’s industrial production rose 6.2% YoY (above consensus forecast of 5.0%) in November and retail sales rose 8.0% YoY (above consensus of 7.6%). On the local front, broader market succumbed to profit taking activities despite both US and China struck a phase one trade deal last week; the FBM KLCI slipped 0.12% to 1,569.35 pts. Market breadth was negative with 453 decliners vs. 376 gainers. Market traded volume stood at 2.29bn, worth RM1.77bn. We noticed building material and construction stocks such as OKA, ANNJOO and ECONBHD traded actively higher for the session. Stocks in the US, especially the tech giants managed to trade higher following the phase one trade deal being struck last week between the US and China. Also, on the data front, the National Association of Home Builders/Wells Fargo Housing Market Index rose in December (highest in 20 years), while IHS Markit indicated US business activity hit a five month high in December. These factors have supported markets movement recently; the Dow and S&P500 added 0.36% and 0.71%, respectively, while Nasdaq rose 0.91%.

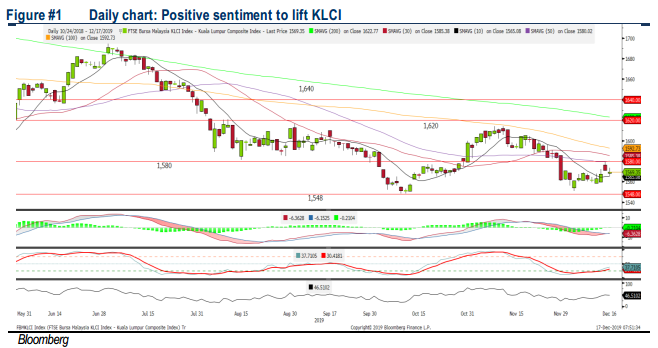

TECHNICAL OUTLOOK: KLCI

The FBM KLCI snapped a 3-day winning streak as profit taking activities emerged. The MACD indicator is still hovering below zero level, while both the RSI and Stochastic oscillators are improving but threading below 50. Resistance is set around 1,580-1,600. Support is envisaged around 1,550.

Still, we opine that the buying interest is likely to spillover towards stocks on the local front and market participants could refocus on technology related stocks over the near term following the phase one trade agreement last week. Also, window traditional window dressing activities could lift the FBM KLCI and the key index may revisit 1,580-1,600 levels.

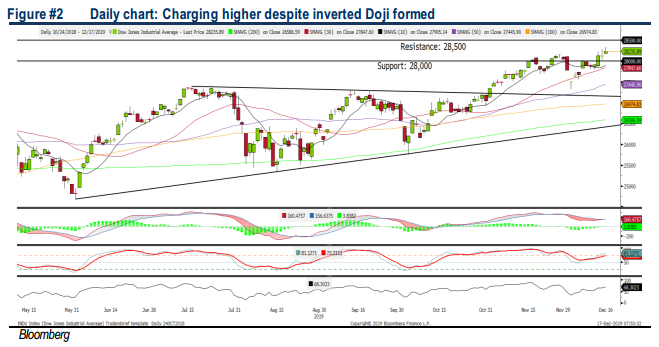

TECHNICAL OUTLOOK: DOW JONES

The Dow has surged for another session despite forming an inverted Doji candle yesterday. The MACD indicator has formed a “Buy” signal (MACD Line crossed above Signal Line). Meanwhile, both the RSI and Stochastic oscillators are trending higher. Hence, with the more positive technical readings, we may anticipate further upside towards resistance near the 28,500 level. Support is set along 28,000.

Given the phase one trade deal has been agreed for now and will be inked by January, we expect market participants to look into higher risk investment instrument such as equities over the near term as this brief interlude of calm period for the US-China relationship should present decent investment opportunities (after a prolonged 18-month trade war). The Dow’s trading range could be located around 28,000-28,500.

Source: Hong Leong Investment Bank Research - 17 Dec 2019