Traders Brief - Positive Rebound to Sustain on KLCI

HLInvest

Publish date: Wed, 18 Dec 2019, 11:55 AM

MARKET REVIEW

Asia’s stock markets generally gotten a strong boost from the phase one trade deal struck between the US and China, and market participants will be awaiting the deal to be signed in early January and moving on with a phase two trade discussions. Also, recent data from China is supportive and lifted the overall market sentiment. The Shanghai Composite Index added 1.27%, while Nikkei 225 and Hang Seng Index rose 0.47% and 1.22%, respectively.

On the local front, the FBM KLCI rose 0.48% to 1,576.95 pts led by selected banking heavyweights such as Maybank and Hong Leong Bank. Market breadth was fairly neutral with 407 gainers as compared to 416 losers. Market traded volumes stood at 2.34bn, worth RM1.99bn for the session. Selected technology stocks such as FPGROUP, JHM and GTRONIC traded actively higher for the session.

Wall Street closed higher for another session on the back of trade optimism after phase one trade deal was being struck last week. The Dow and Nasdaq rose 0.11% and 0.10%, respectively, while S&P500 eked out marginal gains of 0.03%. Meanwhile, on the data front, US homebuilding increased stronger-than-expected in November and permits for future home construction surged to a 12.5-year high.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI managed to trend higher after a day of pullback, the MACD Indicator has formed a cross, indicating positive trend in the making. Meanwhile, both the RSI and Stochastic oscillators are improving over the past few sessions. With the recovering technicals, we believe the FBM KLCI may trend higher over the near term. Resistance is envisaged around 1,600, while support is located around 1,548.

On the local front, we remain optimistic that the FBM KLCI to trade on a recovering trend on the back of traditional window dressing activities as well as optimism on the trade front. Market participants could focus on technology sector on the back of a phase one trade resolution. Meanwhile, Bandar Malaysia theme could spur trading activities within construction and building materials (precast concrete and steel). The FBM KLCI’s trading range is set along 1,548-1,600.

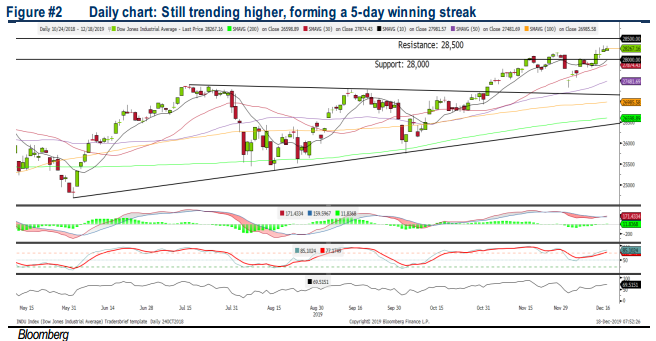

TECHNICAL OUTLOOK: DOW JONES

The Dow extended its upward move for another day, forming a 5-day winning streak. The MACD Indicator is expanding positively above zero, but both the RSI and Stochastic oscillators are slightly overbought. The resistance is envisaged around 28,500, while support is anchored around 28,000.

Still we expect positive sentiment to persist at least for the near term on Wall Street amid the trade optimism after both the US and China agreeing to a phase one trade deal (awaiting sign off in January). Hence, we anticipate the Dow to trend higher over the near term with the trading range located around 28,000-28,500.

Source: Hong Leong Investment Bank Research - 18 Dec 2019