Traders Brief - Window Dressing Activities to Support KLCI

HLInvest

Publish date: Thu, 19 Dec 2019, 09:11 AM

MARKET REVIEW

Following the positive developments on the trade front last week, market participants have turned their focus to Brexit, where UK media reported on Tuesday that Prime Minister Boris Johnson will add a revision to the Brexit bill that would explicitly rule out any extension to the transition period beyond Dec 2020. The Shanghai Composite Index and Nikkei 225 declined 0.18% and 0.55%, respectively but Hang Seng Index added 0.15%. On the local front, the FBM KLCI jumped 1.41% to 1,599.11 pts amid year-end window dressing as well as positive inflow of foreign funds amid potential rebalancing activities. Market breadth was fairly neutral with 423 gainers vs. 417 losers. Market traded volumes stood at 2.550bn shares, worth RM2.03bn. Technology stocks such as JCY and KESM traded actively higher for the day.

Wall Street slipped into the negative territory after a 5-day winning streak led by weaker-than expected earnings from shipping giant FedEx. The Dow and S&P500 slid marginally by 0.10% and 0.04%, respectively, but Nasdaq rose marginally by 0.05%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has surged above 1,580 immediate resistance yesterday, hitting the 1,6000 mark. The MACD Indicator is trending higher towards zero, while both the RSI and Stochastic oscillators are hovering above 50. With the positive technical readings, we anticipate further upside on FBM KLCI after a mild pullback. Resistance will be located around 1,620. Support is set around 1,580.

With the FBM KLCI rising more than 1% yesterday amid year-end window dressing activities as well as portfolio rebalancing activities, we believe the key index may take a mild breather as it has traded near the resistance along 1,600 level. At this juncture, traders may focus on construction stocks on the back of improving sentiment following the revival of Bandar Malaysia project, while technology stocks should be favourable after both the US and China agreed on the phase 1 trade deal.

TECHNICAL OUTLOOK: DOW JONES

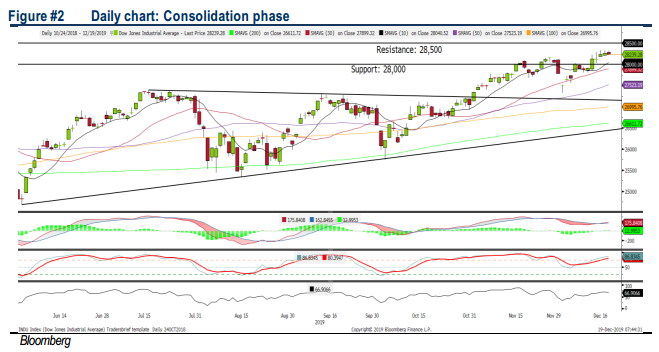

The Dow has turned sideways after the phase one trade deal last week. The MACD Indicator is hovering above zero. However, both the RSI and Stochastic oscillators are overbought. We think the recent upward trend could be overstretched and may look for short term consolidation phase. Resistance is pegged around 28,500. Support is anchored at 28,000.

Although Wall Street is likely to move in an upward intact trend following the positive developments on the trade front following the phase one trade deal, we think mild profit taking activities may emerge as market participants are waiting for the trade deal to sign off in January. The Dow’s trading range is located around 28,000-28,500.

Source: Hong Leong Investment Bank Research - 19 Dec 2019