Traders Brief - Rising geopolitical tension may cap upside

HLInvest

Publish date: Mon, 06 Jan 2020, 10:32 AM

Market Review

Despite the optimism on the trade front, stocks in the key regional exchanges were traded lower amid heightened geopolitical tensions after US Pentagon confirmed that an Iranian military commander was killed in a Baghdad air strike. Hang Seng Index and Shanghai Composite Index 0.32% and 0.05%, respectively, while Nikkei 225 lost 0.76%.

Bucking the regional trend, the FBMKLCI (+0.55% to 1,611.38 pts) trended higher on the back of the spike in Brent oil prices (amid the Middle East tensions) and steady crude palm oil prices above RM3,100 level. Market breadth was positive with 492 advancers as compared to 447 losers, accompanied by 3.58bn shares traded, valued at RM2.36bn. Oil and gas stocks such as Hibiscus and Reach Energy were lifted by the spike in Brent oil prices.

Wall Street declined sharply following the US airstrike on Iran’s top military leader, which caught market participants by surprise while waiting for the Phase 1 trade deal to be signed in Washington next week. Investors were rushing into crude oil, gold and other safe haven asset such as Japanese yen. The Dow and S&P500 declined 0.81% and 0.71%, respectively, while Nasdaq fell 0.79%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has rebounded for the second consecutive day and the MACD Indicator has hooked up on Friday. Meanwhile, both the RSI and Stochastic oscillators are hovering above 50; indicating that the positive momentum is intact. Resistance will be set around 1,620. Support is located around 1,580.

Although the technical readings are positive on the FBM KLCI, we expect the trading sentiment to turn negative, tracking the negative overnight performance on Wall Street following the US Iran events. However, we expect the negative shock to be short-lived and likely to see emergence of buying interest supported by crude oil and crude palm oil prices, eventually lifting on O&G and plantation sectors and overall market sentiment on Bursa Exchange. The FBM KLCI could trend between 1,580-1,620.

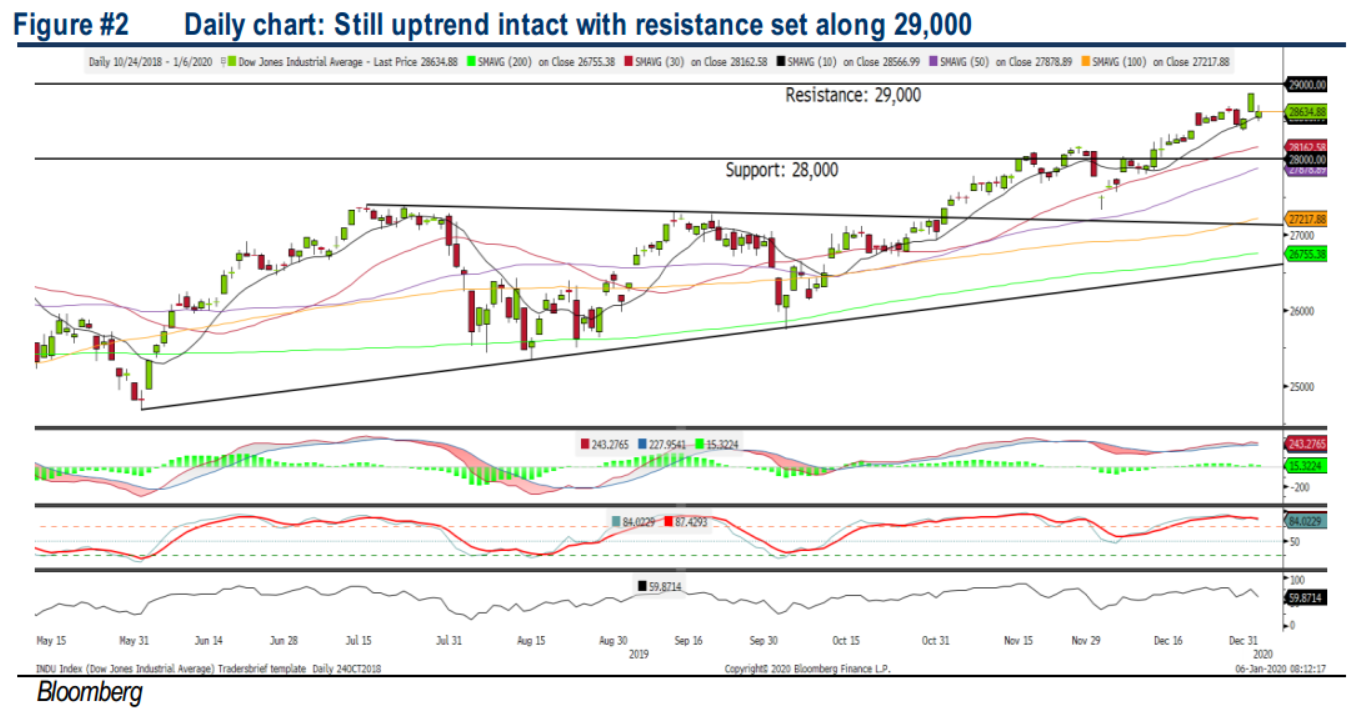

TECHNICAL OUTLOOK: DOW JONES

Despite the rising geopolitical tension, the Dow is still sustaining above 28,500 immediate support. The MACD Line is hovering above zero, while the MACD Histogram has weakened on Friday. Both the RSI and Stochastic oscillators have trended lower on Friday (fallen from the overbought region). With the mixed technical readings, we expect the Dow to consolidate within the range between 28,000-29,000.

In the US, we expect the rising geopolitical tension could be a concern towards trading sentiment on Wall Street. In addition, President Trump’s threatening messages over the weekend which stated that US may hit 52 Iranian targets if Tehran retaliates over top general’s death may could cap the Dow’s upside along 29,000-29,500. Until the tension is being resolved, we expect the Dow to trend sideways with the support located along 28,000. On the bright side, market participants will be awaiting the signing ceremony of Phase 1 trade deal on 15th of Jan and further announcement of Phase 2 trade discussion moving forward.

Source: Hong Leong Investment Bank Research - 6 Jan 2020