Traders Brief - Positive tone gaining strength amid easing tension

HLInvest

Publish date: Fri, 10 Jan 2020, 09:47 AM

MARKET REVIEW

Investors were unwinding their exposure in safe-haven assets (gold and yen) and shifting back into equities, lifting most of the key regional benchmark indices after President’s Trump remarks. The Hang Seng Index and Shanghai Composite Index added 1.68% and 0.91, respectively, while Nikkei 225 advanced strongly by 2.31%.

Similarly, stocks on the local front managed to gain traction and key index rose 0.41% to 1,595.65, tracking gains from the positive performance on Wall Street overnight. Market breadth was positive with advancers led decliners by a ratio of 12-to-5, accompanied by market trading volume of 2.84bn, valued at RM1.89bn. We noticed selected technology stocks such as DATAPRP and VIS traded actively higher yesterday.

Wall Street ended positively on the back of easing trade tensions between Iran and the US and tech shares performed strongly led by Apple after Chinese government registered that iPhone sales rose 18% for December in China. Meanwhile, positive set of jobs data managed to lift the sentiment as well; jobless claims fell to 214k (consensus: 220k), while private payrolls increased 202k vs. consensus of 150k.

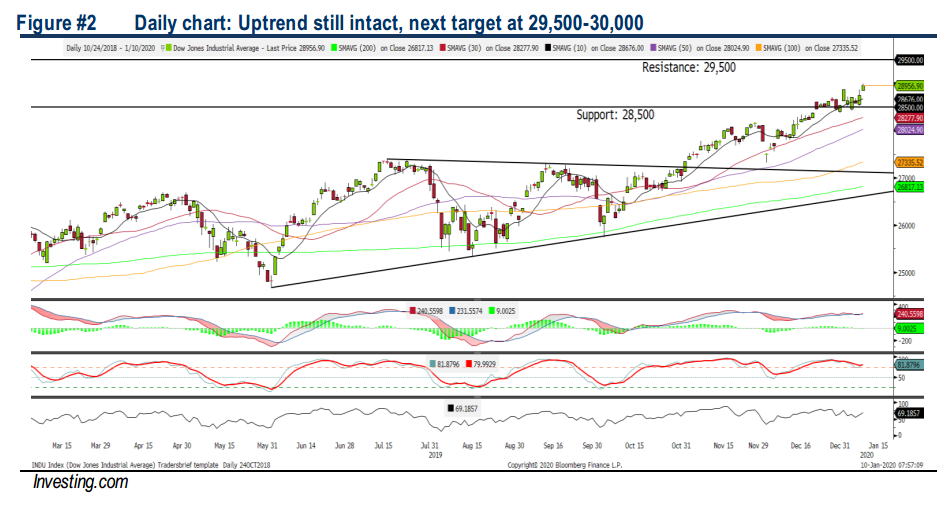

TECHNICAL OUTLOOK: KLCI

After a bearish candle on Wednesday, the FBM KLCI has formed a “harami” candle yesterday and the MACD Line is still hovering above zero. Meanwhile, both the RSI and Stochastic oscillators have trended lower over the past few sessions. Technical readings are on still negative at this juncture. Resistance will be set around 1,620, while support is anchored around 1,580.

Despite the technical readings being slightly negative, we believe the FBM KLCI may rebound today, taking cues from the stellar Wall Street performance overnight. Also, with the fading geopolitical tensions, coupled with the US House passing a resolution to curb President Trump's war powers against Iran (in order to further reduce tensions in the Middle East), buying interest may return on Bursa Exchange. Trading range of the FBM KLCI will be set around 1,580-1,620.

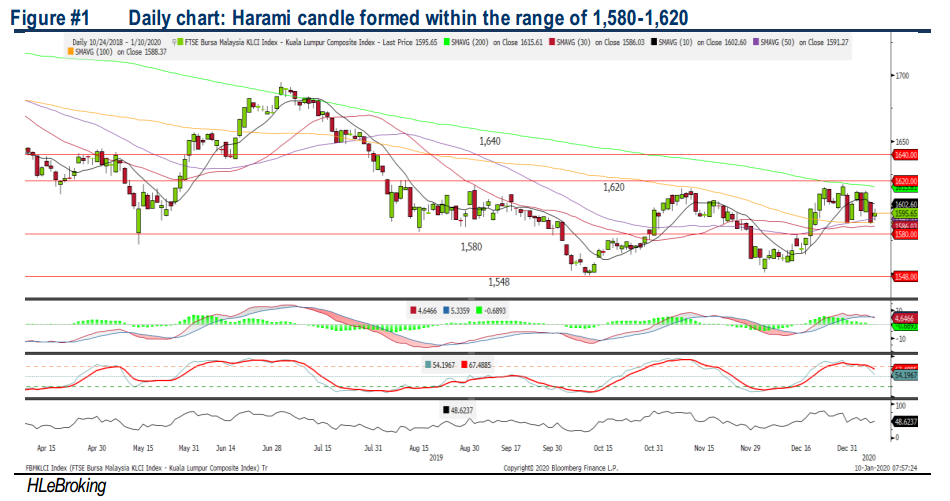

TECHNICAL OUTLOOK: DOW JONES

The Dow marked another fresh high following the easing geopolitical tensions between US and Iran and the MACD indicator has formed a positive signal. Meanwhile, both the RSI and Stochastic oscillators have hooked upwards after yesterday’s positive move. Hence, we think the Dow’s uptrend move is fairly intact with the breakout and resistance will be located around 29,500, while support is set along 28,500.

In the US, the positive sentiment is likely to persist premised on fading US-Iran geopolitical tensions, coupled with the House passing a resolution to curb President Trump's war powers against Iran as well as the optimistic trade front as the US and China will be signing the Phase 1 trade deal next week. In addition, with the solid jobs data and decent growth in selected technology stocks in the US, we may anticipate healthier trading tone on Wall Street. The Dow’s upside could be seen around 29,500-30,000.