Traders Brief - Sideways Consolidation Phase

HLInvest

Publish date: Mon, 13 Jan 2020, 10:19 AM

MARKET REVIEW

Following the easing geopolitical tensions between the US and Iran, Asia’s stock markets ended broadly higher. In addition, with the news that iPhone sales in China grew more than 18% in December led to the buying interest on Apple suppliers in Asia. The Hang Seng Index and Nikkei 225 added 0.27% and 0.47%, respectively, but Shanghai Composite Index slipped 0.08%.

However, profit taking activities quickly emerged on the local front after trading higher on the opening bell; the FBM KLCI fell 0.26% to 1,591.46 pts as crude oil declined further following the easing of US-Iran tensions. Market breadth was fairly neutral (gainers: 401, losers: 398). Market traded volume stood at 2.74bn, worth RM1.60bn. Nevertheless, technology stocks such as PENTA, GTRONIC and UNISEM gained momentum.

Despite the fading geopolitical tensions between the US and Iran, Wall Street reversed from its intraday all time high of 29,009.07 pts to 28,823.77 pts as market participants digested on the weaker-than-expected jobs data, where the US economy added 145k jobs in December vs. consensus of 160k, while wages grew by 2.9% YoY vs. forecast of 3.1%.

TECHNICAL OUTLOOK: KLCI

After the “harami” candle was formed the FBM KLCI has turned lower, unable to cross above the 1,600 zone. The MACD Indicator has turned lower (albeit still above zero) after forming a negative cross last week. Both the RSI and Stochastic oscillators are trending lower for now. The resistance is pegged around 1,620, while support is envisaged along 1,580.

On the local front, given the negative technical readings, we expect sideways consolidation phase to persist over the near term despite the Phase 1 trade deal that will be signed this week as market participants will be expecting some brief details on Phase 2 trade discussion to look forward to. In the meantime, traders would be trading on plantation stocks on the back of better expectations in the upcoming February reporting season. The FBM KLCI is likely to trend between 1,580-1,620.

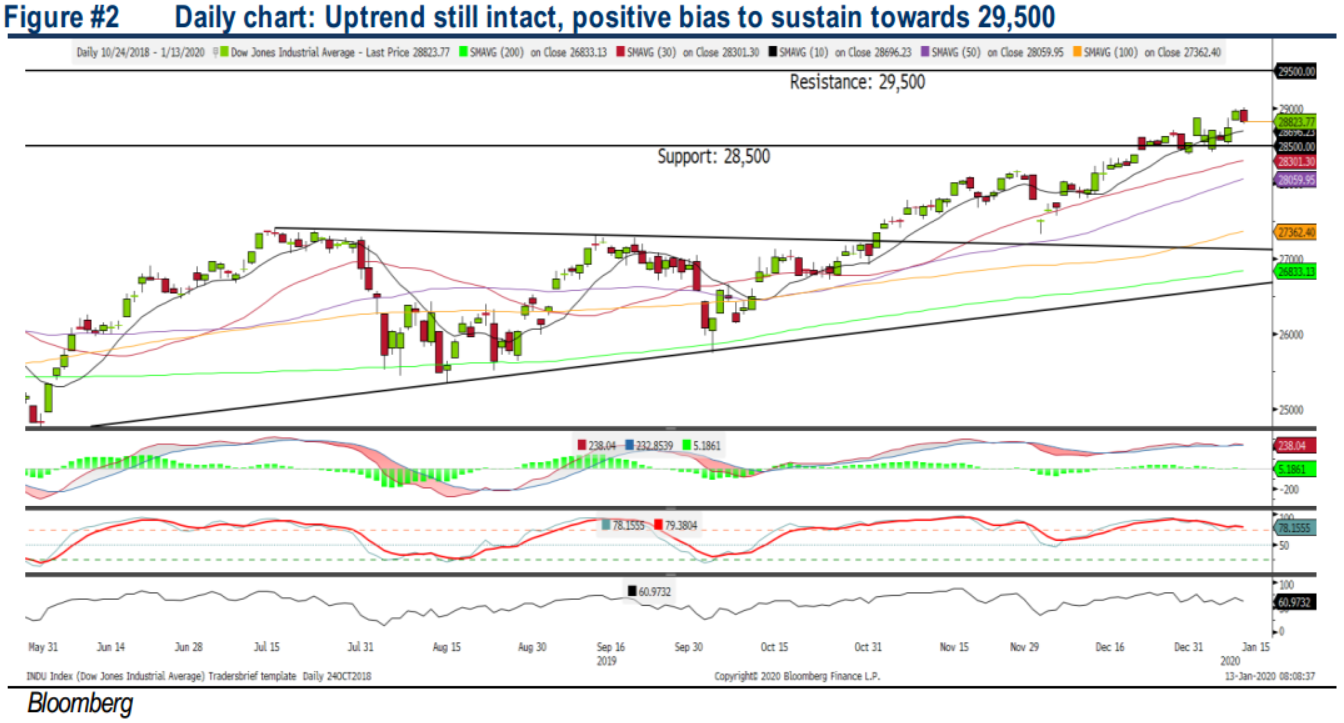

TECHNICAL OUTLOOK: DOW JONES

The Dow has registered a new high but unable to close above 29,000 level. The MACD Indicator is still hovering above zero; suggesting that the uptrend is intact. Meanwhile, both the RSI and Stochastic oscillators are hovering above 50. Hence, with the positive technical readings, we expect the Dow to continue its upward trend over the near term. Resistance will be set around 29,500. Support is anchored around 28,500.

In the US, the Dow retraced mildly after hitting the 29,000 level, but we believe the uptrend is fairly intact amid fading geopolitical tensions between US and Iran. Traders will be focusing on the Phase 1 trade deal signing on 15 Jan and further details on Phase 2 discussions. Also, with tech giants like Apple anticipating stronger results amid healthy growth in China sales, it may lead to buying interest amongst technology stocks in the US over the near term. The Dow should trend on a positive bias mode towards 29,500, with support set around 28,500.

TECHNICAL TRACKER: SUCCESS

Brighter outlook after disposing low-margin process equipment business. We are upbeat on SUCCESS for its sound fundamentals, experienced and hands-on (with an operational track record of ~40 years) management, positive outlook in line with the government’s ongoing push to adopt LED street lightings as well as achieving greater economies of scales and productivity after SEB’s disposal. Valuation is undemanding at 8.7x FY20E (ex-cash P/E only at 5.9x), -28.7% lower than 5Y historical average of 12.2x), supported by decent 4.4% DY and strong 22% FY20-22 EPS CAGR coupled with net cash position of RM72m (29sen/share or 32% to share price). Technically, Success is ripe for an oversold rebound towards RM0.99-1.10 levels after a brief sideways consolidation.

Source: Hong Leong Investment Bank Research - 13 Jan 2020