Traders Brief - Sideways consolidation phase to continue

HLInvest

Publish date: Tue, 14 Jan 2020, 09:26 AM

MARKET REVIEW

Led by higher China (0.8%) and Hong Kong (1.1%) markets, most of the Asian bourses were higher ahead of the long-awaited Phase 1 US-China trade deal signing in Washington on 15 Jan, allowing the world’s top two economies to bury the trade-war hatchet that has kept them squabbling for more than 18 months. According to WSJ, the deal will involve some tariff relief, increased Chinese purchases of US agricultural goods and changes to intellectual property and technology rules. Meanwhile, Washington and Beijing have agreed to hold semi-annual discussions in targeting to resolve disputes and push for further reforms.

Bucking higher regional markets, KLCI slipped 6.7 pts amid concerns over geopolitical risks in Middle East and expectations of weak earnings delivery by Bursa Malaysia companies in Feb reporting. Market breadth was negative with losers 429 outpaced gainers 419. Market traded volume stood at 2.65bn sharers valued 1.65bn against last Friday’s 2.74bn shares worth RM1.60bn as retailers focused on penny and small cap stocks while institutional participation ebbed.

Wall Street on positive tone overnight, with the S&P 500 and Nasdaq ending the day at fresh record highs as US and Chinese officials prepare to sign a phase-one trade deal in Washington this week. Sentiment was further boosted amid news the US will remove China from a list of currency manipulating countries. The Dow rose 82 pts or 0.3% to 28907 and the S&P 500 jumped 23 pts or 0.7% to 3288 whilst the Nasdaq rallied 95 pts or 1% to 9274.

TECHNICAL OUTLOOK: KLCI

To recap, KLCI enjoyed a brief rally as the index rebounded from a low of 1551 (4 Dec) to 1617 (31 Dec) amid year-end traditional window dressing activities. However, following the profit taking pressures that saw the index fell 6.7 pts to 1584 yesterday (plunged 32 pts or 2% from 1617) and violating multiple key SMA supports, KLCI’s immediate term outlook has turned uglier. We reiterate that as long as KLCI is unable to break above the 1600 to 1615 (200D SMA) resistances successfully, the index will continue to consolidate with key supports situated at 1574 (61.8% FR) and 1564 (76.4% FR) levels.

Although overnight positive Wall Street would provide a boost to Bursa Malaysia today, cautious sentiment on the local bourse is likely to prevail ahead of the long CNY holidays next week and expectation of another unexciting Feb reporting season. Whilst institutional stocks continue to remain in sideways consolidation, trading interests on lower liners/penny stocks by retailers would remain active. Overall, in wake of external and internal headwinds, we still expect KLCI to trap in range bound pattern, with key resistances at 1600-1615 whilst supports fall on 1564-1574 levels.

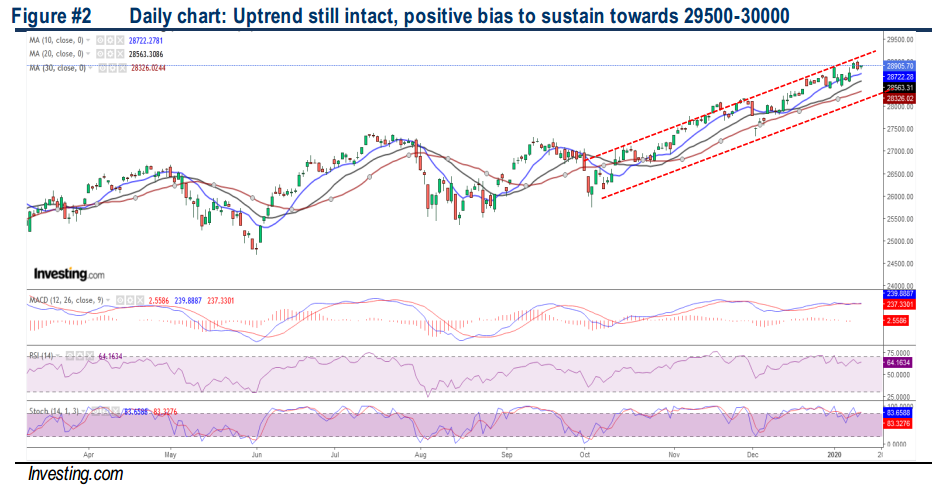

TECHNICAL OUTLOOK: DOW JONES

Despite volatility triggered by geopolitical tensions in the Middle East, the Dow is still able to close above multiple key SMAs supports. As indicators are gradually on the mend amid flattish MACD while both the RSI and Stochastic oscillators are ticking up, the Dow could still break all-time high of 29009 (10 Jan high) and advance further to 29500-30000 zones, barring any decisive breakdown below 28300-28500 supports.

In the US, we believe the Dow’s uptrend is fairly intact amid fading US-Iran geopolitical tensions and the impending US-China Phase 1 trade deal, coupled with the news that US will remove China from a list of currency manipulating countries. Barring any negative surprises in the start of Jan reporting season (for 4Q19 results) this week, the Dow should trend on a positive bias mode towards 29500-30000 territory, with support set around 28300-28500 levels.

Source: Hong Leong Investment Bank Research - 14 Jan 2020