Traders Brief - Technical Rebound May Persist Towards 1600-1613

HLInvest

Publish date: Fri, 17 Jan 2020, 09:25 AM

MARKET REVIEW

Most Asian markets rose as risk sentiment improved after the US and China signed an interim trade accord to defuse their 18-month-long dispute. However, overall mood remains edgy as the partial trade agreement signed on Wednesday still retained tariffs imposed by the two sides over the last 18 months, while structural differences that led to the conflict were not addressed.

Tracking overnight higher Dow and regional markets, KLCI rose 2.8 pts at 1587.9 pts after traded within an intra-day high of 1588.2 and a low of 1575.8 Trading volume increased to 2.60bn shares worth RM1.91bn as compared to Wednesday’s 2.54bn shares worth RM1.68bn. Market breadth was negative with 377 gainers as compared to 448 losers.

Wall Street scaled to new records overnight as the signing of US-China trade deal, strong corporate earnings (Morgan Stanley) and encouraging US economic data (Dec retail sales) lifted equity markets. Sentiment was further boosted by Senate approval of a new trade deal between the US, Mexico and Canada. All three benchmark indexes closing at new records, with the Dow rallied 267 pts at 29298, S&P 500 advanced 28 pts to 3317 and the Nasdaq soared 98 pts to 9357.

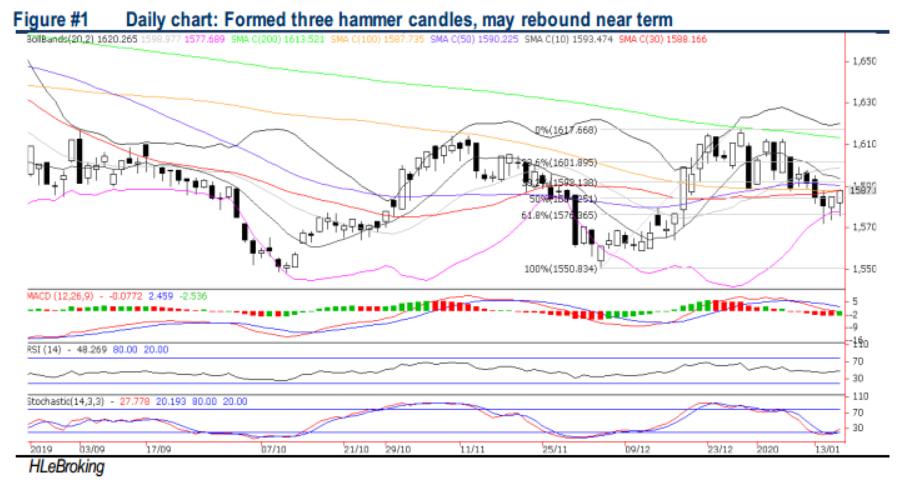

TECHNICAL OUTLOOK: KLCI

After plunging 45 pts from 1M high at 1617 (30 Dec) to a low of 1572 (14 Jan), KLCI managed to rebound and closed 2.8 pts higher at 1587.9, forming three hammer candles over the past three trading days. Meanwhile, the MACD histogram is turning into green while the RSI and stochastic indicators are ticking up. We opine that KLCI’s downside is limited and may rebound towards 1600-1613 (200D SMA) levels in the near term. Support is located around 1572 and 1566 (76.4% FR) levels.

We expect the bullish US record-breaking close to spillover on Bursa Malaysia, lifting the KLCI further towards our envisaged 1600-1613 zones. However, further rally could be capped in anticipation of a soft Feb reporting season, coupled with the local political noises. Nevertheless, traders could look into construction and technology stocks as volumes were building up over the past few trading days.

TECHNICAL OUTLOOK: DOW JONES

The Dow surged 267 pts to new record close at 29298. The MACD has chalked up a golden cross whilst both the RSI and Stochastic oscillators are soaring higher. With the positive technical readings, the Dow may trend higher towards 29500-30000 in the short to mid-term, barring any decisive breakdown below 28694 (20D SMA) and 28457 (30D SMA) and zones.

In the US, we believe the Dow’s uptrend is fairly intact amid fading US-Iran geopolitical tensions and de-escalation of US-China trade tensions coupled with the Senate approval of a new trade deal between the US and the Mexico and Canada on Thursday. Barring any negative surprises from the ongoing start of Jan reporting season (for 4Q19 results) this week, we remain optimistic the Dow to advance towards 29500-30000 territory in the next few weeks, with support set around 28500-28700 levels.

Source: Hong Leong Investment Bank Research - 17 Jan 2020