Traders Brief - Positive Sentiment May Spillover on Bursa

HLInvest

Publish date: Wed, 22 Jan 2020, 09:01 AM

MARKET REVIEW

Tracking the mixed tone on Wall Street, Asia’s stock markets ended lower ahead of the signing ceremony of the Phase 1 trade deal in Washington. Also, investors were waiting for more clarity on trade tariffs, where Washington commented it may cancel or reduce some tariffs in exchange for China purchasing more US products. The Hang Seng Index and Shanghai Composite Index fell 0.39% and 0.54%, respectively, while Nikkei 225 declined 0.45%.

Meanwhile, bucking the negative regional benchmark indices, FBM KLCI ended higher by 0.29% to 1,585.14 pts, led by buying support on selected heavyweight such as Ambank, Public Bank and Press Metal. Market breadth was however negative with 471 decliners vs. 339 advancers, accompanied by market traded volume of 2.54bn, valued at RM1.67bn. Nevertheless, we noticed aluminium stock such as A-Rank and Alcom traded higher for the session led by Press Metal.

Wall Street ended higher but gains were narrowed at the end of the session as investors looked beyond the Phase 1 trade deal signing ceremony for further details on Phase 2 trade details. Meanwhile, the start of the corporate earnings has supported Wall Street as of this juncture with most of the banking heavyweights registered better-than-expected results. The Dow and S&P500 added 0.31% and 0.19%, while Nasdaq inches higher by 0.08%.

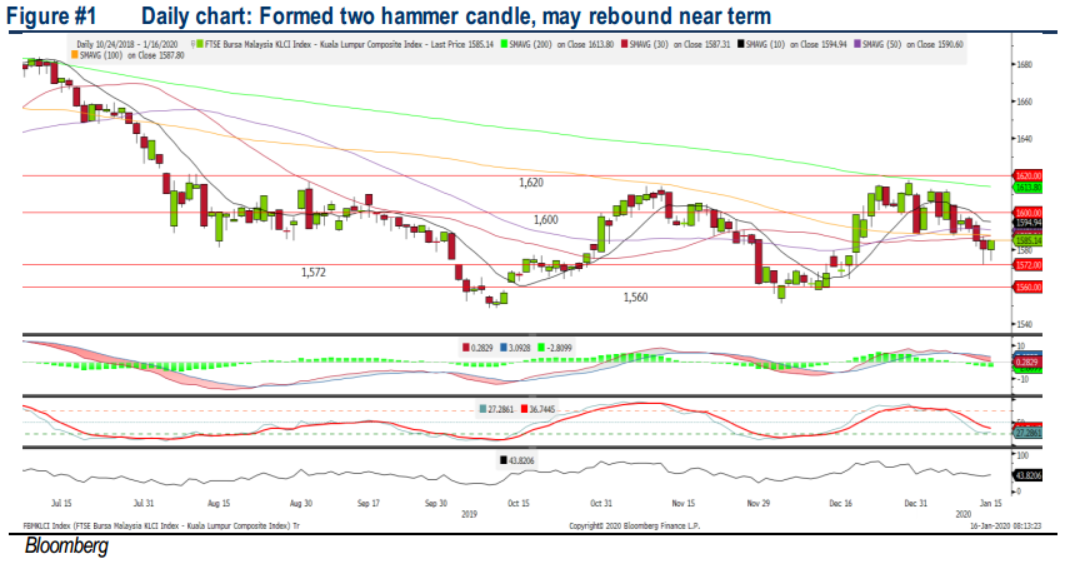

TECHNICAL OUTLOOK: KLCI

The FBMKLCI has retraced towards 1,572 two days ago after hitting the 1,617-1,618 level (end of December) and managed to rebound, forming two hammer candles over the past two trading days. The MACD Line is flat, hovering slightly above the zero level. Meanwhile, the RSI has hooked higher (but hovering below 50), but the Stochastic oscillator has turned higher in the oversold region. We opine that FBM KLCI’s downside is limited and may rebound towards 1,600-1,620 levels in the near term. Support is located around 1,560-1,572.

We expect the positive sentiment to spillover on stocks on the local front, lifting the FBM KLCI in the near term. However, with the anticipation of softer earnings season in February, coupled with the local political noise, which may contribute to softer-than-expected foreign inflows moving forward; the FBM KLCI’s upside could be capped near term along 1,600-1,620. Nevertheless, traders could look into building material segments such as cement and steel and metal-related stocks for trading opportunities.

TECHNICAL OUTLOOK: DOW JONES

The Dow has trended higher and ended above the 29,000 mark. The MACD indicator is hovering above zero and expanding positively in the positive territory. Meanwhile, both the RSI and Stochastic oscillators are hooking higher above 50. With the positive technical readings, the Dow may trend higher towards 29,500, support is located around 28,500.

Following the signing of the Phase 1 trade deal, investors will look forward for more details on the Phase 2 trade talks. The US is set to maintain tariffs on roughly two-thirds of imports from China, but President Trump commented he will agree to take the tariffs off if both the US and China could agree on Phase 2 (where most of the details are still unsure). With the fairly positive sentiment, we think the Dow could trend higher over the near term.

Source: Hong Leong Investment Bank Research - 22 Jan 2020